Yields on German Bunds have been negative since Q2 2019 but David Lewis of FIS says that a return to positive yields is on the cards due to a number of factors and influences, including a change in political management

“Asset values may fall.” It’s a common warning seen alongside many investment opportunities. “You may get back less than you invested,” is another. These warnings are there to ensure a degree of buyer awareness should their investment not achieve the stellar rates of return the marketing materials offer. Those rates of return are never guaranteed, and there is a risk that those future predicted earnings may not match the (occasionally well chosen) prior period of performance. But how would such warnings describe a guarantee that you would lose money?

The government debt markets have been more than a little askew over recent years. Much has been written about the benefits and perils of quantitative easing, but as such fiscal support turns to the end of the cycle, the economies it has sought to support will have to find a way to do without it. Bunds, government debt issued by Germany, have long been one of the highest quality pieces of debt an investor could purchase, virtually guaranteeing their capital would be returned unharmed, if not enhanced a small amount. However, yields on Bunds have been negative since Q2 2019, averaging around -50 basis points (bp) since then but dipping as far as -90bp in March 2020.

Negative yields indicate that an investor, holding the asset to maturity, will receive less back on redemption than they spent to buy that security. This includes all income due on that asset, such as coupons. In essence, the demand for German Bunds has meant that investors have been queuing up to pay the German government to hold their money for them. It’s a kind of extremely secure self-storage rental unit for your money.

There are, of course, many complicated factors at play here, including the quantitative easing policies of the European Central Bank (ECB), which continues to purchase bonds at an eye-watering rate, plus the increasing need for high-quality collateral in the wider financial markets. But the financial markets and the prices of the assets traded within them are always looking forward, attempting to predict what will happen. With the growing talk of the ECB beginning to taper off the bond purchase programme, together with the ongoing weaknesses in European economies striving to emerge from the COVID-19 pandemic, the unthinkable may be happening: Shorting Germany.

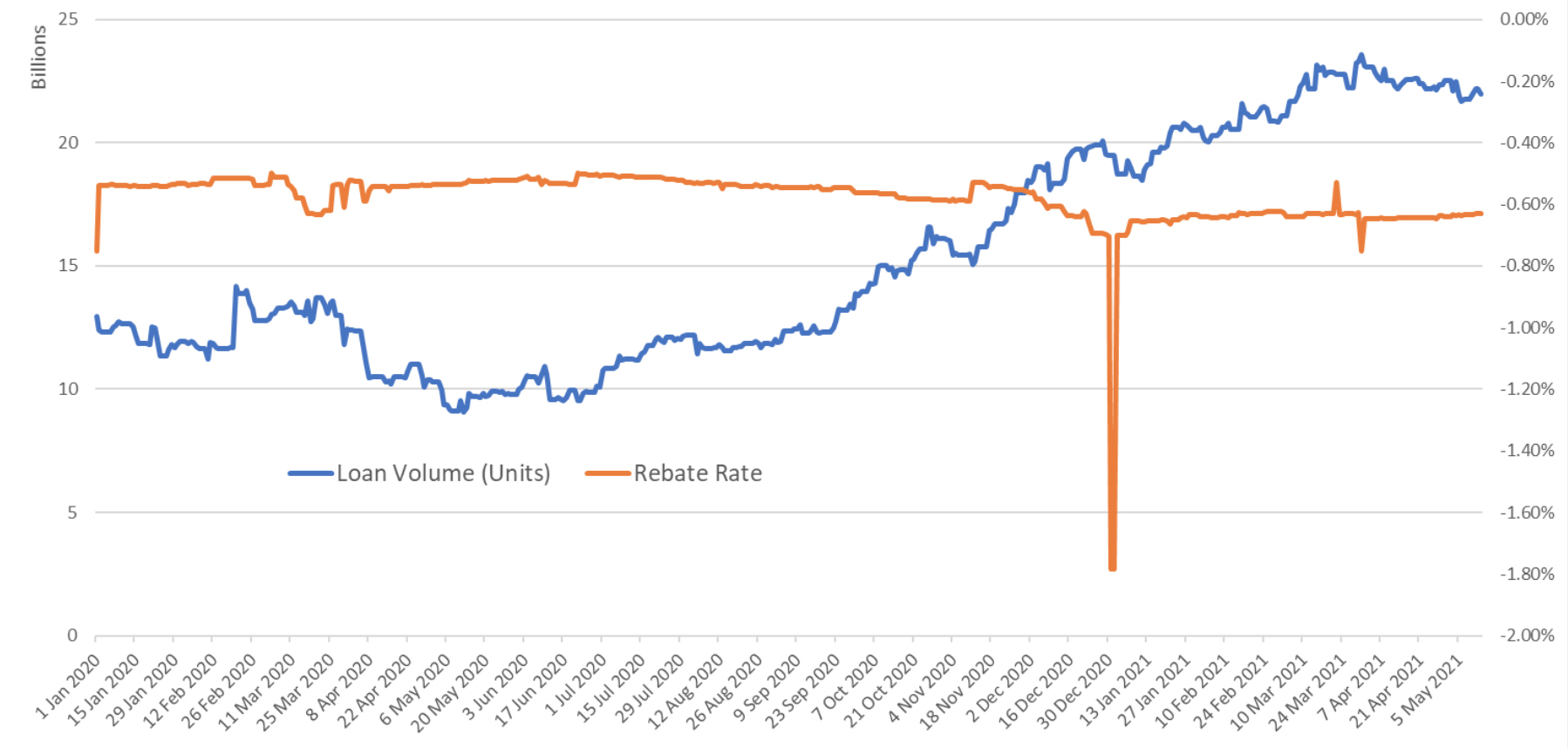

There is a multitude of reasons why investors may want to borrow government debt, especially Germany as a leading nation in the supposedly rock solid G7. However, it is somewhat hard to ignore the change in borrowing patterns since January 2020, the end of the pre-COVID era. Figure 1 shows borrowing volumes and costs for German government debt from 1 January 2020 to 13 May 2021.

January 2020 saw the volume of German government debt borrowed opening around the 12 billion bonds mark. The rebate rates charged over the year end dipped to around -75bp, rising to -50bp from 2 January as year-end influences abated. Borrowing volume decreased through the first half as the world began to respond to the growing pandemic, but, as the full impact of the situation became clearer, borrowing began to rise. As Figure 1 shows, the start of the second half of 2020 saw the start of a steady and almost inexorable rise in borrowing volume, from around 10 billion bonds to a recent peak of over 23.5 billion bonds at the end of March 2021, a rise of some 135 per cent. Over the same period, utilisation increased from 21 per cent to 37.5 per cent, a rise of 73 per cent which, at a little over half the increase in volume, would suggest growth in available supply in the market.

Year-end 2020 saw the usual scramble around borrowing and lending rates, but this time it showed a significantly higher impact, with rebates falling a full percentage point lower than the previous year, dipping at a new low around -178bp.

Peak volume at the end of Q1, 31 March 2021, also saw a dip in rebate rates to -75bp as shown in Figure 1.

Figure 1

Looking forward through 2021 and beyond, other influences are going to be putting pressure on German government yields, not least of which will be the potential change in political leadership after a prolonged period of certainty. Elections later this year may bring changes to Germany’s traditional grip on fiscal policy, debt management and bond issuance. A change in political management in Germany will likely bring a potential loosening of the purse strings, increasing government debt and inflationary government spending across Germany. These factors, coupled with the pent-up spending from a European population emerging from over a year of lockdown, will bring inflation and estimates for consumer price growth in 2021 are growing. A return to positive yields is, therefore, on the cards. For yields to rise, asset prices must fall with the associated impacts a sell off in such debt will incur.

According to a global research paper by the Bank of America, the turn from negative to positive yields in the ten-year benchmark German bonds will mark the end of the bull run in corporate bonds. Some 15 per cent of respondents backed this as a turning point in the markets, which does not sound like much of a majority viewpoint when quoted in isolation. However, context is everything and this inflection point was second only in terms of bearish market indicators to the tapering of central bank support, something bullish markets have been relying on alongside the significant stimulus packages being rolled out by many governments.

Nothing is certain, of course, and central banks may back away from tapering plans if the economic shock is deemed too great alongside the issues the last year under lockdown have brought, but whatever happens, the warning notes to investors about the potential to lose their capital should be written in large font.