FIS Astec’s David Lewis reviews how the year’s unprecedented events have impacted securities finance revenue compared to prior years

To say that 2020 has been an unusual year pushes the limits of the definition of ‘unusual’. So much has changed across the globe, and some of it will never go back to where it once was. Much has been said over the years about the fundamental place the activities of securities finance and collateral management occupy in the wider financial markets. The lubricant of the capital markets has been used more than once to describe securities lending, while the short interest activity that forms just one part of the complex demand drivers behind the business has been described as the tool that promotes price efficiency and early warnings of forthcoming shocks.

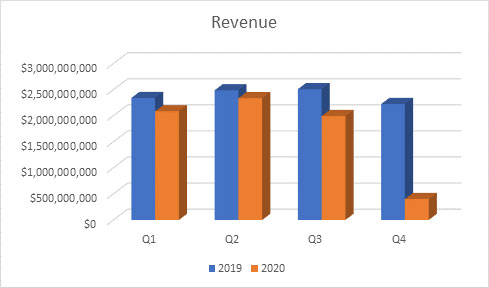

Behind all this, of course, is the requirement for securities finance to be a profitable business. 2019 saw strong revenues, pushing over $10 billion for only the second time since 2008. 2018 was the only other year to breach $10 billion in the past 10 years, and 2019 revenues represented a drop of around 6 percent compared with the prior year. The spread of income generation across the two years was more than uneven, with several special securities and situations coming to the rescue of the overall levels of revenue earned.

The 2020 impact on securities lending

This year so far has seen a very specific specials situation in light of the global COVID-19 pandemic. As an industry that excels during volatility, the first quarter of 2020 appeared to be very good for securities lending markets. As global economies shifted toward the realisation of what was unfolding, some hushed conversations around the market discussed the positive revenue impact that these events were having. But, has it lasted and did those revenue gains really materialise?

We are only just entering the final quarter of 2020 and, with the past nine months exhibiting such an unpredictable nature, it may be an error to make any significant assumptions about what is yet to come, but we can take a good look at what has happened.

Understanding market availability

At the highest level of aggregation across the global data pool managed by Astec Analytics, we can see some stark but perhaps not surprising differences between 2019 and 2020. It will come as a surprise to few that availability is up. Many observers have noted the entry of new funds into the securities lending market, seeking additional alpha for funds suffering in the global economic slowdown. Many others have added securities lending participation to their funds in order to replace management fee income.

Figure 1 shows a quarter-by-quarter comparison of asset availability between the two years. An average is shown across each quarter, including the first days of the fourth quarter of 2020. It is important to note that the values shown are in units of availability rather than monetary value, where one share and one unit of a bond each constitute one unit of lendable asset.

Through 2019, as figure 1 shows, volumes were relatively static apart from the third quarter which exhibited an 8 percent reduction compared to the rest of the year. Looking into 2020, availability was up across the first three quarters, by 6, 4 and 18 percent respectively. With only 20 days of the fourth quarter having passed at the time of writing, care should be taken with the illustrated drop of 7 percent compared with the same period in 2019, but it could be an early sign of some funds closing out their securities finance activity as a result of policy or regulatory changes. These can include a view that securities lending may be contrary to aspects of their environmental, social and governance (ESG) principles, while short selling bans in some countries may have encouraged others to exit.

Looking at the demand side of the equation throws up some interesting statistics. Figure 2 compares loan volume for each quarter across 2019 and 2020, again in units of assets rather than value. These results may be a little more surprising than those around availability. Loan volume has remained relatively static; it is lower in every quarter, but perhaps by less than expected. As figure 2 illustrates, the changes are small, specifically -1, -6, -1 and -6 percent respectively.

A starker difference, perhaps, shows in the change in loan count. Last year has an average open loan count of just under 1.8 million while 2020 was closer to 1.63 million, or around 9 percent lower, on average, per quarter. In addition, average trade durations were down in three of the four quarters, so far, of 2020, compared with 2019. The first quarter, as the pandemic began to ramp up showed a small increase from 111.2 days to 112.7, while the past three quarters together each showed a drop of 9, 3 and 1 percent respectively.

Average fee and rebate rates

The final component in this analysis must, of course, be average fee and rebate rates. With utilisation down due to the additional supply in the market rather than a significant change in overall demand, the all-important revenue results hinge on asset values and fees charged. The impact on fees when comparing 2020 to 2019 is quite dramatic. Each quarter shows a drop compared to the same period in the prior year, with quarterly comparisons being 11, 12, 24 and 18 percent down (for Q4 2020 this is based on the average to date only). Add this to falling durations, then the downward impact on revenues is unavoidable and obvious.

By each of the first three quarters, 2020 shows revenues dropping by 11, 6 and 21 percent respectively. There is a small spark of optimism when looking at the last quarter; extrapolating the first 20 days of revenues suggests a 4 percent gain over the last quarter of 2019, but this is based on just 20 days with 72 yet to go and should not be taken as a reliable indicator of revenue expectations.

2018 was a bumper year for securities finance with 2019 demonstrating a good year but with a semblance of reality thrown in. By contrast, 2020 has thrown all norms out of the window with the uncontrollable factors of demand dictating the outcomes for us all. What has shown through, however, is that securities finance remains a fundamental part of an efficient financial marketplace, delivering a resilient and efficient service to all its stakeholders, generating valuable incremental income along the way.

Figure 1

Figure 2