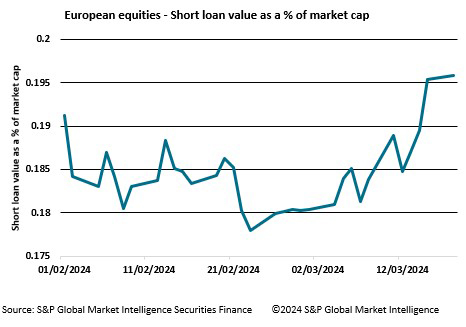

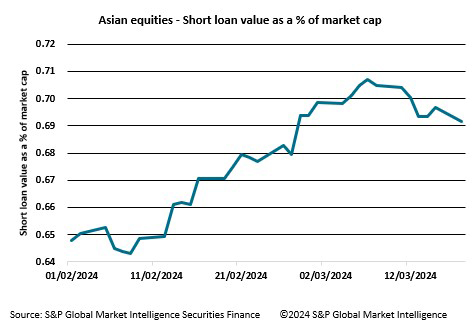

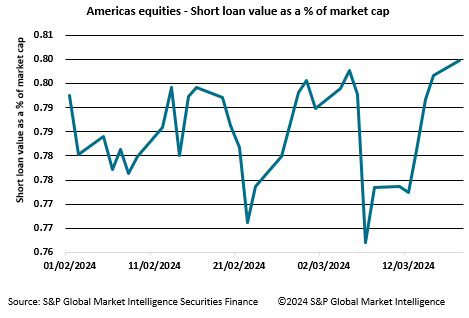

Since mid-February, short loan value as a percentage of market capitalisation has started to increase across European, Asian and Americas equities. As equity markets touch all-time highs, Matthew Chessum, director of securities finance at S&P Global Market Intelligence, predicts further volatility on the horizon and a positive short-term outlook for securities lending markets

FOMO, the fear of missing out, continues to be one of the major driving forces behind the recent stock market rally. Strong earnings and the continued downward trend seen in inflation have helped many global equity markets surge to highs that investors do not want to miss out on. Over the past few weeks, Japan's benchmark Nikkei Stock Average crossed the 40,000 mark for the first time in 34 years and hit an all-time high.

In the US, the Nasdaq closed at a record high for the first time since 2021 and the S&P 500, after breaking consecutive highs, is approximately 5 per cent away from the most-bullish year-end forecasts. Across Europe, the Euro Stoxx 600 continues to climb after reaching an all-time high in February, topping its previous peak reached during January 2022 with European tech stocks leading the increase.

The recent rise of artificial intelligence has left investors, and speculators, desperately searching for new tech stocks that can help them share in Wall Street’s recent meteoric gains. Nvidia (NVDA) has been the main focus of the AI revolution and has now replaced Tesla as Wall Street’s most-traded stock. Nvidia’s historic 2024 rally continues to break records. The chip maker has recently experienced its longest and most sustained winning streak, rising for 10 consecutive weeks. The company controls a reported 80 per cent of the high-end AI chip market and serves customers such as ChatGPT, Microsoft, Alphabet and Meta Platforms.

The stock gained over 80 per cent during the period and serves as a perfect example of how investors continue to buy stock as demand for microchips grows. The rise of the magnificent seven — Apple (AAPL), Alphabet (GOOG and GOOGL), Amazon (AMZN), Microsoft (MSFT), Meta Platforms (META), Nvidia (NVDA) and Tesla (TSLA), is well documented and they all continue to trade on higher-than-average forward earnings multiples as demand strengthens.

Although investors may be rejoicing over the recent surge in valuations worldwide, it is crucial to acknowledge and evaluate significant risks that persist. One such risk is the ongoing dominance of a select group of stocks driving market returns across major markets. In the US, this group, often referred to as the "Magnificent Seven," remains prominent. Similarly, in Europe, companies like ASML, L’Oréal, LVMH and Novo Nordisk stand out as primary contributors to index gains in their respective regions. Many of the other constituents in these indices remain nowhere near previous highs, or have remained relatively unchanged from a price perspective over the last few months.

The second main risk on the horizon is the slow deterioration in the economic data. The most recent S&P Global Market intelligence Purchasing Managers Index (PMI) was underwhelming. Inflation, while falling, remains above the 2 per cent target across most major markets and several other leading economic indicators remain weak.

The third major risk is geopolitical uncertainty. Tensions continue to grow as wars in the Middle East and Ukraine persist. As the year proceeds, focus will move onto the US Presidential elections, with voters facing a choice between two very different candidates which offer different perspectives on the future of the global economy. In short, it is increasingly becoming a stock pickers’ market, which is positive news for the securities lending landscape.

Since mid-February, short loan value as a percentage of market capitalisation has started to increase across European, Asian and Americas equities as we noted in the March edition of the S&P Global Market Intelligence long-short report. This metric tracks the percentage of the market capitalisation of securities which are out on loan, removing financing, dividend and pay to hold trades from the total. This increase is taking place against a backdrop of equity markets reaching all-time highs. Some of the sectors which are experiencing these higher moves include financial services, consumer services, capital goods, transport and materials.

In addition, a recent S&P Global Market Intelligence Capital Market flows report showed that institutional investors maintained a trend of selling throughout February, with reduced buying in index accounts when compared with the previous month. The report also highlighted that “retail investors and hedge funds, while aggressive buyers, displayed a degree of scepticism about the sustainability of the rally, focusing their inflows on defensive sectors like utilities and materials, while also offloading shares in communication services and information technology”.

When looking at these reports in conjunction, it does appear to suggest that there may be more volatility on the horizon. While a prolonged period of growth in stock valuations does benefit lenders through higher revenues, lending fees tend to fall as volatility declines. With the possibility of an increase in volatility, any correctional period offers to end-users the opportunity to execute trading strategies at more favourable levels and take advantage of pricing discrepancies or temporary dislocations. This often drives borrowing demand higher and increases average fees.

Figure 1

Figure 2

Figure 3

The perfect scenario of increased levels of periodic volatility paired with an overall increase in market valuations is the textbook recipe for securities lending revenues to thrive. A decline in interest rates — triggered by worsening economic indicators or the recognition of a necessity to maintain higher rates for an extended period — could both instigate heightened volatility in financial markets. As investors start to reposition their investment portfolios based on either FOMO or JOMO (Joy of missing out), the reality is that activity within the securities lending market is likely to increase in the coming months. That is my prediction anyway because let’s face it, YOLO.