October securities finance revenue snapshot

10 November 2020

Securities lending revenue reached $717 million in October, down 17 percent year-over-year. IHS Markit’s Sam Pierson crunches the numbers

Image: Shutterstock

Image: Shutterstock

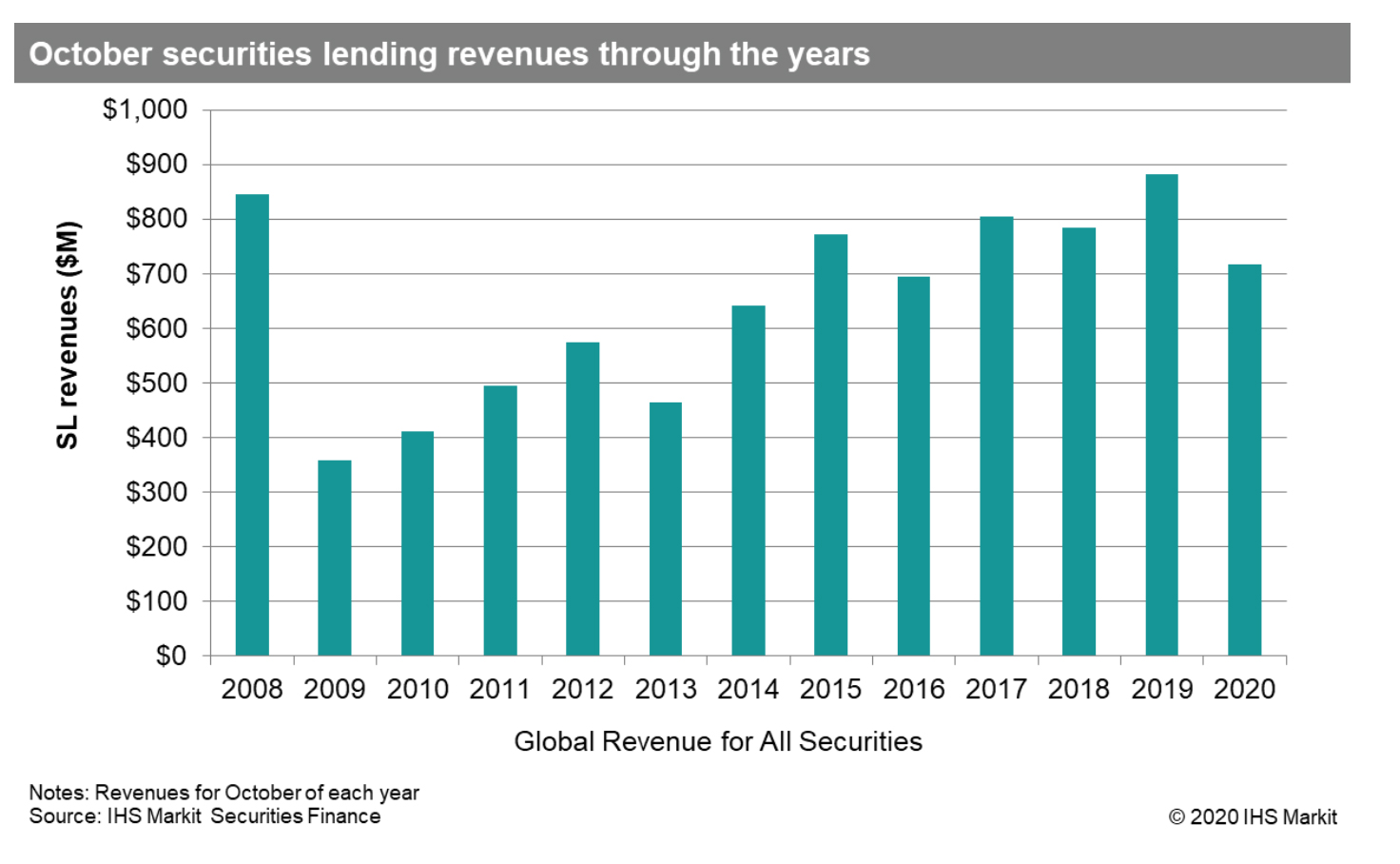

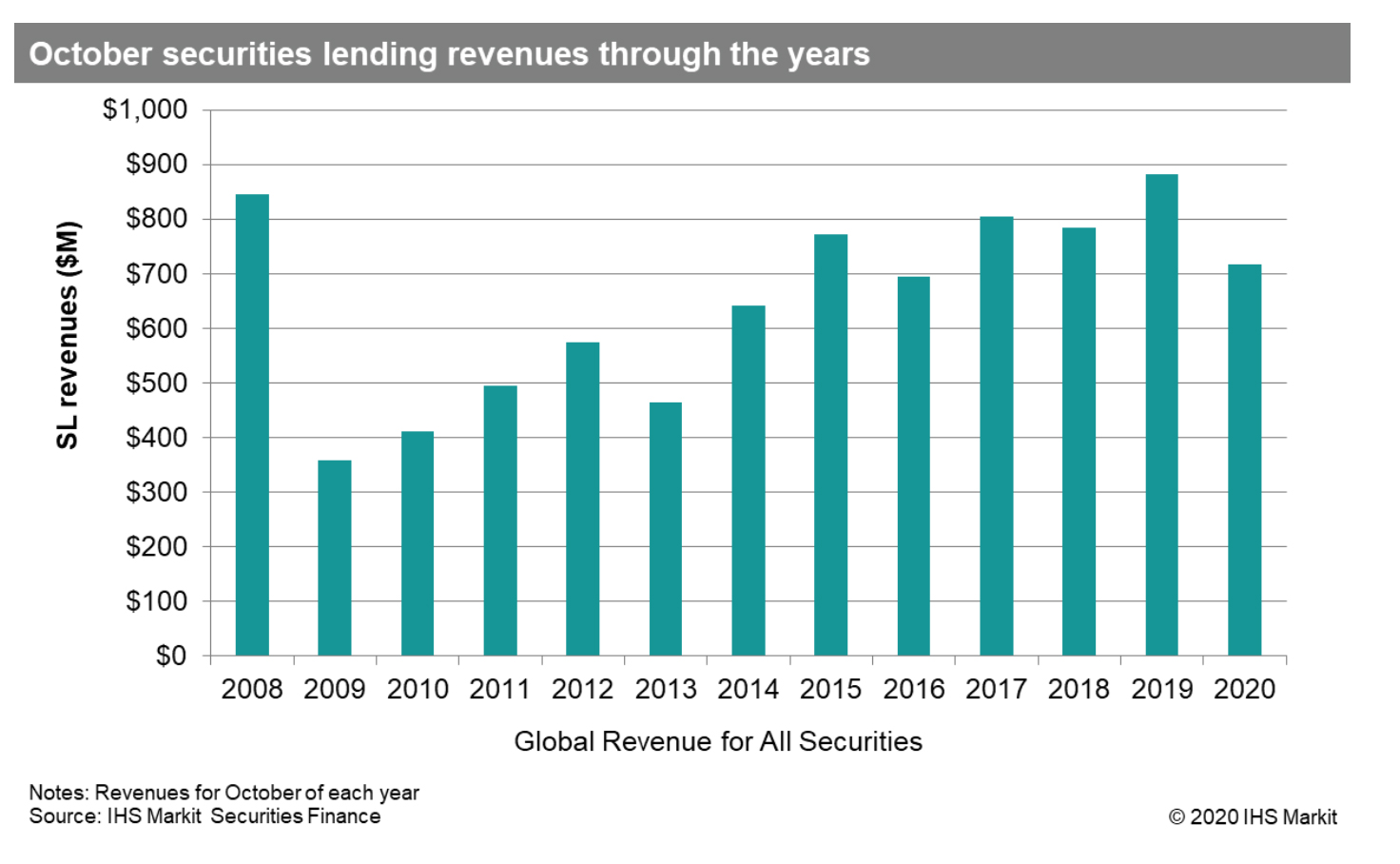

Global securities lending returns declined 19 perent year-over-year (YoY) in October, however, the $717 million in revenue did reflect a 10 percent increase compared with September. The YoY shortfall was primarily driven by Americas and Asia equities.

The US equity market continues to fall short of a stellar 2019, however, the revenue trend is upward, while Asia equity returns remain in a downtrend. European equity revenues remain elevated as the result of hard-to-borrow shares which started in Q3. Overall, October saw an increase in financing activity, following up on trends which emerged toward the end of September and appear likely to persist going forward. Those trends include increasing capital raises both for distressed enterprises as well as initial public offerings. While equity lending revenues have benefitted substantially from corporate actions, and the event-driven fund managers who trade them, a new trend may have emerged in October which could set the stage for broader equity short demand over the last two months of 2020.

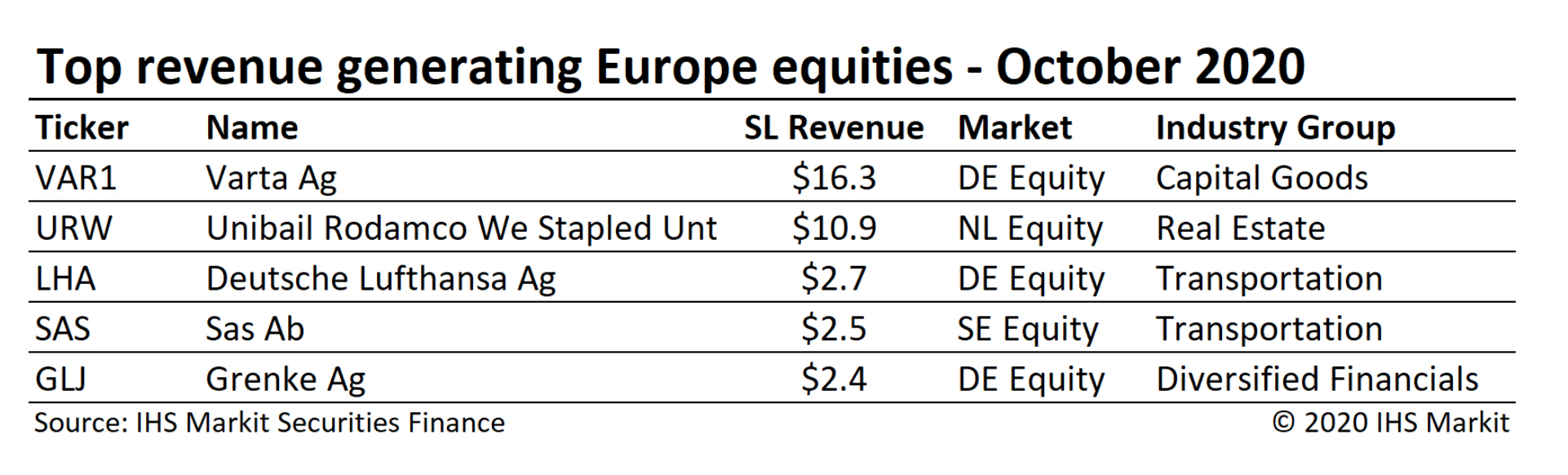

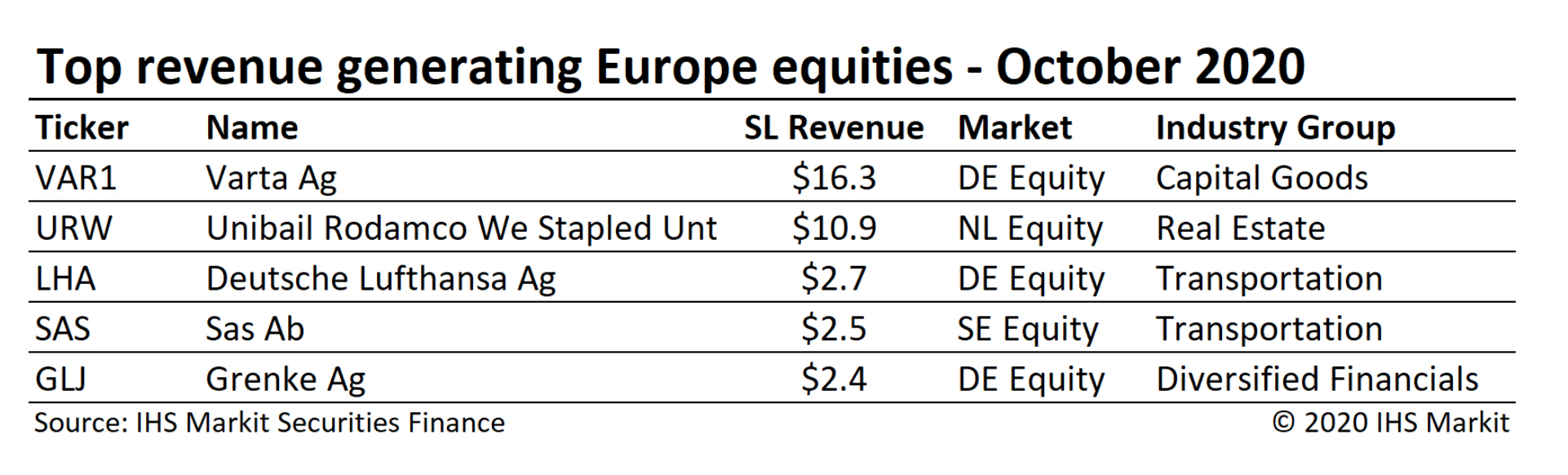

European equity revenue increased 17 percent YoY for October, following a strong Q3 result where revenues increased by 10 percent YoY. The European upswing continues to be concentrated in Germany and the Netherlands, with the rest of Europe combining for a 12 percent YoY decline in October. German equity lending revenue was bolstered by hard-to-borrow shares, with three of the top five revenue generators being listed there. Varta Ag delivered $16.3 million in October revenue, the third consecutive month that the German battery maker was the top revenue-generating security globally. German equity lending revenues totalled $31.6 million for October, a 104 percent YoY increase and a 4 percent month-on-month (MoM) increase.

Rights issues continue to drive borrow demand for European equities, with Danish airlines SAS AB shares being the most recent to see soaring borrow cost for common shares as arbitrageurs pay a steep price for hedges. Dutch firm Unibail Rodamco Westfield Se was the second most revenue-generating European equity for the second consecutive month, with increasing fees offsetting a decline in shares on loan. On a related note, Italian firm BPER Banca (BPE) generated just over $3 million in October revenue as the result of a capital raise required to purchase assets from Intesa Sanpaolo SpA. The increase in revenue from BPE shares boosted October Italy equity lending revenues by 21 percent YoY; the only month of 2020 where revenues increased compared with 2019.

Americas equity revenues came in at $281 million for October, a 27 percent YoY decline. As noted in the September snapshot, the YoY comparison suffers from a particularly strong return in 2019. The October return increased by 25 percent compared with September as the uptrend from the August doldrums remains in place.

US equity revenues came in at $259 million, a 21 percent YoY decline and 30 percent MoM increase. A few examples of 2020 vintage initial public offerings (IPOs) generating outstanding returns include BigCommerce Holdings and Lemonade Inc, which generated $6.3 million and $6.2 million in September revenue, respectively. With further conventional and special-purpose acquisition company IPOs on deck, notably including the long-awaited Airbnb listing, it’s likely that US equity returns maintain the current uptrend through the latter two months of Q4. The two most revenue-generating US equities, INO and SRNE, are both related to the COVID-19 vaccine and treatment pipelines, a trend of borrow demand likely to persist for the duration of virus impact. US equity ‘special’ balances, defined here as loans with fee greater than 500bps, increased from an average of $8.2 billion in September to $9.8 billion in October (remaining well below the $18 billion YTD peak observed in June).

Figure 1: October securities lending revenues through the years

Asia equity lending revenues continue to fall short of 2019, with October revenues of $116 million reflecting a 31 percent YoY decline, and the lowest monthly return YTD. The largest market, Japan equities, delivered $55 million in October revenues, a decline of 26 percent YoY. Hong Kong equity lending revenues mounted a modest recovery in October, with $25.5 million in revenues reflecting a 9 percent YoY and a 12 percent MoM increase.

The short sale ban in South Korea continues to limit lending revenue, with $9.5 million in October revenue being the lowest for any month of 2020. Australia posted the first YoY increase in monthly revenues YTD, with $8.3 million in October revenues reflecting a 1.3 percent YoY increase.

Through the first 10 months of 2020 global securities lending returns of $6.9 billion reflect a decline of 11 percent compared with the first 10 months of 2019, a result almost entirely driven by lower fee spreads. Global loan balances increased by 2.3 percent YoY. Revenues have been highly dependant on corporate actions and will likely remain so, however, the relative decline in the most-shorted equities may augur well for market liquidity and borrow demand for the remainder of 2020.

Figure 2: Top revenue generating Europe equities - October 2020

The US equity market continues to fall short of a stellar 2019, however, the revenue trend is upward, while Asia equity returns remain in a downtrend. European equity revenues remain elevated as the result of hard-to-borrow shares which started in Q3. Overall, October saw an increase in financing activity, following up on trends which emerged toward the end of September and appear likely to persist going forward. Those trends include increasing capital raises both for distressed enterprises as well as initial public offerings. While equity lending revenues have benefitted substantially from corporate actions, and the event-driven fund managers who trade them, a new trend may have emerged in October which could set the stage for broader equity short demand over the last two months of 2020.

European equity revenue increased 17 percent YoY for October, following a strong Q3 result where revenues increased by 10 percent YoY. The European upswing continues to be concentrated in Germany and the Netherlands, with the rest of Europe combining for a 12 percent YoY decline in October. German equity lending revenue was bolstered by hard-to-borrow shares, with three of the top five revenue generators being listed there. Varta Ag delivered $16.3 million in October revenue, the third consecutive month that the German battery maker was the top revenue-generating security globally. German equity lending revenues totalled $31.6 million for October, a 104 percent YoY increase and a 4 percent month-on-month (MoM) increase.

Rights issues continue to drive borrow demand for European equities, with Danish airlines SAS AB shares being the most recent to see soaring borrow cost for common shares as arbitrageurs pay a steep price for hedges. Dutch firm Unibail Rodamco Westfield Se was the second most revenue-generating European equity for the second consecutive month, with increasing fees offsetting a decline in shares on loan. On a related note, Italian firm BPER Banca (BPE) generated just over $3 million in October revenue as the result of a capital raise required to purchase assets from Intesa Sanpaolo SpA. The increase in revenue from BPE shares boosted October Italy equity lending revenues by 21 percent YoY; the only month of 2020 where revenues increased compared with 2019.

Americas equity revenues came in at $281 million for October, a 27 percent YoY decline. As noted in the September snapshot, the YoY comparison suffers from a particularly strong return in 2019. The October return increased by 25 percent compared with September as the uptrend from the August doldrums remains in place.

US equity revenues came in at $259 million, a 21 percent YoY decline and 30 percent MoM increase. A few examples of 2020 vintage initial public offerings (IPOs) generating outstanding returns include BigCommerce Holdings and Lemonade Inc, which generated $6.3 million and $6.2 million in September revenue, respectively. With further conventional and special-purpose acquisition company IPOs on deck, notably including the long-awaited Airbnb listing, it’s likely that US equity returns maintain the current uptrend through the latter two months of Q4. The two most revenue-generating US equities, INO and SRNE, are both related to the COVID-19 vaccine and treatment pipelines, a trend of borrow demand likely to persist for the duration of virus impact. US equity ‘special’ balances, defined here as loans with fee greater than 500bps, increased from an average of $8.2 billion in September to $9.8 billion in October (remaining well below the $18 billion YTD peak observed in June).

Figure 1: October securities lending revenues through the years

Asia equity lending revenues continue to fall short of 2019, with October revenues of $116 million reflecting a 31 percent YoY decline, and the lowest monthly return YTD. The largest market, Japan equities, delivered $55 million in October revenues, a decline of 26 percent YoY. Hong Kong equity lending revenues mounted a modest recovery in October, with $25.5 million in revenues reflecting a 9 percent YoY and a 12 percent MoM increase.

The short sale ban in South Korea continues to limit lending revenue, with $9.5 million in October revenue being the lowest for any month of 2020. Australia posted the first YoY increase in monthly revenues YTD, with $8.3 million in October revenues reflecting a 1.3 percent YoY increase.

Through the first 10 months of 2020 global securities lending returns of $6.9 billion reflect a decline of 11 percent compared with the first 10 months of 2019, a result almost entirely driven by lower fee spreads. Global loan balances increased by 2.3 percent YoY. Revenues have been highly dependant on corporate actions and will likely remain so, however, the relative decline in the most-shorted equities may augur well for market liquidity and borrow demand for the remainder of 2020.

Figure 2: Top revenue generating Europe equities - October 2020

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times