New metrics for lending programmes

08 December 2020

IHS Markit and Credit Benchmark are seeking to overlays credit and stability on lender performance

Image: Shutterstock

Image: Shutterstock

IHS Markit Securities Finance recognises the focus and effort the industry put forward to improve data reporting and we are proud of the role we play in transforming data submissions into actionable data. In this note, we’ll discuss some third party partnerships and new thinking on data aggregation which we hope will provide additional insight for lenders and agents seeking to perfect the understanding of program management for all stakeholders.

Through an agreement with MSCI and iBoxx, IHS Markit Securities Finance has published monthly reports on lending returns for 12 key MSCI Equity and iBoxx Fixed Income Indices for the last year to aid in the general understanding of broad market trends affecting lenders. These reports are made available to the public via the Securities Finance page on the IHS Markit website.

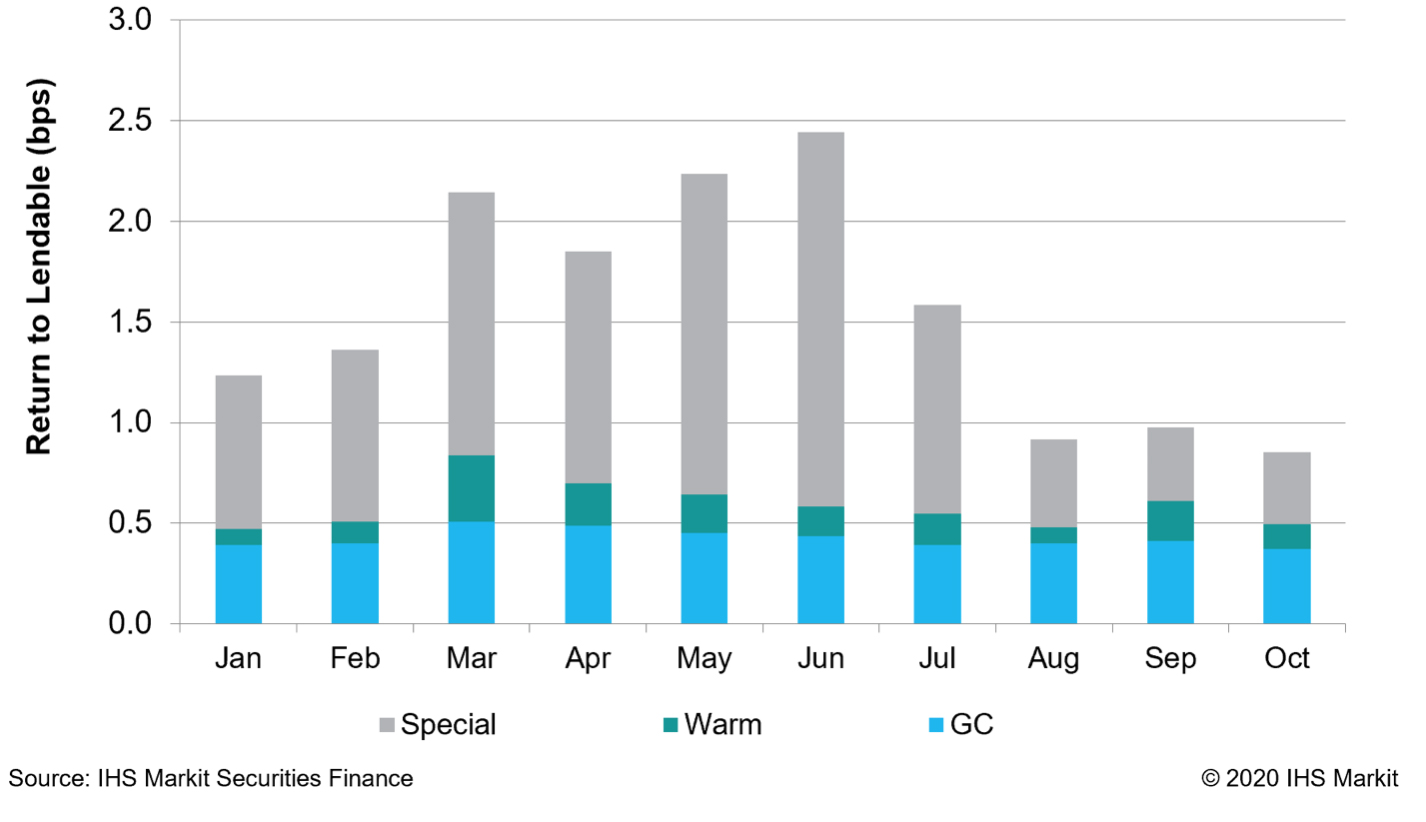

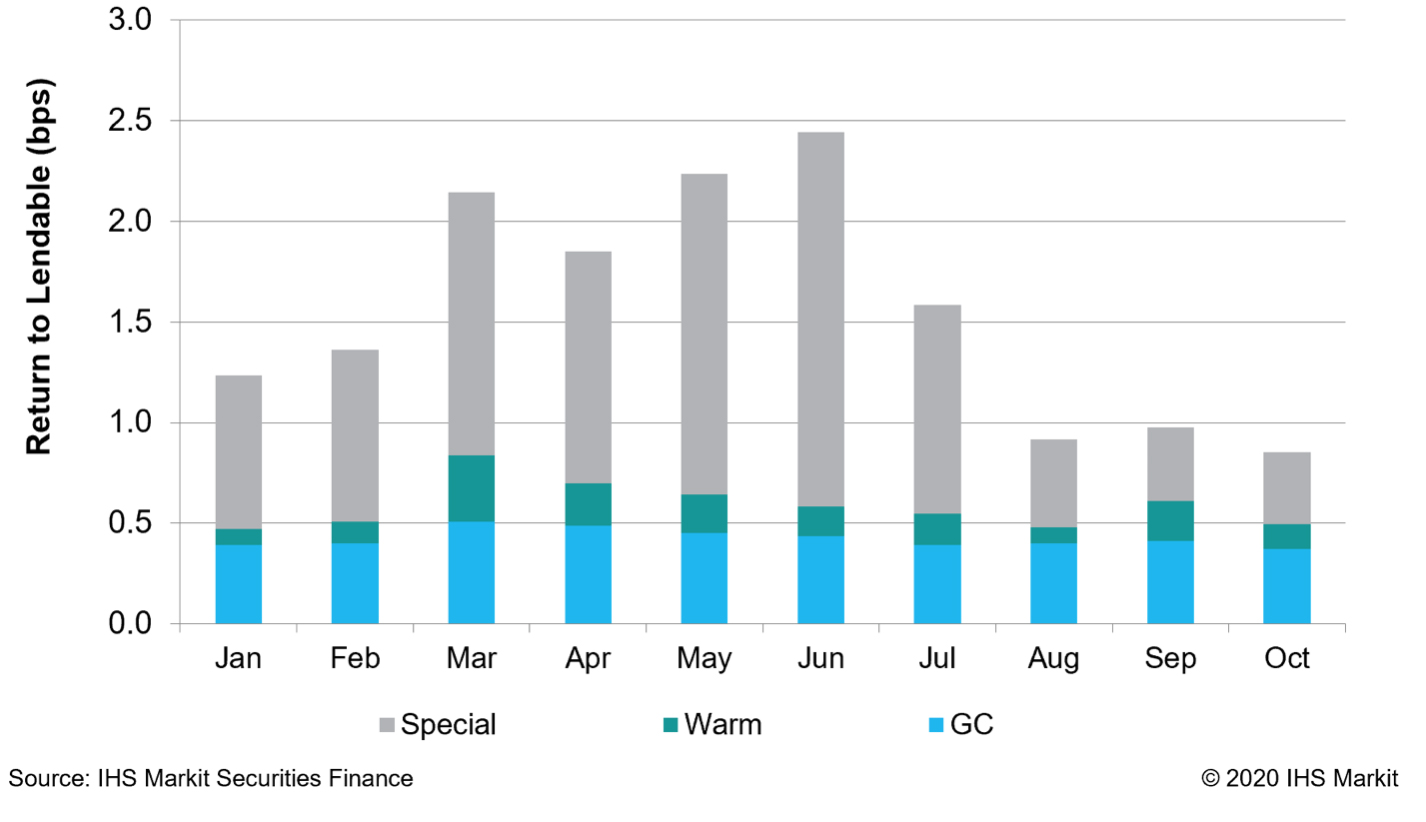

The MSCI World Index is a broad global equity index representing large and mid-cap equity performance across all 23 developed markets countries. The index covers approximately 85 percent of the free float-adjusted market capitalisation in each country, making it an ideal lens for a broad view of global equity lenders. Revenues generated by lending the MSCI World portfolio have lagged 2019 comparable for every month of 2020 except for June and July, per the October report.

Figure 1 MSCI World - return to index lendable assets

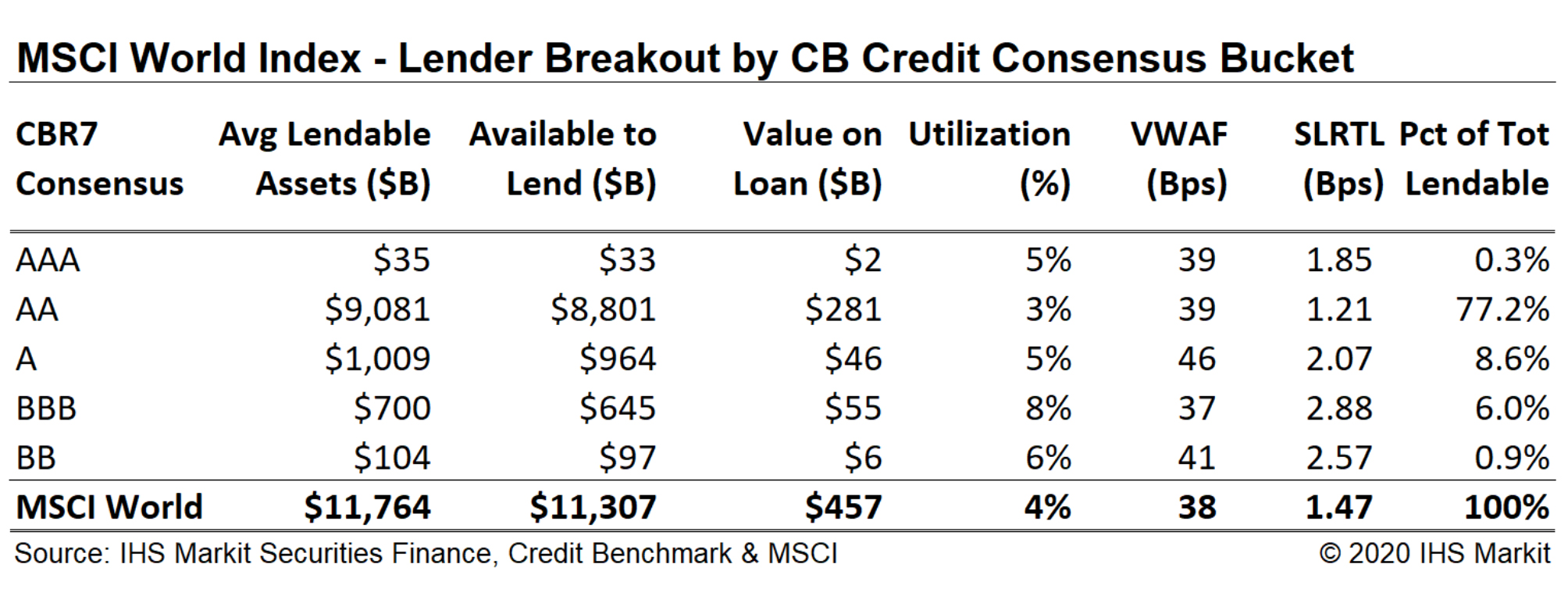

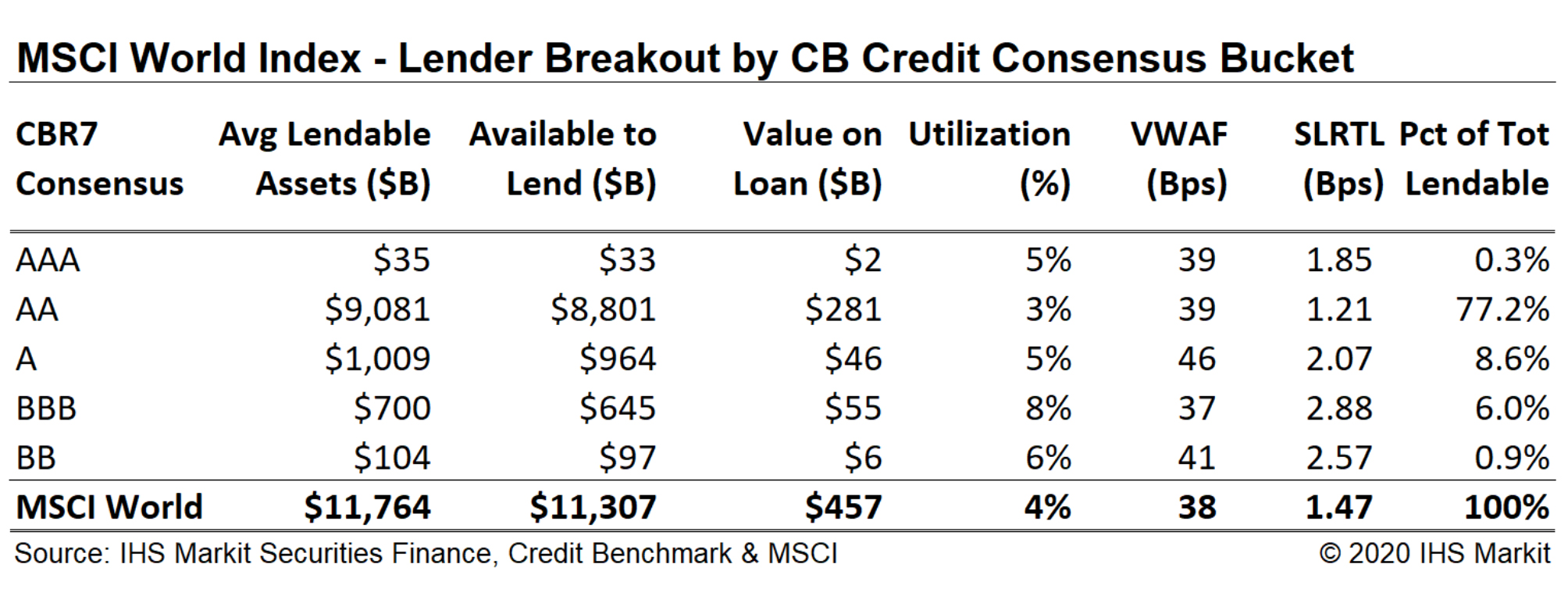

Credit Benchmark (CB) constructs a consensus credit risk dataset, which aggregates the views of thousands of institutional credit analysts to deliver timely standardized metrics for more than 50,000 global counterparts. IHS Markit Securities Finance has partnered with CB to deliver the first integration of credit risk metrics alongside securities finance data. By linking the LEIs for lenders reporting to the IHS Markit performance reporting with the CB Consensus dataset an unprecedented profile of lender credit risk emerges.

Figure 2 MSCI World Index - lender breakout by CB credit consensus bucket

Visualising the breakout of lender activity by credit ‘bucket’ reveals the variation between them, suggesting peer group comparisons could be improved by incorporating this data. Borrowers can reduce risk-weighted assets and cost-of-borrowing by allocating borrows to higher credit quality lenders, so all else being equal the expectation would be greater utilisation for AAA/AA and less for A and BBB, sequentially. Observing that this thesis doesn’t hold warrants further investigation, which reveals that BBB lenders gain in utilisation owing to greater collateral flexibility. Breaking the returns out by fee buckets we observe a similar trend where greater collateral flexibility helps BBB returns in GC, however, higher-rated lenders outperform within warm and special buckets owing to greater utilisation.

Lendable stability is a novel metric for lender inventories, derived from the change in portfolio securities over the preceding four quarterly observations. Lendable stability metrics were originally designed to assist traders with gauging the stability of inventory behind on-loan balances and reported availability; they will soon be released into the performance measurement tool as an overlay for lender peer groups.

When the MSCI World index GC lendable is broken out by stability score the group with the greatest stability outperforms lower stability lenders when lending the harder to borrow shares in the index (fee greater than 100bps); lower stability lenders outperform in general collateral lending, which appears similar to the credit breakout as largely the result of collateral flexibility.

A challenge for securities lending program management comes in finding peer groups which are alike, but not so overly specified that a group average is too narrow or volatile based on individual contributors. IHS Markit Securities Finance actively contributed to the development of ISLA Securities Lending Performance Measurement standards for data aggregation and calibration of performance-related metrics for securities lending and have deployed resources to aide contributors with compliance.

In addition, lenders seek novel metrics to improve the marketability of their portfolios to borrowers. The high-quality liquid assets status of lendable portfolios are now available, with classifications provided gratis to securities finance clients by the IHS Markit Fixed Income Pricing product.

The development of new metrics and refinement of inputs jointly push forward the tools available for lending program managers. These new tools will also benefit borrowers who will be able to improve counterparty selection and provide superior colour to their internal stakeholders and buy-side clients. At IHS Markit Securities Finance we welcome and encourage these developments and look forward to the role we are fortunate to play in bringing them about. Feedback and suggestions are, as always, welcome and encouraged.

Through an agreement with MSCI and iBoxx, IHS Markit Securities Finance has published monthly reports on lending returns for 12 key MSCI Equity and iBoxx Fixed Income Indices for the last year to aid in the general understanding of broad market trends affecting lenders. These reports are made available to the public via the Securities Finance page on the IHS Markit website.

The MSCI World Index is a broad global equity index representing large and mid-cap equity performance across all 23 developed markets countries. The index covers approximately 85 percent of the free float-adjusted market capitalisation in each country, making it an ideal lens for a broad view of global equity lenders. Revenues generated by lending the MSCI World portfolio have lagged 2019 comparable for every month of 2020 except for June and July, per the October report.

Figure 1 MSCI World - return to index lendable assets

Credit Benchmark (CB) constructs a consensus credit risk dataset, which aggregates the views of thousands of institutional credit analysts to deliver timely standardized metrics for more than 50,000 global counterparts. IHS Markit Securities Finance has partnered with CB to deliver the first integration of credit risk metrics alongside securities finance data. By linking the LEIs for lenders reporting to the IHS Markit performance reporting with the CB Consensus dataset an unprecedented profile of lender credit risk emerges.

Figure 2 MSCI World Index - lender breakout by CB credit consensus bucket

Visualising the breakout of lender activity by credit ‘bucket’ reveals the variation between them, suggesting peer group comparisons could be improved by incorporating this data. Borrowers can reduce risk-weighted assets and cost-of-borrowing by allocating borrows to higher credit quality lenders, so all else being equal the expectation would be greater utilisation for AAA/AA and less for A and BBB, sequentially. Observing that this thesis doesn’t hold warrants further investigation, which reveals that BBB lenders gain in utilisation owing to greater collateral flexibility. Breaking the returns out by fee buckets we observe a similar trend where greater collateral flexibility helps BBB returns in GC, however, higher-rated lenders outperform within warm and special buckets owing to greater utilisation.

Lendable stability is a novel metric for lender inventories, derived from the change in portfolio securities over the preceding four quarterly observations. Lendable stability metrics were originally designed to assist traders with gauging the stability of inventory behind on-loan balances and reported availability; they will soon be released into the performance measurement tool as an overlay for lender peer groups.

When the MSCI World index GC lendable is broken out by stability score the group with the greatest stability outperforms lower stability lenders when lending the harder to borrow shares in the index (fee greater than 100bps); lower stability lenders outperform in general collateral lending, which appears similar to the credit breakout as largely the result of collateral flexibility.

A challenge for securities lending program management comes in finding peer groups which are alike, but not so overly specified that a group average is too narrow or volatile based on individual contributors. IHS Markit Securities Finance actively contributed to the development of ISLA Securities Lending Performance Measurement standards for data aggregation and calibration of performance-related metrics for securities lending and have deployed resources to aide contributors with compliance.

In addition, lenders seek novel metrics to improve the marketability of their portfolios to borrowers. The high-quality liquid assets status of lendable portfolios are now available, with classifications provided gratis to securities finance clients by the IHS Markit Fixed Income Pricing product.

The development of new metrics and refinement of inputs jointly push forward the tools available for lending program managers. These new tools will also benefit borrowers who will be able to improve counterparty selection and provide superior colour to their internal stakeholders and buy-side clients. At IHS Markit Securities Finance we welcome and encourage these developments and look forward to the role we are fortunate to play in bringing them about. Feedback and suggestions are, as always, welcome and encouraged.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times