Global dividend forecast 2021

16 March 2021

IHS Markit data indicates global dividends are set to recover overall, but not universally, this year and hit $1.78 trillion and provide a healthy revenue stream for the securities finance universe

Image: Shutterstock

Image: Shutterstock

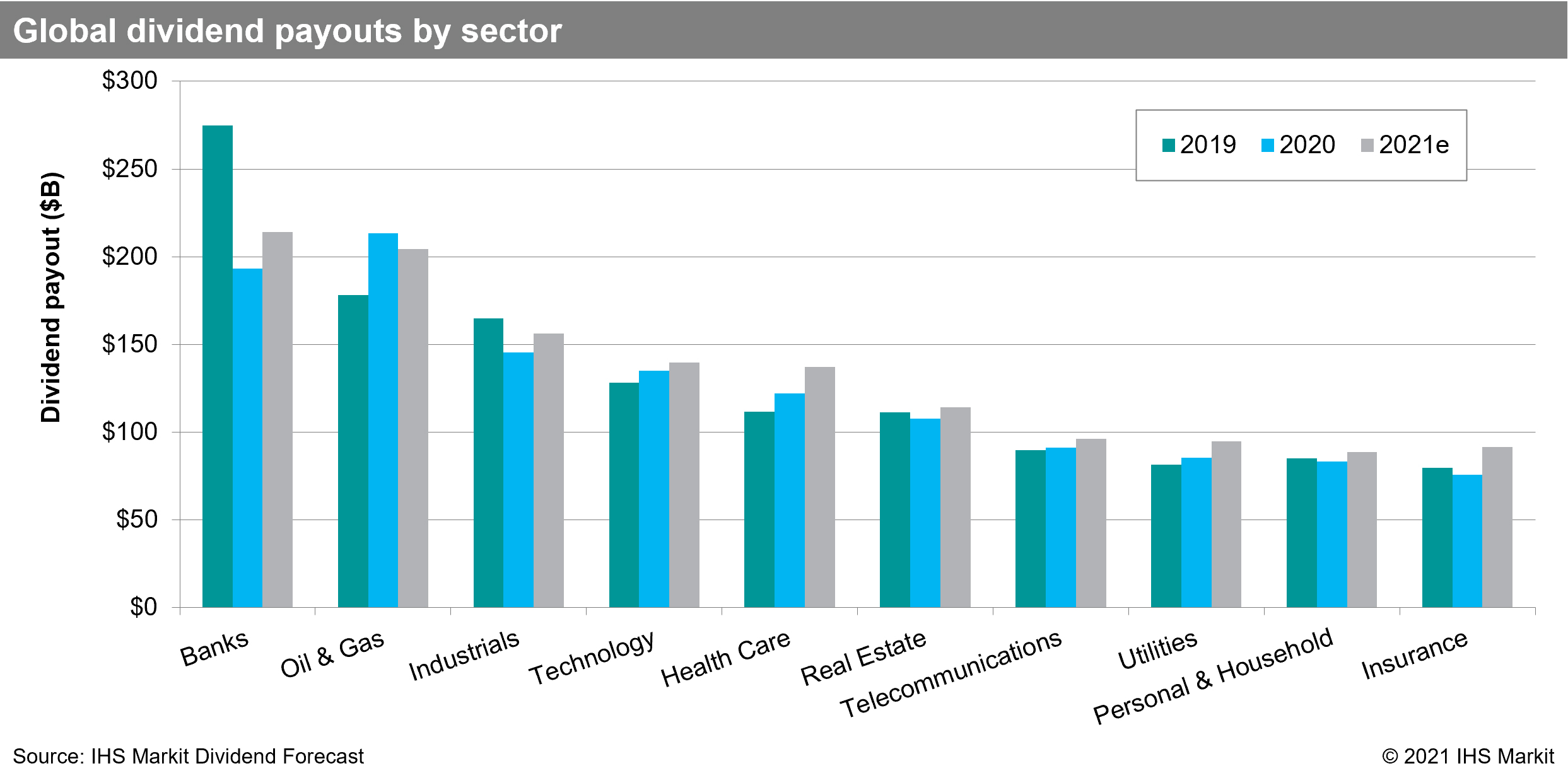

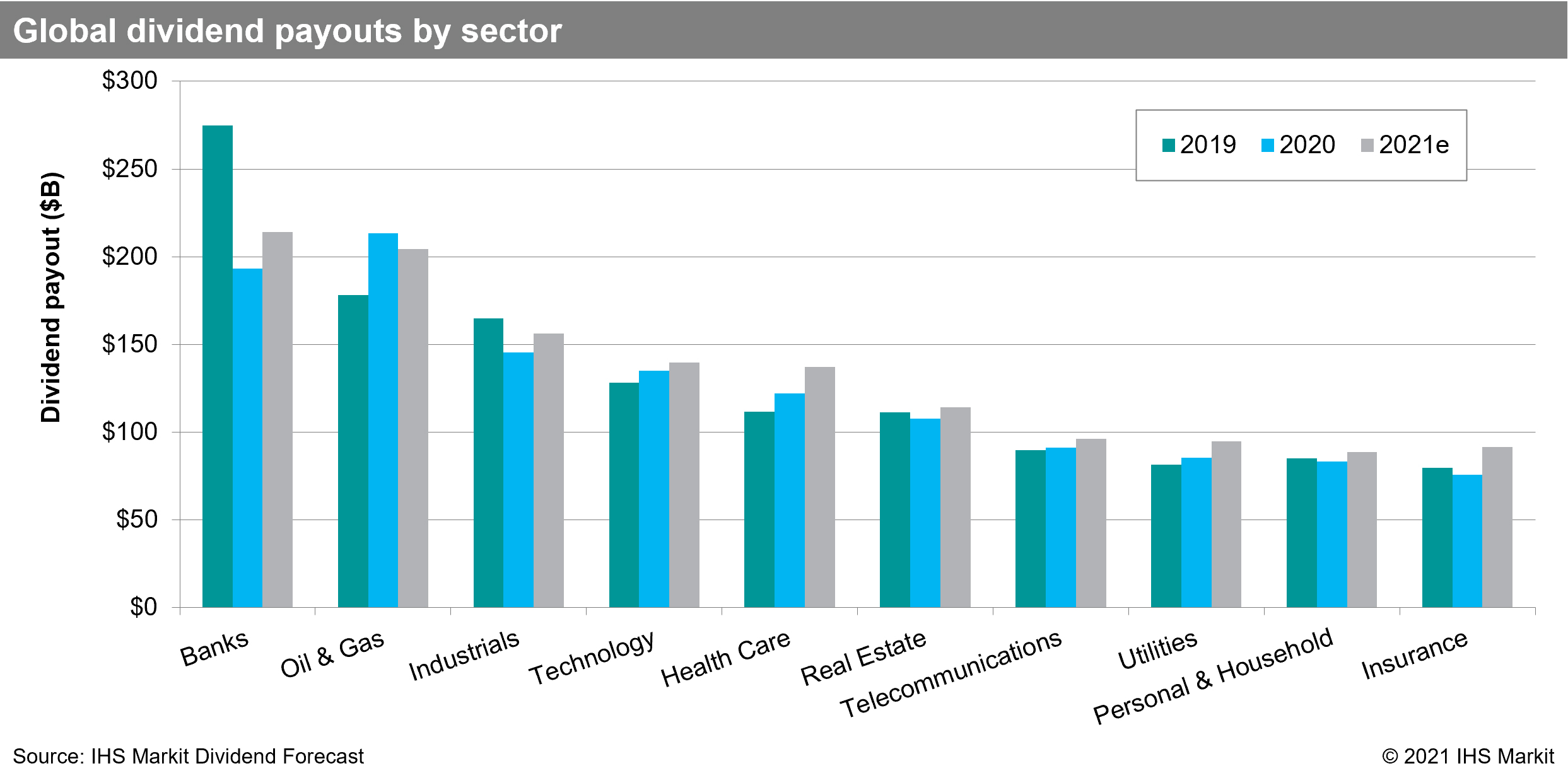

The recovery in dividend payouts is expected to vary across regions in 2021, per IHS Markit Dividend Forecast analysts. Global dividend payouts are forecast to reach $1.78 trillion in 2021, a 6.5 per cent year-on-year (YoY) increase. Global banks are forecast to retake the mantle of most dividend paying sector globally, with payouts of $214 billion in 2021, an 11 per cent YoY increase, though the sector will still fall 22 per cent short of 2019 payouts. The global oil and gas sector is forecast to have the second most dividend payouts in 2021, with $178 billion, reflecting a 4 per cent YoY decrease. Oil and gas is the only global sector forecast to see a decline in YoY payouts.

Figure 1

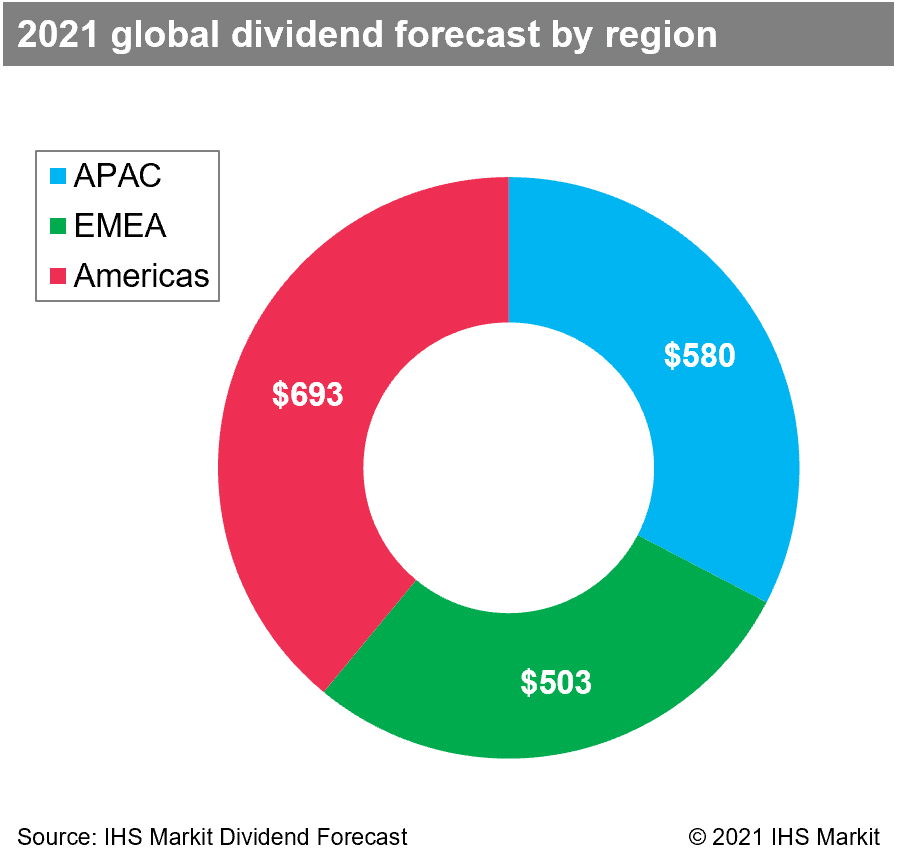

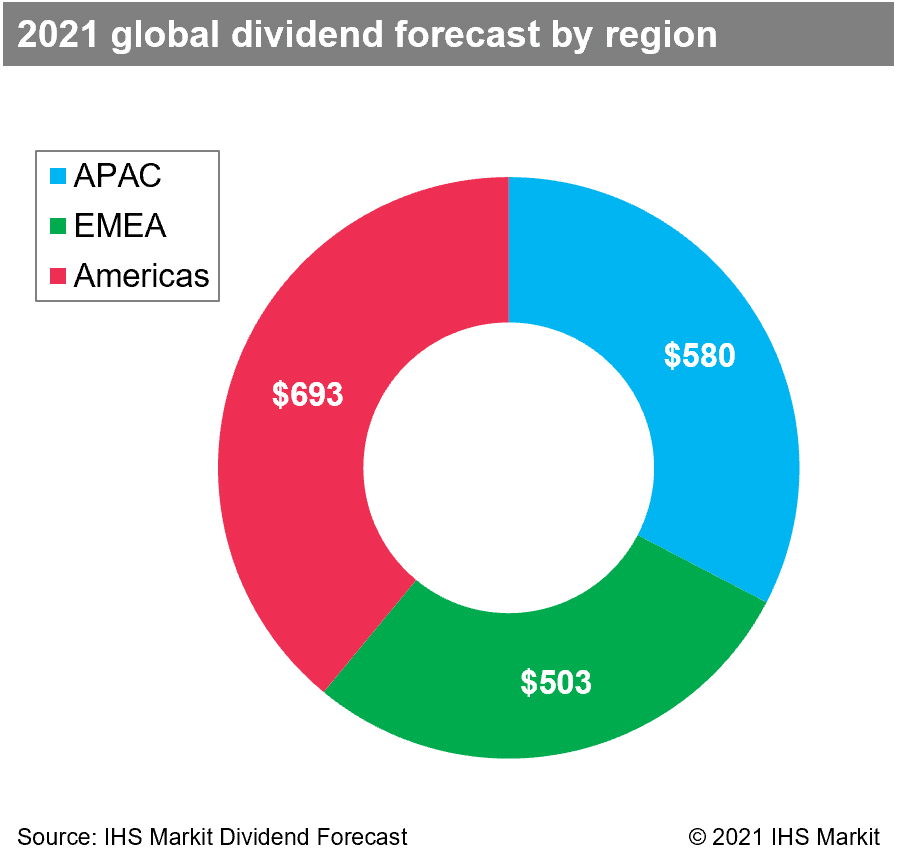

Dividends in Europe, the Middle East and Africa (EMEA) are expected to recover unevenly, with UK dividends leading the growth. Eurozone and the UK are expected to increase 22 per cent and 30 per cent YoY, respectively; however, payouts are not forecast to exceed 2019 levels. Most sectors outside of travel and leisure and automobiles are expected to see some level of recovery. Total EMEA dividends are expected to increase by $74 billion in 2021, a 17 per cent YoY increase. Nearly 28 per cent of EMEA dividends are forecast to be paid out by emerging markets.

Dividends in Asia Pacific are expected to grow by 6.7 per cent in 2021, with growth expected across all sectors excluding travel and leisure and oil and gas. China and Hong Kong SAR are both forecast to grow in 2021, increasing by 9 per cent and 3 per cent respectively. After declining 5 per cent in 2020, dividends in Japan are forecast to increase 5.6 per cent in 2021, sufficient to notch a narrow increase compared with 2019.

Figure 2

There is forecast to be a 0.4 per cent decline in overall payouts for the Americas. Dividends in the US are expected to fall 0.7 per cent YoY, largely due to ongoing sluggish performance in travel and leisure and retail sectors. The banking sector is also forecast to see a YoY decline, though, that is primarily concentrated in a single payer. Canada is forecast to deliver $54.5 billion in 2021 payouts, a 7 per cent YoY increase, driven by the oil and gas and banking sectors.

The expected rebound in dividend payouts serves as another marker of the global economic recovery underway. Global dividends are forecast to increase markedly YoY overall and for many global markets. The forecast $1.78 trillion in global payouts is 0.34 per cent below the 2019 level, a most welcome return to form after the 6 per cent decline in 2020.

Figure 1

Dividends in Europe, the Middle East and Africa (EMEA) are expected to recover unevenly, with UK dividends leading the growth. Eurozone and the UK are expected to increase 22 per cent and 30 per cent YoY, respectively; however, payouts are not forecast to exceed 2019 levels. Most sectors outside of travel and leisure and automobiles are expected to see some level of recovery. Total EMEA dividends are expected to increase by $74 billion in 2021, a 17 per cent YoY increase. Nearly 28 per cent of EMEA dividends are forecast to be paid out by emerging markets.

Dividends in Asia Pacific are expected to grow by 6.7 per cent in 2021, with growth expected across all sectors excluding travel and leisure and oil and gas. China and Hong Kong SAR are both forecast to grow in 2021, increasing by 9 per cent and 3 per cent respectively. After declining 5 per cent in 2020, dividends in Japan are forecast to increase 5.6 per cent in 2021, sufficient to notch a narrow increase compared with 2019.

Figure 2

There is forecast to be a 0.4 per cent decline in overall payouts for the Americas. Dividends in the US are expected to fall 0.7 per cent YoY, largely due to ongoing sluggish performance in travel and leisure and retail sectors. The banking sector is also forecast to see a YoY decline, though, that is primarily concentrated in a single payer. Canada is forecast to deliver $54.5 billion in 2021 payouts, a 7 per cent YoY increase, driven by the oil and gas and banking sectors.

The expected rebound in dividend payouts serves as another marker of the global economic recovery underway. Global dividends are forecast to increase markedly YoY overall and for many global markets. The forecast $1.78 trillion in global payouts is 0.34 per cent below the 2019 level, a most welcome return to form after the 6 per cent decline in 2020.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times