Catching up with performance in Q2 2024

23 July 2024

Revenues continued to cool across most asset classes during Q2, but the market has been firing on all cylinders throughout 2023, according to Matthew Chessum, director of securities finance at S&P Global Market Intelligence

Image: Shutterstock

Image: Shutterstock

Both stock and bond markets faced a few jitters as the second quarter kicked off, as the outlook for any imminent rate cut by the Federal Reserve bank started to dim, given the strong economic data that continued to flow out of the United States during April.

Markets started to pare back previous expectations of three rate cuts this year, after already cutting expectations from five cuts at the beginning of 2024. Towards the middle of the quarter, the outlook brightened as economic data started to soften, leading to lower than expected levels of inflation and a growing sentiment of the first Fed rate cut being likely during September. Across the globe, asset valuations continued to rally as stocks related to the artificial intelligence theme continued to perform strongly.

Across bond markets, yields fell across US treasuries, and as the quarter continued, French government bond spreads widened sharply versus German government bonds following the snap parliamentary elections in France. The European Central Bank cut its interest rates during the quarter by 25bps after pre-committing to a June cut earlier in the year. This led to central policy bank divergence for the first time in many years. This also led to moves in the currency markets with a strong US dollar causing problems, particularly for the Japanese Yen.

Meme stocks made a comeback into the financial press during Q2 after Keith Gill, the infamous Roaring Kitty, made a comeback on YouTube. Gamestop (GME) who was the original star of the meme stock frenzy rallied as much as 300 per cent at its Q2 peak before experiencing a correction.

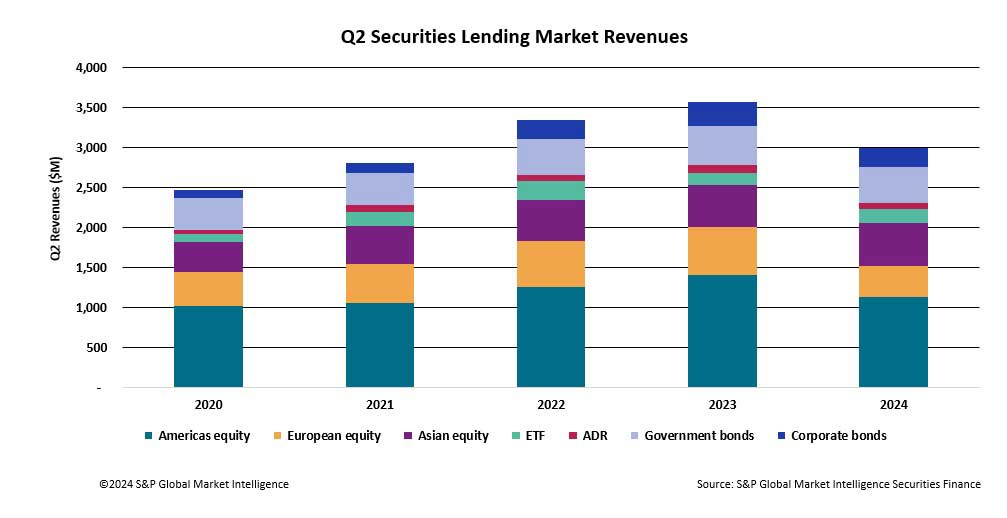

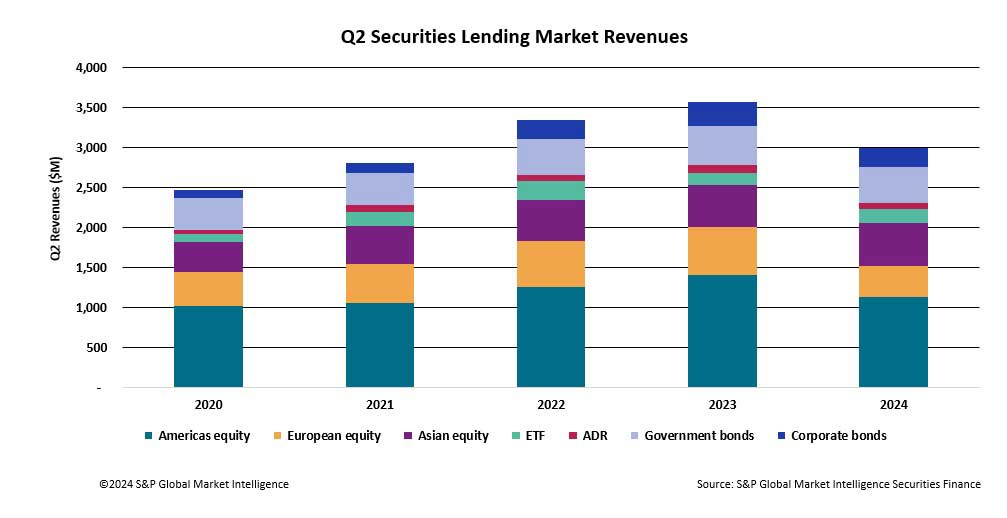

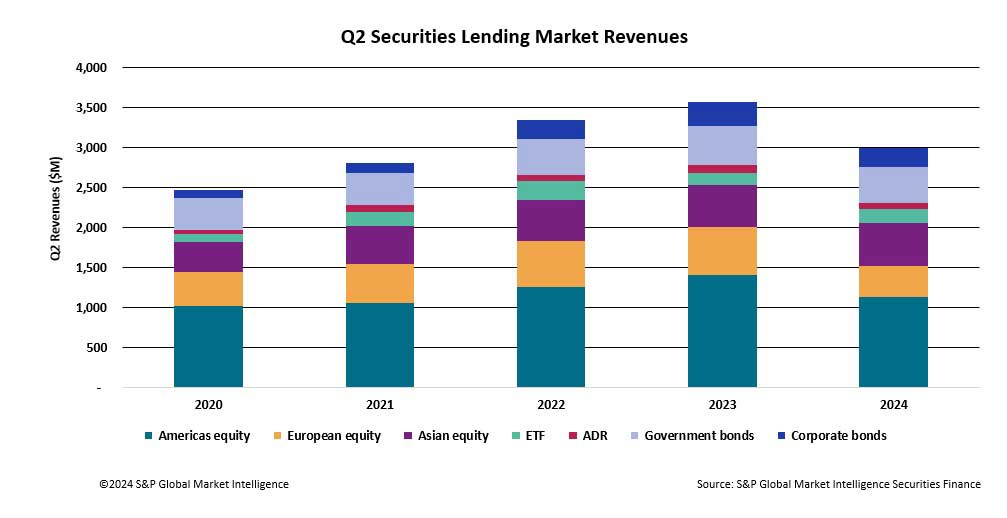

In the securities lending markets, revenues continued to decline when compared year-on-year (YoY). Lower volumes and lower average fees across a large swathe of markets lowered revenues. A decline in the mega specials activity that previously lifted market revenues to all-time highs led to more modest H1 2024 returns.

In the second quarter, revenues generated US$3,068 million. A reduction of 15 per cent YoY, but a 12 per cent increase when compared with Q1 2024. June was the worst month of the quarter, producing US$962 million, and May was the best month of the quarter, producing revenues of US$1.07 billion. Interestingly, April was the strongest month of both the quarter and the year during 2023, producing just under US$1.3 billion in revenues.

Across the equity markets, Asia continued to be the standout region, producing revenues three per cent higher than those seen during Q2 2023. Average fees increased five per cent YoY to 105bps, marking the only region to experience any YoY growth. There were a number of standout markets in terms of revenues across the region including Taiwan which produced US$213 million (+49 per cent), the highest revenues of any country within the region, Malaysia (+50 per cent YoY, US$7 million) and Singapore (+30 per cent, US$5 million).

Japan experienced a strong quarter and was the second highest revenue producing country across the APAC region after producing US$167 million (+12 per cent YoY). Average fees across Japan increased 20 per cent YoY which helped to push revenues higher. As a result of the short selling bans across APAC, revenues across South Korea and Thailand continued to suffer, down 69 per cent and 18 per cent respectively. Average fees also plummeted in these two countries as a result.

European equities continued to suffer excruciating YoY declines. The region generated US$386 million in revenues, down 35 per cent YoY, following a decline of 40 per cent YoY during Q1. Not only did average fees decline by 20 per cent YoY but so did balances — and this is during a period where the Eurostoxx 600 increased by over 2.38 per cent.

All of the high revenue producing countries within the region underperformed when compared YoY, Swedish revenues were down 28 per cent, France -52 per cent, Germany -41 per cent and Norway -60 per cent. Other countries such as South Africa (+49 per cent YoY), Italy (+35 per cent YoY) and Spain (+26 per cent YoY) all performed well, but unfortunately the revenues were too modest to make an impact on the regional landscape.

After the blistering performance seen across Americas equities during 2023, when both Q1 and Q2 produced revenues in excess of US$1.4 billion each, Q2 2024 revenues were more modest. US$1.147 billion was generated during Q2 which represents a decline of 19 per cent YoY.

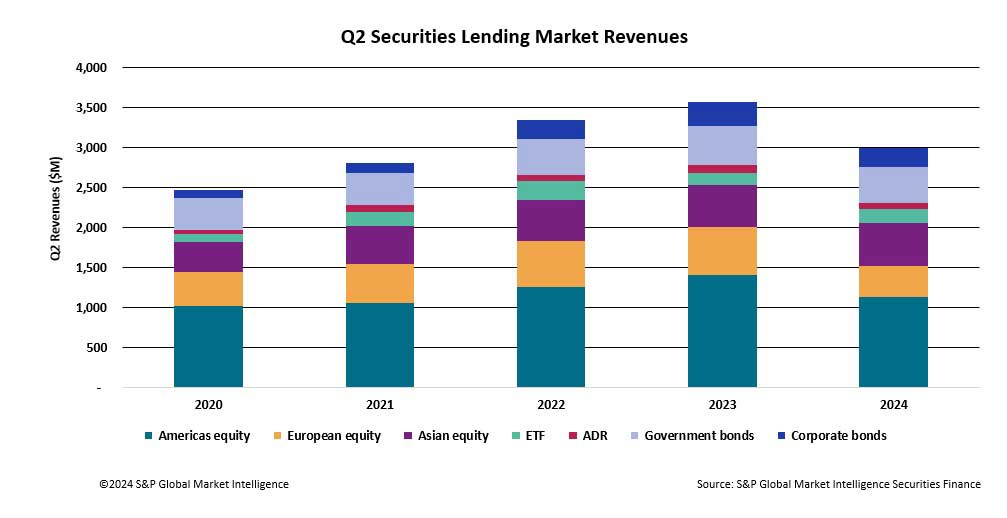

Figure 1: Q2 securities lending market revenues

Across the US, revenues fell by 21 per cent YoY to US$1.017 billion, and in Canada revenues increased by 13 per cent YoY to US$117 million. Average fees were strong across Canada during the period rising 22 per cent YoY to 78bps. Across US equities, average fees declined 21 per cent YoY and balances decreased four per cent YoY, again, this was during a period where the S&P500 increased by four per cent over the quarter.

ETPs performed well during Q2 with revenues growing seven per cent YoY. There was growth in borrowing activity for fixed income ETFs, with strong demand seen for LQD and HYG towards the end of the quarter, and equity ETFs with the iShares MSCI EAFE ETF (EFA), which invests in large and mid-cap equities outside of the US and Canada, generating strong returns.

In the fixed income markets, YoY revenues continued to dip. Government bond revenues fell four per cent YoY and corporate bond revenues declined by 22 per cent YoY. Balances continued to grow across both asset classes, increasing nine per cent and 13 per cent respectively. Average fees continued to fall however, continuing the trend of higher on loan balances and falling average fees.

In summary, revenues continued to cool across most asset classes during Q2, but it is important to remember that the market has been firing on all cylinders throughout 2023, generating some of the best returns ever experienced, so any YoY comparisons and declines in revenues must be kept in context.

Market conditions were generally not very supportive for securities lending activity during the quarter with relentless moves higher in equity markets and a lack of any meaningful correctional periods outside of the first few weeks of April. The lack of volatility led to a continuation in the overall decline in average balances across equity lending and a subsequent reduction in average fees.

Figure 2: H1 2024 securities finance market revenues

Edging into Q3, the market rally appears to be broadening out, more movement, both up and down, has been seen across both main index and small cap indices. Several recent events also appear to be having a greater impact upon market sentiment compared to what was seen during the first half of the year.

Interest rate divergence is also now a reality which puts pressure on currency markets and valuations. It also impacts company profits as interest rates change. This may bring opportunities for more directional trading throughout Q3.

The political landscape continues to change and is starting to impact financial markets as well. The on-going speculation of Trump 2.0 and the impact that a new President may have on the global economy continues to be seen in the financial landscape through the newly termed “Trump trade”. In France, the new government is also likely to impact not only domestic fiscal and monetary policy but also that of the European Union.

Finally, speculation continues to grow regarding the future performance of the technology and semiconductor sectors. Some analysts are predicting an end to the rally, a degree of profit taking and a rotation out of the red-hot tech sector into small caps and other areas of the market that have been out of favour lately. This may provide an opportunity for lenders, as tech now accounts for such a disproportionate share of the market index that any fall in tech stock prices often pushes equity indexes into negative territory, providing the opportunity to spark a broader sell off. This is likely to create more volatility going forward to the benefit of securities lenders.

Heading into the second half of the year it does feel as if uncertainty is growing and the one thsing that financial markets and investors do not like is uncertainty. It is therefore possible that markets will be more volatile and less predictable heading into Q3 and Q4 which should provide a more fertile ground for a wider range of securities lending opportunities, boosting market revenues during the second half of the year.

Markets started to pare back previous expectations of three rate cuts this year, after already cutting expectations from five cuts at the beginning of 2024. Towards the middle of the quarter, the outlook brightened as economic data started to soften, leading to lower than expected levels of inflation and a growing sentiment of the first Fed rate cut being likely during September. Across the globe, asset valuations continued to rally as stocks related to the artificial intelligence theme continued to perform strongly.

Across bond markets, yields fell across US treasuries, and as the quarter continued, French government bond spreads widened sharply versus German government bonds following the snap parliamentary elections in France. The European Central Bank cut its interest rates during the quarter by 25bps after pre-committing to a June cut earlier in the year. This led to central policy bank divergence for the first time in many years. This also led to moves in the currency markets with a strong US dollar causing problems, particularly for the Japanese Yen.

Meme stocks made a comeback into the financial press during Q2 after Keith Gill, the infamous Roaring Kitty, made a comeback on YouTube. Gamestop (GME) who was the original star of the meme stock frenzy rallied as much as 300 per cent at its Q2 peak before experiencing a correction.

In the securities lending markets, revenues continued to decline when compared year-on-year (YoY). Lower volumes and lower average fees across a large swathe of markets lowered revenues. A decline in the mega specials activity that previously lifted market revenues to all-time highs led to more modest H1 2024 returns.

In the second quarter, revenues generated US$3,068 million. A reduction of 15 per cent YoY, but a 12 per cent increase when compared with Q1 2024. June was the worst month of the quarter, producing US$962 million, and May was the best month of the quarter, producing revenues of US$1.07 billion. Interestingly, April was the strongest month of both the quarter and the year during 2023, producing just under US$1.3 billion in revenues.

Across the equity markets, Asia continued to be the standout region, producing revenues three per cent higher than those seen during Q2 2023. Average fees increased five per cent YoY to 105bps, marking the only region to experience any YoY growth. There were a number of standout markets in terms of revenues across the region including Taiwan which produced US$213 million (+49 per cent), the highest revenues of any country within the region, Malaysia (+50 per cent YoY, US$7 million) and Singapore (+30 per cent, US$5 million).

Japan experienced a strong quarter and was the second highest revenue producing country across the APAC region after producing US$167 million (+12 per cent YoY). Average fees across Japan increased 20 per cent YoY which helped to push revenues higher. As a result of the short selling bans across APAC, revenues across South Korea and Thailand continued to suffer, down 69 per cent and 18 per cent respectively. Average fees also plummeted in these two countries as a result.

European equities continued to suffer excruciating YoY declines. The region generated US$386 million in revenues, down 35 per cent YoY, following a decline of 40 per cent YoY during Q1. Not only did average fees decline by 20 per cent YoY but so did balances — and this is during a period where the Eurostoxx 600 increased by over 2.38 per cent.

All of the high revenue producing countries within the region underperformed when compared YoY, Swedish revenues were down 28 per cent, France -52 per cent, Germany -41 per cent and Norway -60 per cent. Other countries such as South Africa (+49 per cent YoY), Italy (+35 per cent YoY) and Spain (+26 per cent YoY) all performed well, but unfortunately the revenues were too modest to make an impact on the regional landscape.

After the blistering performance seen across Americas equities during 2023, when both Q1 and Q2 produced revenues in excess of US$1.4 billion each, Q2 2024 revenues were more modest. US$1.147 billion was generated during Q2 which represents a decline of 19 per cent YoY.

Figure 1: Q2 securities lending market revenues

Across the US, revenues fell by 21 per cent YoY to US$1.017 billion, and in Canada revenues increased by 13 per cent YoY to US$117 million. Average fees were strong across Canada during the period rising 22 per cent YoY to 78bps. Across US equities, average fees declined 21 per cent YoY and balances decreased four per cent YoY, again, this was during a period where the S&P500 increased by four per cent over the quarter.

ETPs performed well during Q2 with revenues growing seven per cent YoY. There was growth in borrowing activity for fixed income ETFs, with strong demand seen for LQD and HYG towards the end of the quarter, and equity ETFs with the iShares MSCI EAFE ETF (EFA), which invests in large and mid-cap equities outside of the US and Canada, generating strong returns.

In the fixed income markets, YoY revenues continued to dip. Government bond revenues fell four per cent YoY and corporate bond revenues declined by 22 per cent YoY. Balances continued to grow across both asset classes, increasing nine per cent and 13 per cent respectively. Average fees continued to fall however, continuing the trend of higher on loan balances and falling average fees.

In summary, revenues continued to cool across most asset classes during Q2, but it is important to remember that the market has been firing on all cylinders throughout 2023, generating some of the best returns ever experienced, so any YoY comparisons and declines in revenues must be kept in context.

Market conditions were generally not very supportive for securities lending activity during the quarter with relentless moves higher in equity markets and a lack of any meaningful correctional periods outside of the first few weeks of April. The lack of volatility led to a continuation in the overall decline in average balances across equity lending and a subsequent reduction in average fees.

Figure 2: H1 2024 securities finance market revenues

Edging into Q3, the market rally appears to be broadening out, more movement, both up and down, has been seen across both main index and small cap indices. Several recent events also appear to be having a greater impact upon market sentiment compared to what was seen during the first half of the year.

Interest rate divergence is also now a reality which puts pressure on currency markets and valuations. It also impacts company profits as interest rates change. This may bring opportunities for more directional trading throughout Q3.

The political landscape continues to change and is starting to impact financial markets as well. The on-going speculation of Trump 2.0 and the impact that a new President may have on the global economy continues to be seen in the financial landscape through the newly termed “Trump trade”. In France, the new government is also likely to impact not only domestic fiscal and monetary policy but also that of the European Union.

Finally, speculation continues to grow regarding the future performance of the technology and semiconductor sectors. Some analysts are predicting an end to the rally, a degree of profit taking and a rotation out of the red-hot tech sector into small caps and other areas of the market that have been out of favour lately. This may provide an opportunity for lenders, as tech now accounts for such a disproportionate share of the market index that any fall in tech stock prices often pushes equity indexes into negative territory, providing the opportunity to spark a broader sell off. This is likely to create more volatility going forward to the benefit of securities lenders.

Heading into the second half of the year it does feel as if uncertainty is growing and the one thsing that financial markets and investors do not like is uncertainty. It is therefore possible that markets will be more volatile and less predictable heading into Q3 and Q4 which should provide a more fertile ground for a wider range of securities lending opportunities, boosting market revenues during the second half of the year.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times