UK short sellers cover, defying Brexit anxiety

24 January 2017

UK equities are enjoying their longest positive streak on record and investors are showing no desire to short the rally, says IHS Markit analyst Simon Colvin

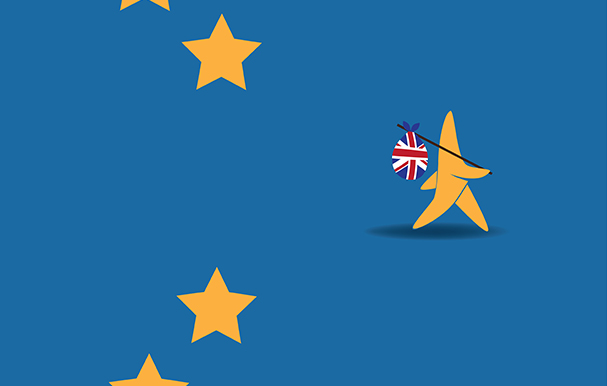

Image: Shutterstock

Image: Shutterstock

The potential impact of the ‘hard’ Brexit plan has seen the pound sink further in 2017 despite a brief rally in the wake Theresa May’s long awaited speech on the issue. However, anxiety has by and large been constrained to the sterling market as both large and midcap UK equities have managed to sustain the rally initiated in the closing weeks of last year.

This rally has not only pushed the FTSE 350 index to new highs, but has also tamed many UK equity skeptics as short sellers have actively been covering their positions in the index’s constituents over recent weeks.

In fact, the average demand to borrow the constituents of the FTSE 350 constituents now stands to a three-month low of 2 percent of shares outstanding—12 percent lower than the average registered in early December last year. This covering marks the largest monthly fall in average UK short interest since the referendum back in June, underscoring the improving investor mood.

A further dig into the numbers shows that the covering has been led by the midcap FTSE 250 end of the index, whose relatively large UK exposure made them favourite short targets following the referendum. While these companies still see relatively more shorting activity than at the same time last year, the fact that domestically exposed equities see covering indicates that the market is choosing to focus its attention on buoyant economic indicators, such as the latest service and manufacturing UK PMI published by Markit Economics, rather than the possible impact of a falling pound.

High conviction shorts lead the covering

Short sellers have been just as eager to trim positions in their high conviction plays as the rest of the market, as 17 of the 20 most borrowed constituents of the FTSE 350 index that have been shared out on loan returned over the last four weeks.

Chief among the stocks experiencing covering is supermarket WM Morrison, whose demand to borrow has sunk by a fifth in the last month. This covering has been spurred on by its best performance over the Christmas trading period in over seven years, which has propelled its shares to the highest level in nearly three years.

WM Morrison’s peers, Ocado and Sainsbury’s, which also feature among the high conviction short plays, have also experienced covering over the last month, with an 8 percent and 9 percent fall in demand to borrow, respectively.

Covering isn’t confined to retailers, as engineering and automation firm Rotork has also experienced a significant fall in its short interest, with 19 percent of its loans returned in the last four weeks. The pound’s crash is likely to disproportionately benefit the firm as it earns over 88 percent of its revenues from overseas.

ETF investors pile in

Exchange-traded fund (ETF) investors have also been keen to ride the surging trade as UK equity ETFs have seen more than £160 million of inflows year-to-date, with flows coming from both Europe- and overseas-listed funds. US investors have driven two thirds of the inflows after £117 million of new assets were parked into the iShares MSCI United Kingdom ETF.

Despite the falling pound, products that hedge against the further falls in the UK’s currency have continued to see lukewarm demand from investors as these funds have only attracted £17 million of new assets over 2017 or 10 percent of year-to-date inflows.

This rally has not only pushed the FTSE 350 index to new highs, but has also tamed many UK equity skeptics as short sellers have actively been covering their positions in the index’s constituents over recent weeks.

In fact, the average demand to borrow the constituents of the FTSE 350 constituents now stands to a three-month low of 2 percent of shares outstanding—12 percent lower than the average registered in early December last year. This covering marks the largest monthly fall in average UK short interest since the referendum back in June, underscoring the improving investor mood.

A further dig into the numbers shows that the covering has been led by the midcap FTSE 250 end of the index, whose relatively large UK exposure made them favourite short targets following the referendum. While these companies still see relatively more shorting activity than at the same time last year, the fact that domestically exposed equities see covering indicates that the market is choosing to focus its attention on buoyant economic indicators, such as the latest service and manufacturing UK PMI published by Markit Economics, rather than the possible impact of a falling pound.

High conviction shorts lead the covering

Short sellers have been just as eager to trim positions in their high conviction plays as the rest of the market, as 17 of the 20 most borrowed constituents of the FTSE 350 index that have been shared out on loan returned over the last four weeks.

Chief among the stocks experiencing covering is supermarket WM Morrison, whose demand to borrow has sunk by a fifth in the last month. This covering has been spurred on by its best performance over the Christmas trading period in over seven years, which has propelled its shares to the highest level in nearly three years.

WM Morrison’s peers, Ocado and Sainsbury’s, which also feature among the high conviction short plays, have also experienced covering over the last month, with an 8 percent and 9 percent fall in demand to borrow, respectively.

Covering isn’t confined to retailers, as engineering and automation firm Rotork has also experienced a significant fall in its short interest, with 19 percent of its loans returned in the last four weeks. The pound’s crash is likely to disproportionately benefit the firm as it earns over 88 percent of its revenues from overseas.

ETF investors pile in

Exchange-traded fund (ETF) investors have also been keen to ride the surging trade as UK equity ETFs have seen more than £160 million of inflows year-to-date, with flows coming from both Europe- and overseas-listed funds. US investors have driven two thirds of the inflows after £117 million of new assets were parked into the iShares MSCI United Kingdom ETF.

Despite the falling pound, products that hedge against the further falls in the UK’s currency have continued to see lukewarm demand from investors as these funds have only attracted £17 million of new assets over 2017 or 10 percent of year-to-date inflows.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times