Wematch

Anne Taieb, Wematch’s head of product, securities financing, explains how their product has established industrial scale for synthetics, but can be easily adapted to other areas of securities finance with the objective of offering cross-asset synergies between synthetic and physical products

What trends have you seen in collateral optimisation and what has been the main driver of your product?

As an ex-delta one trader, balance sheet costs and collateral costs were a key factor in my trading decisions. As head of product at Wematch, it is exciting now to be helping our clients to manage the optimisation of their books and to bring greater effectiveness to the marketplace. Over the past few years, the market trend has been all about spread compression and the true cost of doing business. The cost of the balance sheet and the various forms of capital requirements — for example risk-weighted assets (RWA), net stable funding ratio (NSFR) and liquidity coverage ratio (LCR) — are now such a huge component of any trading decision. Therefore, as a dominant trend, we have seen banks building out new algorithms and taking steps to trade as effectively as possible.

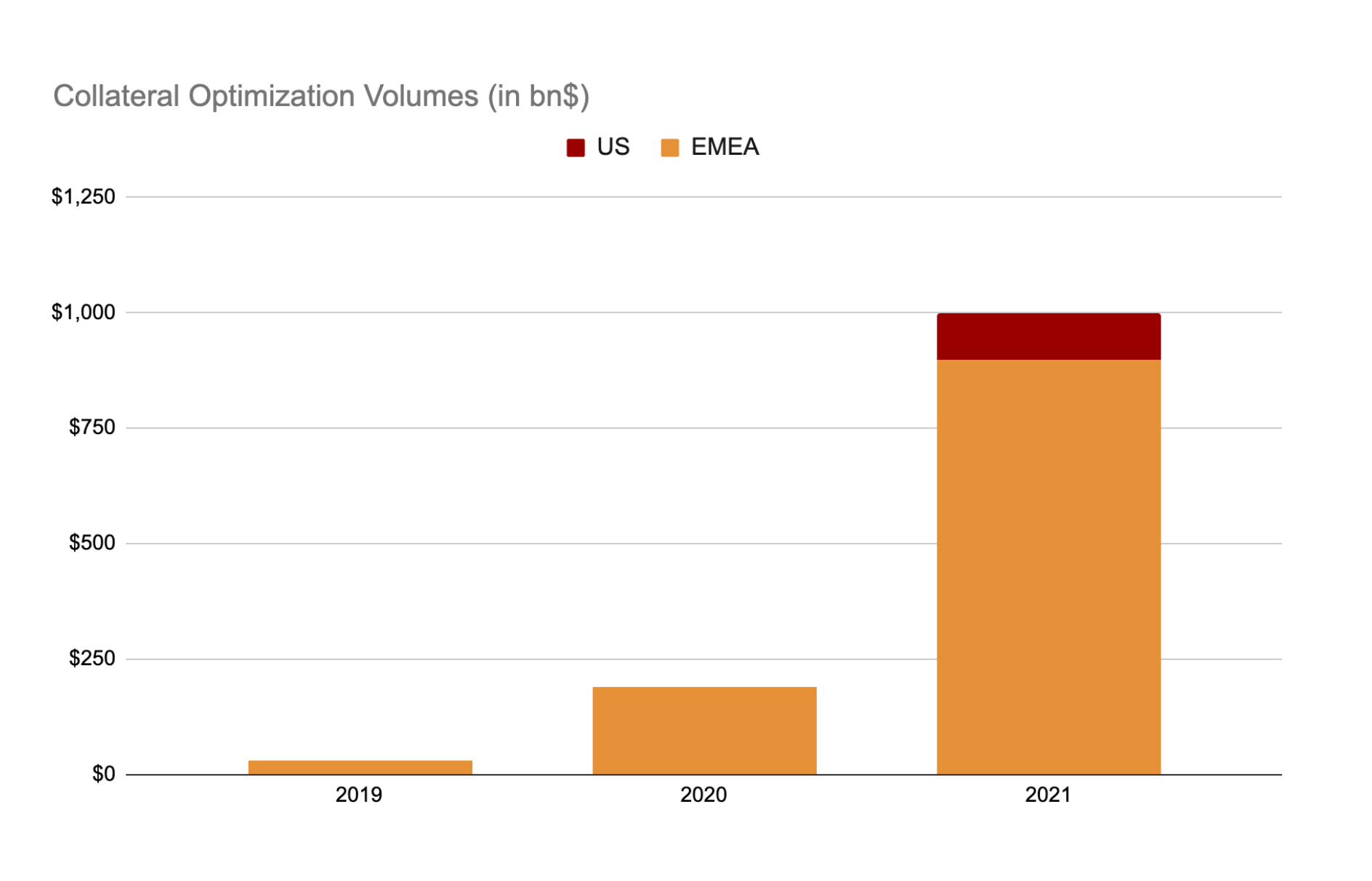

With more than US$1 trillion of collateral optimised in our platform in 2021, collateral optimisation on synthetic books (total return swaps, TRS) has seen a very significant increase in terms of demand and product sophistication. Our current clients have been contributing to building a complete product, where users can now select rules within a very rich library, allowing them to enjoy a fully customisable experience. Collaboration is one of our key values as a firm and this is true for my product team. We listen to our customers' requirements and strategically innovate to ensure our technology benefits the entire community. This has encouraged the adoption of market standards in an opaque marketplace, ensuring the market wants to use Wematch for liquidity and lifecycle management.

A second major trend we have identified is around connectivity. Our web-API is now being rolled out to most of our clients, who then benefit from low-touch workflows and optimal time management, focusing on the optimisation rules and adjusting the outputs depending on their daily needs.

Do you think your current solution can be adapted to multiple asset classes and alternative structures?

Absolutely. The product has now reached an industrialised status for synthetics, but it can be easily adapted to other segments of securities financing. We are looking to leverage this powerful tool to address securities lending and repo markets, with the intention of offering cross-asset synergies between synthetic and physical products. There is also a natural extension of our solution to address collateral optimisation on financial resource management. Our algos within TRS can be easily adapted to fixed-income securities and we have started discussions with the market and implementation of our technology into this sphere.

We have also implemented a dedicated workflow for sales, enabling sales teams to use the platform to interact with traders and to act on behalf of their end clients. This module is extremely popular and enables multiple teams within a single bank to benefit from the Wematch technology to drive more efficient communication.

Finally, we have recently released a similar solution for ETF Synthetic management into production, where clients can set up funds and manage highly bespoke collateral constraints such as UCITs rules and sophisticated rules attached to Index and underlying ETF positions.

Towards the end of 2021, you launched a new securities lending platform. Why did you decide to re-engineer your platform and how is it going?

Once again, we applied a very simple recipe. We sat down with our clients and listened. It was clear to me that the focus should be on hard to borrow, as that seemed still to be in the dark ages with voice-to-voice communication remaining a leading avenue to source liquidity and trade.

With our signature design and new algos, we have brought equity-like protocols to the SBL space. Since launch last November, the traction has been unbelievable. Our clients value the speed of execution, the dynamic approach we have built.

And, as is common when you innovate and iterate at speed, we have discovered a second derivative of our original build. As a result, we have been integrated into the daily workflow of some of the largest prime brokers on the Street. We are encouraged by what we have accomplished in a short period of time and thankful to our key partners, which have provided detailed feedback and rich idea generation to us at Wematch. We are excited to announce that we will be offering our product globally in the near future and expanding into a wider range of securities lending products.

What are the main inefficiencies in the synthetic market today and how are you working to address these constraints?

The synthetic market currently suffers from a lack of standardisation. For instance, term sheets are not standardised and require a lot of manual processing within banks. This results in extensive back and forth, commonly resulting in a need to sign term sheets manually. Those processes are cumbersome and we are actively looking for a way to leverage our import tools to facilitate more efficient trade reconciliation.

A derivation of this significant pain point is the tedious process around cash flow reconciliation. Any delta in the term sheet will inevitably lead to a break in the cash flow management process, with another set of back and forth between middle-office and operations teams and the need for the desk to accept losses as long as these fall below the acceptable threshold. Being able to identify those differences at inception and implement a reliable and seamless process to reconcile data can be a game changer and save significant costs and operational risks to banks.

We understand that you held a synthetic forum in London in April. What was the driver of that idea and was it a success?

Yes, we held our inaugural TRS forum in London last month. We felt that this segment of the market place was under represented. The International Securities Lending Association (ISLA) has securities lending, the International Swaps and Derivatives Association (ISDA) has derivatives, but the TRS segment of the market has no one!

So we felt it was an ideal opportunity with our collaboration mindset to address this. We invited our key partners to attend a forum to discuss industry topics. It was very much the “David and Shane“ show but, as with all sales, they need a product person when the going gets tough! We were overwhelmed by the enthusiastic discussions that took place that evening and the positive feedback from the event — so much so that we are holding the second TRS forum in my home town of Paris in September.

Do you have an analytics offer and where do you see the value for your clients?

Yes. Now that most clients are using our platform for either 100 per cent, or a very significant portion of their synthetic book, we are looking into implementing more sophisticated analytics to enable them to find all the information they need. The ability to gather market data for securities lending, repo, TRS, and listed products [single stock futures, total return on futures] offers to our users a unique view covering the whole spectrum of the securities financing and Delta 1 space. Benchmarking tools can also offer to our clients the ability to stress test their book per currency, per tenor, or even per counterpart or client segment, depending on their needs.

Do you see differences across regions? And how do you plan to roll out your solution globally?

The product has reached its maturity phase in Europe and we have seen a significant increase in volumes and interest in both the US and APAC in recent months. We have beefed up our teams in both regions to offer more onshore support to our clients and we are currently rolling out more connectivity to our current users in both regions. The US market is extremely focused on execution risks and the product has been built to address those risks very specifically, also offering the ability to adjust basket details extremely quickly in case of high market volatility. APAC markets necessitate local processes and expertise and we are looking into a phased roll out, setting priorities according to our clients’ requirements and needs.

Do you see regulation as an opportunity in your product roadmap?

Regulation has played such a significant role in the evolution of markets and it is clear that regulation will continue to adapt the shape of the business. You only need to look at the scrutiny of the synthetic market in the US post Archegos. We have also seen a plethora of regulations around short selling in the US of late. My view is that with every challenge there is an opportunity. For example, the recent deployment of the Central Securities Depositories Regulation (CSDR) in Europe led to thinking about how Wematch can help solve this new market dynamic. The focus for CSDR has been very much in the post-trade world — and rightly so. But I recollect getting bought in while trading an MSCI world basket due to a “reg sho” issue in the US. Upon further investigation, it was amazing to me that traders in the US would spend hours running around trying to cover scraps of liquidity to avoid buy-ins. So, although the automatic buy-in rules changed, we have built a specific section on the platform allowing traders to highlight their needs on a T+0 basis and cover these regulatory issues more effectively.

What is your roadmap in the other asset classes?

We are about to release a new EQD platform for delta one, volatility and exotic products. We hired a team of experts from top tier banks to build and sell an innovative tool focused on automation, data collection and analytics. Our vision is not to disrupt, but to empower, trading desks with powerful tools, allowing them to scale up their executions and handle transactions automatically. A lot of trading desks still rely on ageing tools and processes and are not benefiting from automated setups. We are here to help them transition to a digital era and to ensure they get modern tools to collect and analyse data on a systematic basis. Our approach is both time and cost efficient as we offload the IT burden from the banks, and it is evolutive as we constantly improve our platform to ensure we deliver the best tool to the industry.

Do you have any regrets now that you have transitioned from investment banking to fintech? Does the fintech sector offer everything you expected from it?

I was a market person for a decade and, while I thoroughly enjoyed my time in that space — learning so much and having the pleasure of working with some super smart people — I decided to go a more entrepreneurial route. I have not looked back. I love the creativity my role provides me. I was employee number 15 at Wematch and now we are close to 50 in less than 18 months. Being part of that growth is exhilarating and exciting. I am working harder than I ever have, but it is amazing to be part of a team that is so focused on our core values to enable us to succeed. I would recommend the jump to the new world!

Figure 1