Roy Zimmerhansl, practice lead at Pierpoint Financial, revisits the news that DWS pulled one of its ETF’s securities lending programmes as part of its transition to tracking an ESG index and examines whether there are lessons to be learned or warning signposts as ESG continues to increase in importance

The environment

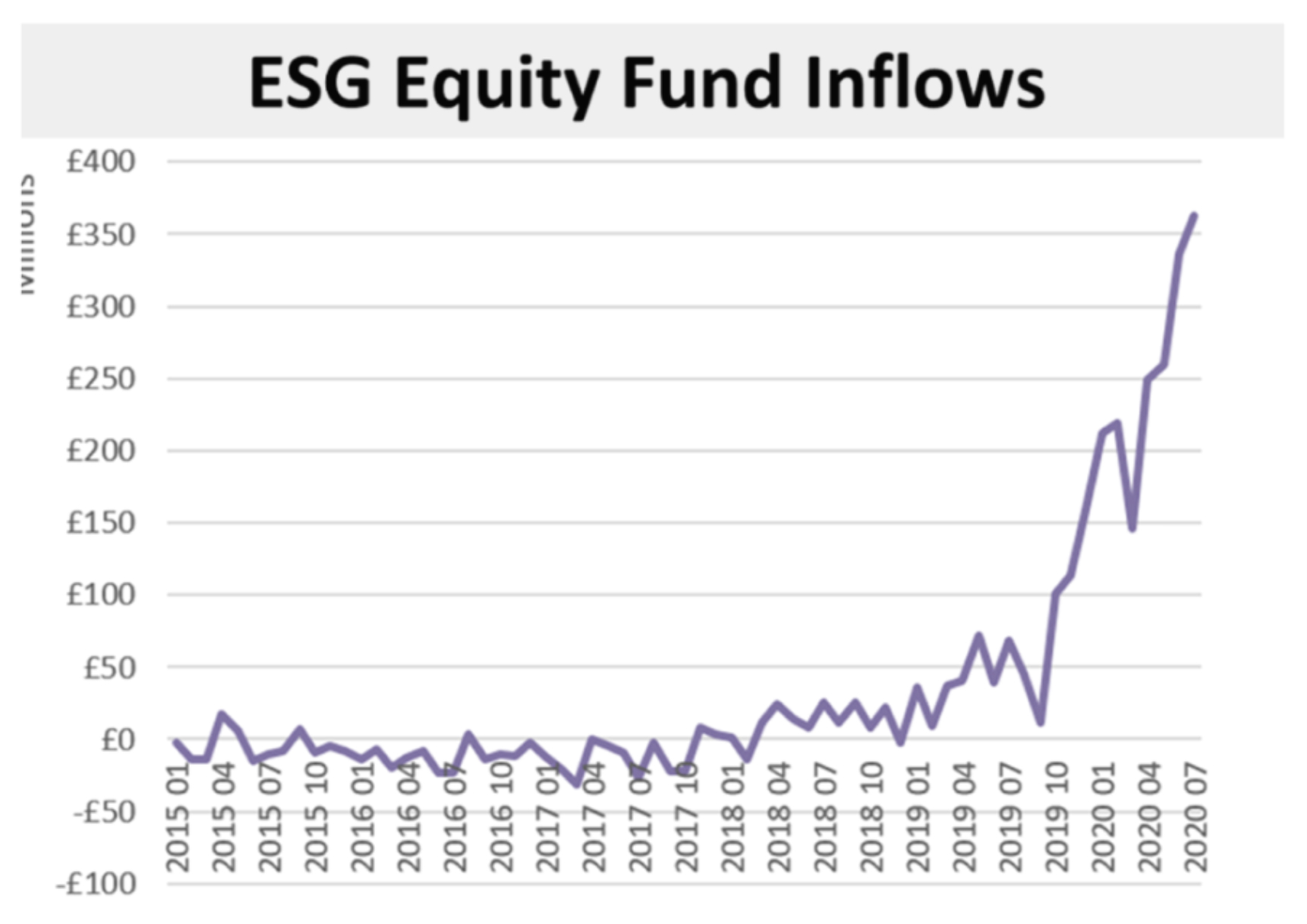

You don’t have to look too hard to find data supporting the argument that socially responsible investing is picking up momentum, with the Calastone diagram (see Figure 1) neatly illustrating the rapidly increasing trend. Indeed, I read elsewhere another story by ETF Stream on this news where Simon Klein, global head of passive sales at DWS, advised: “We have seen exceptional flows into environmental, social and governance (ESG) exposures this year and expect that demand to continue into 2021”.

Figure 1

The story

At a headline level, the story reported DWS was ‘pulling the plug’ on securities lending for one of its exchange-traded funds (ETFs) that tracks ESG indices, citing “the need for restrictive collateral parameters and regular recalls” and referring to “a number of other challenges” which went unnamed, but cumulatively these were identified as eroding potential lending revenue.

So, if the trio of factors - collateral, recalls and unnamed items – undermines the economics of lending while more assets are going into ESG funds, is this a worrying trend for securities lending?

The fund facts

• The fund has assets under management (AUM) of c. $40 million (according to DWS website as at 23 December 2020)

• The fund tracks MSCI UK IMI Low Carbon SRI Leaders Select on a fully replicating basis (115 stocks)

• The fund was repurposed in early December, with the predecessor index being the FTSE All-Share

• The peak AUM of the fund since launch was in October 2013 at near $350 million

• The fund challenges

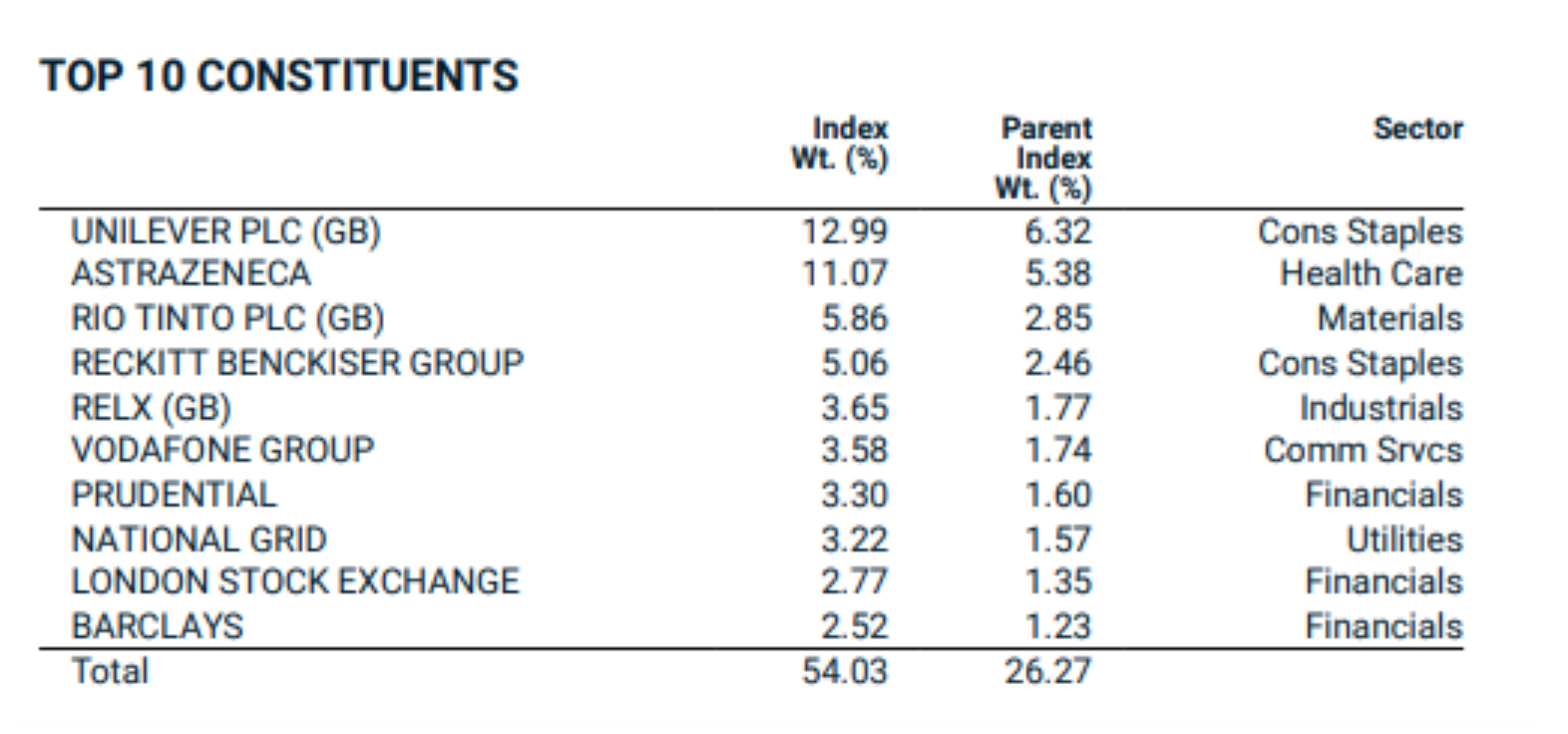

Figure 2

When I first saw the current fund AUM, I was surprised that it had even been approved by borrowers given fund approval backlogs that still plague small and some not-so-small beneficial owners waiting for borrower approvals. Then I saw that it was launched in June 2007 and discovered the fund peak size. Given the length of time in existence, it was no longer a surprise. If this were a new launch with that AUM, I think it would be amongst the lowest priority funds.

I had a scan of the MSCI UK IMI Low Carbon SRI Leaders Select index constituents with the ‘top ten’ shown (see Figure 2). Based on weightings, you really need to get to the 18th largest stock before you get a sniff of a stock that is not ‘super-GC’ (very high supply, very low demand). That stock is Ocado, which still has an element of borrower interest, but not anywhere near the interest of two to three years ago. In any case, the holding of the fund in Ocado is likely under $500,000.

My Verdict: this fund has little intrinsic lending value even absent any non-standard lending criteria.

The wider challenges

The biggest issues to examine are those suggested as being allegedly germane to ETF lending. If these can be shown to carry some weight, then these may act as warning signals for the securities lending ecosystem.

Restrictive collateral parameters

It is entirely appropriate that lenders apply the same ESG filtering criteria that they do for their front-end stock selection to their collateral. Historically that has been dealt with by i) ignoring it as too difficult to deal with (we have seen other examples where funds have excluded collateral from their management criteria – see here) ii) by sector exclusion (I have argued this is a very blunt tool that disadvantages companies in target sectors that make progress towards meaningful ESG oriented change) or iii) individual security approvals at an ISIN level (theoretically possible today but operationally unsustainable or reliable).

I am confident 2021 brings better solutions – ask us for more information.

Regular recalls

This is a contentious area and DWS is correct to call attention to it. On the one hand, borrowers want as much certainty as possible of a continuous borrowing opportunity. On the other, ESG conscious investors should be purposefully voting when they determine voting is in the best interests of their stakeholders. Can the two co-exist? They already do in many countries where domestic investors lend callable stock and within many individual investor lending policy guidelines.

It would be interesting to canvas end-borrowers on whether increasing availability in less liquid stocks would encourage more trading activity or whether they would be concerned over getting caught out. That might argue against an individual lender’s portfolio making a difference, but liquidity often begets liquidity.

Ethics of short selling

The DWS representative is at pains to make it clear they have no view on the ethics of short selling as such, rather they are there to deliver investor results. Readers and followers will know I feel very strongly on the issue, but rather than repeating myself, I’ll remind you that we had a guest blogger - Eric Jensen CEO, Antrim Investment Research - provide his views in ‘On the Ethical Implications of Short Selling’ in August this year.

Unnamed ESG challenges

Might I suggest two and ask for your thoughts on others: transparency and tax.

The issue of transparency was used by the Japanese Government Investment Fund as one reason for their suspension of equity lending, so this is a real ‘thing’. Transparency has many angles – that a fund lends, their governance policy, why borrowers borrow, collateral criteria and holdings, voting activity – and more. These are all important issues for focus, but I am not convinced that they unduly disadvantage ESG funds. Nevertheless, fiduciaries involved with oversight on securities lending should be cognisant of how these are dealt with and oversight applied. A potential complex area requiring specialist expertise and advice.

The other issue is tax and given that 2020 has seen the first court cases related to alleged tax abuse with Cum-Ex trading, it too deserves attention and focus. Much has been done since the turn of the century to tighten practice on this topic and perhaps more is required. If securities lending is a niche speciality, securities lending taxation is super-niche and I repeat there is value in expert guidance (I recommend Ali Kazimi of Hansuke Consulting).

Summary

Is the DWS decision to withdraw this one fund from lending a sign of things to come? As noted earlier, irrespective of historical demand for the fund, I don’t think the repurposed fund at the current size is particularly well-suited for lending. To me, this is an individual decision for a specific fund that is entirely sensible.

However, the issues raised by DWS apply more broadly and must be addressed by the securities lending ecosystem to ensure that what is manageable today, does not become disruptive tomorrow. Fortunately, the spotlight is on all the stakeholders including vendors and this is driving engagement which will, in my opinion inevitably lead to a better operating environment.

The new year we find ourselves in will likely be remembered as the year the vaccines had an impact on getting the world back to ‘normal’. Specifically, for securities lending, 2021 is likely to be remembered as one where ESG debate became mainstream.