Michael Jahn, director of Eurex Securities Transactions Services (Eurex STS), advises on how to prepare for the Settlement Discipline Regime under CSDR and how to engage with the buy-in agent

Eurex is committed to transparent and efficient markets. Consequently, we are glad to observe the additional focus that market participants are placing on settlement efficiency in their efforts to prepare for the Settlement Discipline Regime (SDR). Some markets are even thinking of reducing their settlement cycles, possibly bringing in new perspectives on the topic that had not previously been considered.

A lot has been said already about the root causes of settlement failures. While the results of such analysis might vary from institution to institution, there is evident consensus about the financial impact and undesirable effects of settlement inefficiency going forward. It is therefore essential to detect the breaks in the operational processes from front to back office.

This holds especially true in light of ESMA’s finding that settlement fails increased sharply in past months during the Covid-19 crisis. This motivates us to be more efficient in order to reduce the number of settlement fails in the European Union. ESMA’s recent risk dashboard confirms heightened risk of settlement failures for equities above pre-pandemic levels. Consequently, the need to address settlement failures should remain high on market participants’ and regulators’ task lists.

How to increase settlement efficiency?

One thing should be clear to everyone. Settlement efficiency does not begin in the operations department with handling settlements. Rather, it requires a full review of trade processing from front to back office. We have spoken with many clients who are analysing these issues with high priority. They ask questions such as:

Where do I have breaks in the straight-through processing chain from trade capture to final settlement?

• Is my trading network as efficient as I am? Who causes the most need for intervention?

• Do the trading desks have access to real-time information on available securities positions and settlement status?

• How efficient is my settlement location network? Do I really need accounts in all markets?

• Do my trading counterparties have access to my latest Standard Settlement Instructions (SSIs)?

Regardless of the answers to these questions, solutions are available. In the past, middle and back offices often suffered from rigorous cost management and consequently applied manual short-term solutions. These error-prone arrangements often turned out to be permanent. The road to settlement efficiency will help to get rid of such long-established inefficiencies.

The positive effects of efficient securities settlement in the long term are becoming more evident as we bring transparency to the costs of inefficiency. Investing in process improvements and automation in middle and back offices will undoubtedly pay off.

The Race for Settlement Efficiency

Over recent months, the conversations we have had with clients confirm that a race for settlement efficiency is on. The winners will not only benefit from low cash penalties and fewer buy-ins, they should also be able to reduce their operations costs dramatically. Qualified staff will be able to work on tasks more valuable than chasing counterparties for matching settlement instructions or reconciling trade confirmations. With lower costs and settlement risks, front-office desks will no longer need to factor in the potential costs of settlement failures. Additional revenue potential will result from efficiency measures, while inefficiency may lead to loss of market share.

The value of the buy-in agent

The race for efficiency will have the positive effects that are intended. However, for certain financial instruments and markets, buy-ins will be required as a last resort. Buy-ins are nothing new in the industry. Yet, in the past very few buy-ins have been executed. Difficulties in selecting a buy-in agent for a specific financial instrument, together with cumbersome operational procedures, were the main obstacles to successful executions.

Moreover, some market participants didn’t initiate buy-ins to avoid harming existing trading relationships. An appointed buy-in agent could be any broker which has had a previous business relationship with the client. Such buy-ins have then been executed as regular transactions.

From February 2022, buy-in agents will play a vital role in the settlement process. They will act as neutral intermediaries and ensure that settlement finality is established for all trades within a reasonable timeframe. In addition, steps to reduce settlement fails for retail investor transactions, which have peaked in relation to institutional investors, will strengthen the stability of markets and, as such, are very much in line with policymakers’ intentions to strengthen the Capital Markets Union while fostering retail investments.

Eurex has a long history of developing market solutions to address regulatory challenges. As early as 2018, we started consultations with market participants to discuss the solution for mandatory buy-ins to comply with the Settlement Discipline standards. This industry feedback has formed the backbone of our buy-in agent service offering. The service guarantees that the regulatory obligation is fulfilled for market participants and is accompanied by a certificate to be used in regulatory audits.

However, we understand industry concerns regarding the effect multiple buy-ins in the same security might have on existing market structures. Thus, we are working on concepts for infrastructural support to reduce the number of buy-ins in so-called “fail chains”.

A transparent and standardised process

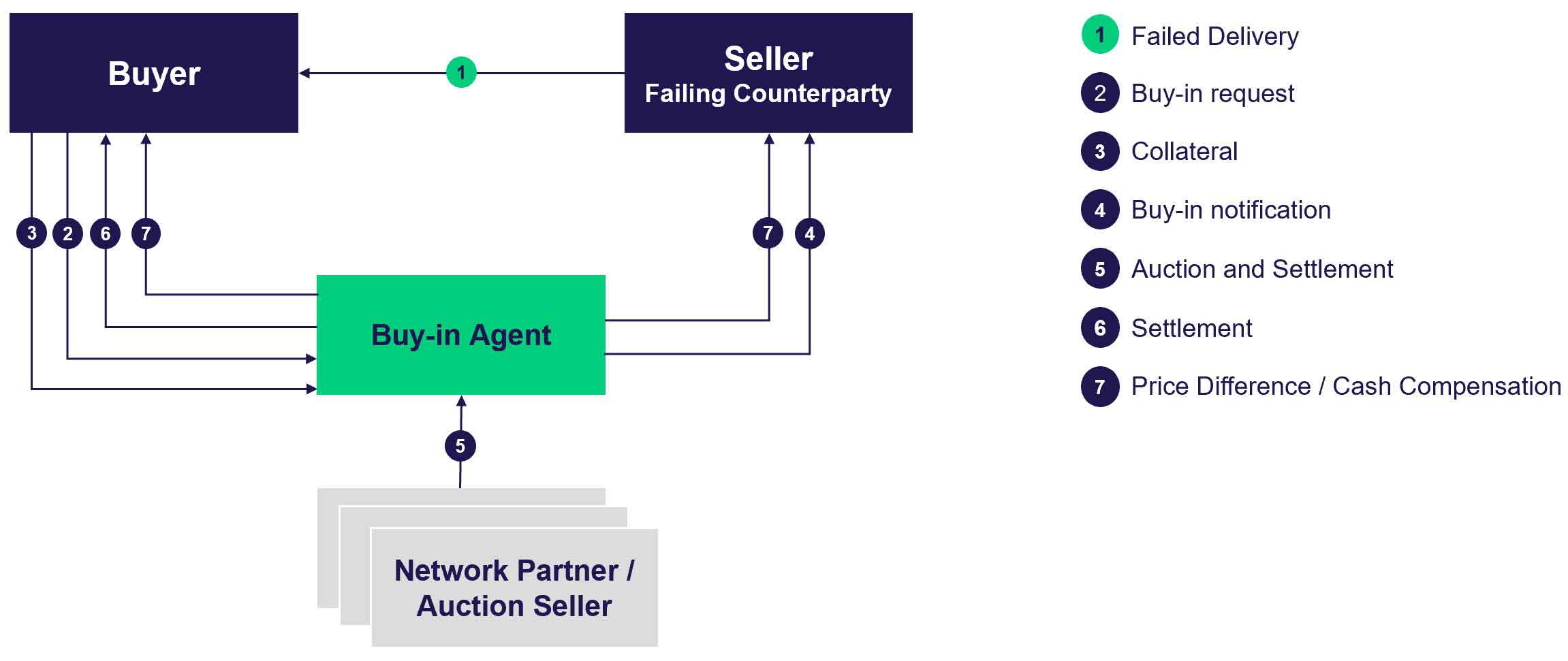

Registered clients of Eurex Securities Transactions Services (Eurex STS) will be connected to the buy-in agent platform B7. This allows buy-in requests to be submitted at any time in any Central Securities Depository Regulation (CSDR)-relevant financial instrument.

If the measures taken to avoid buy-ins are unsuccessful, the buy-in agent will take over and organise an auction to source the securities. These auctions are held at the same time on each business day, enabling clients to plan accordingly. The buy-in agent notifies the failing counterparty via the B7 platform about the upcoming buy-in and keeps this counterparty informed about the progress and the final result of the buy-in auction. Registered Network Partners may submit their offers and Eurex STS selects the offer with the best price.

With guaranteed same-day delivery by the network partners to Eurex STS, and onwards to the client, this provides early certainty about the outcome of the buy-in for clients and failing counterparties. This avoids overnight exposures and keeps the cash penalties for the failing counterparty to a minimum.

Our new buy-in agent platform B7 is fully automated and allows flexible settlement between network partners, Eurex STS, and clients. We make use of T2S cross-border settlement and transaction linking to benefit from its available efficiency features as much as possible. Non-T2S eligible instruments can, of course, also be settled via the ICSDs and selected non-T2S domestic CSDs. Clients may also select an innovative option where the purchase amount is offset against the deposited collateral and delivery will consequently be made free-of-payment. This may help to extend the settlement window for same-day delivery and reduce the number of collateral movements.

Efficient auction and settlement are complemented by a highly automated optional price difference and cash compensation process where the client can negotiate the payment details with the failing party on the B7 platform and settle it through Eurex STS. We even have procedures to remove the potentially burdensome process of claiming the costs of the buy-in from the failing party.

Eurex STS has designed automated standardised processes for the benefit of all parties involved. Fair and transparent auction rules, supported by standard settlement instructions and Eurex STS’ neutrality as agent, reduce risks and operational complexity.

Connectivity to the buy-in agent system B7 can be directly screen based or through a technical interface. The technical system integration is another key preparatory measure. Eurex STS has also partnered with several technology providers to ease technical access and provide choice to clients.

Participation Options

Sell-side and buy-side firms across the globe should, if they have not yet done so, analyse their trading and settlement activities to identify their current settlement efficiency. According to the CSDR buy-in rules, some settlement fails could lead to mandatory buy-ins after the extension period. Consequently, to comply with the SDR, there is the need to engage a buy-in agent.

As a simple guideline, regardless of your jurisdiction and your own settlement efficiency, if securities trading takes place in your own name in instruments falling under the scope of CSDR and settlement is in an European Union CSD or ICSD, there is a high probability that you need a buy-in agent.

Registration and technical connectivity to B7 are necessary to participate in Eurex STS’ buy-in process. Owing to regulatory onboarding requirements and hard deadlines specified in CSDR, it is crucial to approach your buy-in agent sufficiently early.

Multiple participation models are available to all market participants using Eurex STS as buy-in agent. An easy access model allows the submission of buy-ins for own trades and those of affiliated entities. The extended participation models provide greater flexibility and the option to submit buy-in requests for third parties, for instance custody clients. These extended participation models have been specially designed for custodians and transactions banks, but also with a focus on asset managers and prime brokers. Their clients can benefit from easy and fast indirect access to the buy-in agent. We encourage everyone to consider offering such a buy-in service to their client base as a complementary service offering.

Furthermore, international institutions with complex group structures may benefit from the segregated portfolio approach with separate user rights and collateral pools for each sub-entity, while maintaining just one contractual relationship to Eurex STS.

Ready to support the market

Operational process improvements and automation are key to increasing settlement efficiency in Europe. These preparations, and the onboarding with Eurex STS as buy-in agent, should be prioritised simultaneously for timely readiness. Eurex STS offers extensive support to help firms to find the most suitable participation model and to prepare for the new requirements coming into force in February 2022. Additionally, a permanent simulation environment is available to registered clients to provide first-hand experience of processing buy-ins on the B7 platform.

We recommend firms intensify their own efforts to prepare for SDR. That begins with the described measures and questions raised in this article, and continues with a solid data source for SDR. To identify transactions which are relevant for SDR, Eurex STS, together with Deutsche Börse Market Data and Services, have developed data products to manage SDR risks effectively.

With less than eight months to the start of the Settlement Discipline Regime in February 2022, the new rules have already started to have their intended effect on securities settlement operations in Europe and beyond.

Institutions will inevitably soon have to focus on SDR preparations. Experience has shown that legal onboarding, building up connectivity, functionality testing and process integration may require up to six months before readiness. Begin onboarding with Eurex STS now. The buy-in agent is prepared for February 2022. Will you be ready?