For firms using derivatives and securities finance transactions, a wave of new regulatory amendments is demanding that they review their regulatory reporting architecture and adapt to changing reporting obligations. S&P Global, Market Intelligence, Global Regulatory Reporting Solutions’s Igor Kaplun and Ron Finberg offer guidance on managing this regulatory pipeline

Financial markets, and the securities finance market in particular, have been facing an increasing number of regulatory reporting obligations over the past few years. This has impacted not only plain securities lending and repo trades through the Securities Finance Transaction Regulation (SFTR), but also synthetic securities financing trades, involving swaps, options, futures or forwards, through the lens of various derivatives-focused regulations all over the world.

For those firms using derivatives and securities finance which have heavily invested in developing disparate internal systems at great cost, both for implementation and maintenance, there is little reprieve in sight with more regulations and investments on the horizon to keep up with the steady flow of incoming additional requirements. S&P Global Market Intelligence regulatory reporting experts have compiled a short summary — one that is by no means final — of the main regulatory changes expected. Securities finance firms should find this article useful when reviewing their regulatory reporting architecture and preparing for the upcoming wave of new regulatory changes.

EMIR REFIT and equity derivatives

With SFTR planning and implementation now well in the past, European Market Infrastructure Regulation (EMIR) REFIT is the new regulatory buzz. First arriving in June 2020 with clearing threshold obligations and requirements to report for non-financial counterparties (NFCs), a much larger update arrives for REFIT when its Technical Standards for Reporting goes live.

Figure 1

Both the European Securities and Markets Authority (ESMA) and the Financial Conduct Authority (FCA) published similar consultation papers in 2021. Feedback on those papers, and regulator approval from the EU and UK, has yet to be published at the time of writing. Taking into account the requirement of an 18 month lead time following parliamentary approvals, we could see the new technical standards go into effect by Q4 2023.

Despite the go-live date being still well in the future, complexities of the REFIT require adequate preparation — with 203 fields and 41 per cent of them being newly introduced — to comply with the updated standards. Below, we review a number of the changes affecting equity derivatives often traded by securities finance teams.

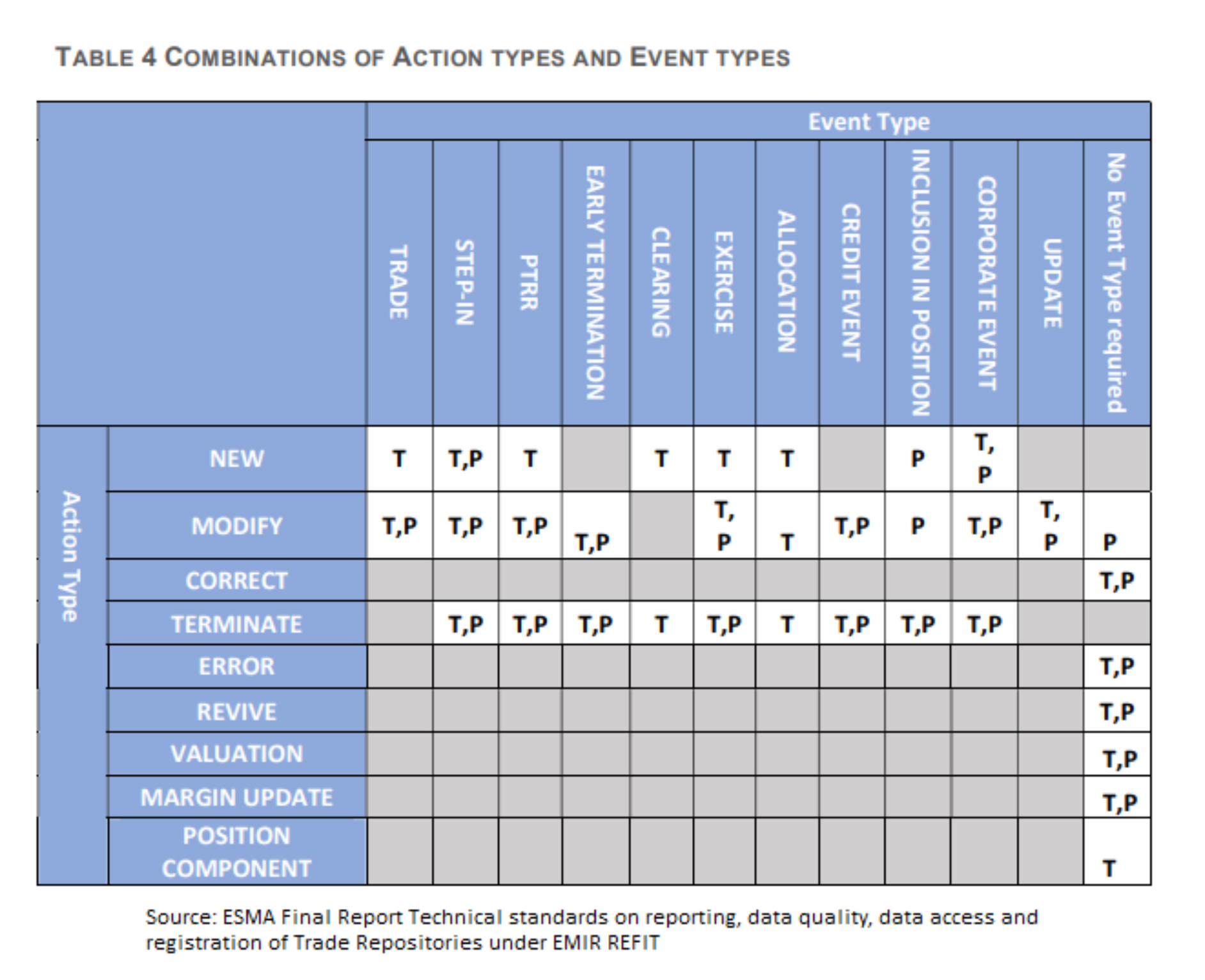

Lifecycles

As part of the REFIT, EMIR is introducing new event types and action types to those that currently exist. The goal is to provide additional granularity to describe why events are taking place. Examples are descriptions for new actions, terminations or modifications that are the result of an allocation, post-trade risk reduction (PTRR), credit event or corporate events (see ESMA chart below). For equity derivatives, the corporate event type is of interest. The new event type will now allow reporting firms to explain in more detail modifications and new transactions of derivatives that are the result of stock splits and mergers of their underlying equities.

ISO 20022 XML submission format

Familiar to firms currently reporting under SFTR, the REFIT update will also require all submissions to trade repositories (TR) to be in the ISO 20022 XML format. This change is expected to improve data quality as it standardises the submission format across all reporting entities and TRs. As a result, firms currently submitting to TRs in CSV or fPML formats will require processes to comply with the ISO standard.

Counterparty details

Another item that should be familiar to SFTR reporting firms are the new counterparty fields that are being introduced. This will add:

Entity Responsible to the trade

• Non-Reporting Counterparty Identifier type – indicator if LEI is used

• Nature of Non-Reporting Counterparty – description of non-reporting party NFC/FC/Other

• Corporate Sector of Non-Reporting Counterparty – sector description for NFC/FC

• Clearing threshold of Non-Reporting Counterparty – indication if above the clearing threshold

• Reporting Obligation of Non-Reporting Counterparty – whether they have

• EMIR obligation

While the data fields are not complicated, they do put the burden on reporting firms to collect additional details about their counterparties for use in submissions.

Equity options

Currently, there are five option-specific fields under EMIR reporting. That number grows to 11. Of the current five, Option Type, Exercise Style, Strike Price and Maturity Date of the Underlying will remain. The Strike Price Notation field is being removed.

Two new fields are explicitly relevant to equity options: Option Premium and Option Premium Currency. The Option Premium field is the amount per option paid by the buyer. The value for this field mimics that of Price.

Cryptocurrency derivatives

The REFIT aims to fill a gap for how to report cryptocurrency derivatives. As a derivative product, crypto products such as Contracts for Difference (CFDs), options, tokens and total return swaps fall under the scope of EMIR. However, reporting them is difficult. As they lack ISO 4217 currency codes, they can not be submitted under the Foreign Exchange asset class. As a workaround, most firms currently report cryptos under the Commodity asset class, using the Commodity Base description of ‘Other’.

With cryptocurrency derivatives volumes rising substantially to billions of dollars per day for both over-the-counter (OTC) and exchange-based offerings, EMIR REFIT introduces a new field called ‘Derivative based on Crypto-assets’. While neither the FCA or ESMA directly define the asset class of cryptocurrencies, the new field will allow regulators to identify how exposure and risk relates to the cryptos.

Direction field

Another area where REFIT aims to align reporting to how products are booked and traded is with an adaptation of the Direction field. Currently, the field is limited to Buy and Sell. However, Buy and Sell do not correctly describe multiple leg products such as swaps and forwards where there is payment made by both sides of the trade.

As an alternative, REFIT introduces the ‘Direction of Leg 1’ and ‘Direction of Leg 2’ fields to be used instead of the Direction field for swaps, forwards and forward rate agreements (FRAs). In place of the Buy and Sell values, firms will report whether they are the ‘Payer’ or ‘Receiver’ of each leg. For equity derivatives, the change does not affect equity contract for difference (CFDs) or options and futures, but securities swaps will fall under the new format.

CFTC Rewrite

One year after the publication of the CFTC rewrite final rules, released in January 2021, the implementation timeline has been extended for an additional six months to 5 December 2022 from the initial compliance date of 25 May 2022.

By issuing this no-action relief, the CFTC Division of Data is indicating that they will not recommend enforcement action against anyone that does not meet the 25 May 2022 compliance date.

Ultimately, this is welcome news to the industry that has been expecting a reprieve from the May timeline and an additional six months will help both the SDRs and market participants prepare for the implementation.

The rewrite represents the most significant change to the CFTC reporting rules since they first went live in 2012. The entire derivatives ecosystem, from trade capture, risk management and confirmation systems, will potentially be impacted in some form to ensure data is captured accurately and represented in the new formats required.

This announcement also clarifies to the industry that the CFTC rewrite will be implemented in two phases. Phase 1 will be actual submission changes (new data fields, timing of trade state, etc.) for 5 December 2022 and Phase 1 to bring in UPI and ISO in Q4 2023.

The UPI and ISO implementations are significant in their own right and it will be interesting to see how these will be rolled out, particularly with the work around EMIR REFIT running in parallel.

The delay to the CFTC rewrite also introduces inherent delays to suggested REFITS and rewrites in Canada, which has historically stayed tightly integrated to the US reporting rules.

As with any delay or extension to the compliance date, it is imperative that firms use this opportunity to review their current systems, processes, technical and product solutions and ensure they are fit for purpose to meet the next regulatory challenge in front of them.

S&P Market Intelligence is partnering with clients to help them with the CFTC rewrite and is already servicing over 500 of the largest customers around the world with their trade and transaction reporting requirements. Clients using S&P Market Intelligence for the current CFTC requirements will seamlessly migrate to the Rewrite for the December 2022 implementation date.

SEC 10c-1

On 18 November, the SEC released for comment proposed Rule 10c-1 under the Securities Exchange Act of 1934. The comment period was initially 30 days, but the SEC subsequently reopened the consultation with an amended close date of 1 April.

The core objective of this proposal is to increase transparency in the securities finance market by requiring any person lending securities to report that transaction to a registered national securities association (RNSA). The RNSA being proposed here is the Financial Industry Regulatory Authority (FINRA), which will collect and publicly disseminate information about each transaction and aggregate information.

Let’s examine some of the key elements of the proposal:

Who needs to report under SEC Rule 10c-1?

Any lender or lending agent would be required to report. A lending agent is identified as an intermediary such as a bank, broker-dealer or clearing agency that helps lend securities on behalf of the beneficial owners (which includes banks, insurance companies, pension funds). For example:

• Where insurance or pension funds employ an agent lender to loan their securities, the agent lender would be responsible to report. If an agent lender is not used and the beneficial owner lends securities directly, then the responsibility lies with the beneficial owner.

• Clients of broker-dealers that take part in fully paid lending programmes would have their loans reported by their broker-dealer.

• Clearing agencies that have programmes that lend on behalf of beneficial owners would be responsible for providing the stock lending activity.

As we have seen with other regimes, the reporting could be delegated by the client to another party and there is a point in the proposal where a reporting agent can be designated through a written agreement.

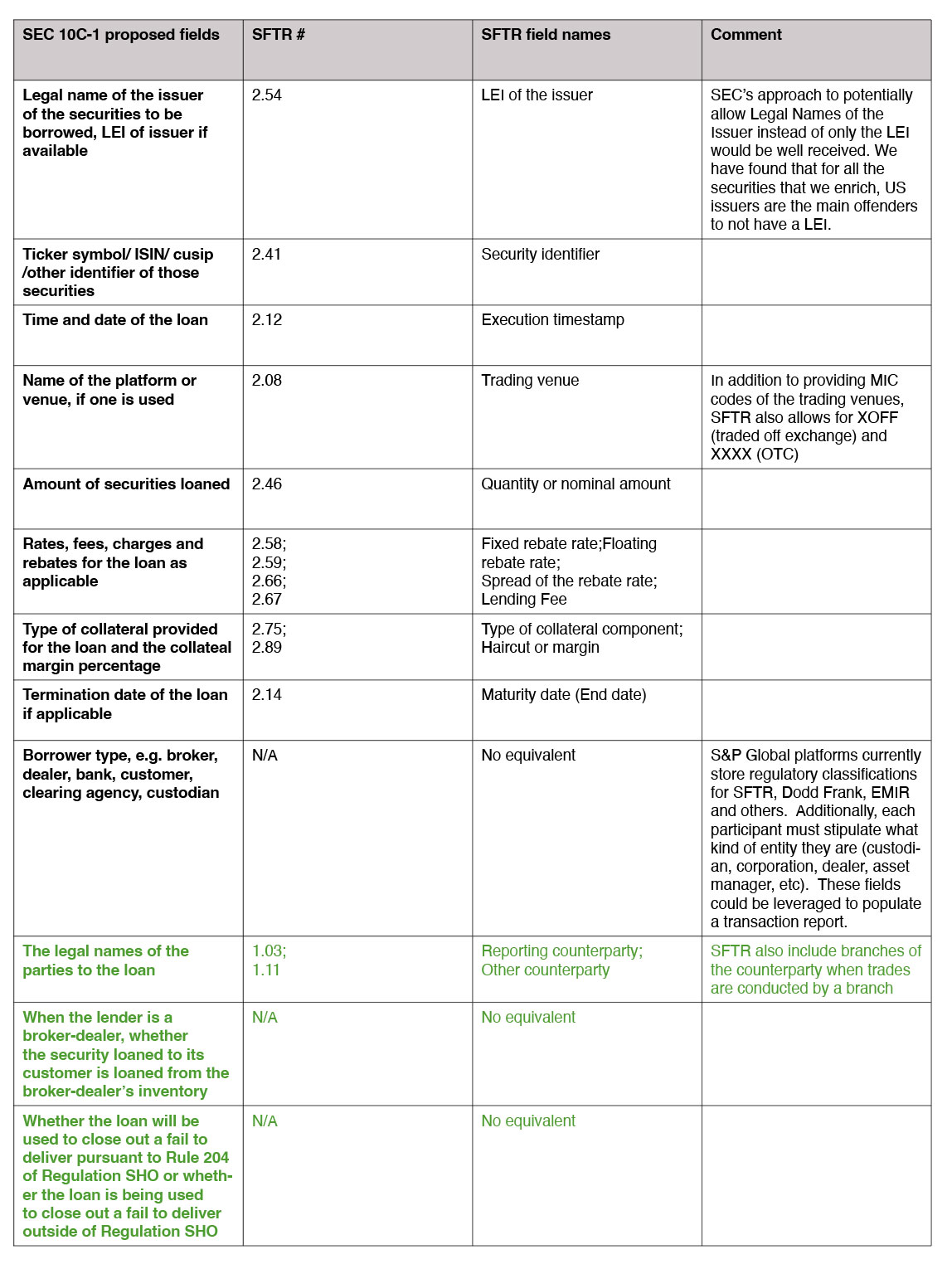

What needs to be reported under SEC Rule 10c-1?

Any securities lending trade involving equities or fixed income would need to be reported. If we compare the SEC’s 10c-1 proposal against ESMA’s SFTR, we see that participants that are in scope for reporting under SFTR would be well versed in retrieving the vast majority of fields required for 10c-1, as most of them are reported in SFTR. Although there are similarities in terms of data required, they have different objectives. The SEC is looking to improve transparency in the market, while ESMA wanted to measure risk and exposure in the securities finance market, which additionally includes repos, buy or sell backs and margin loans.

The following table on page 27 covers the data points requested by the SEC proposal. The fields in black indicate information that would be made public and those in green refer to fields that would be kept away from the public eye.

The key open question is how to determine whether a firm has to report. It is unclear if the determination is at the product level (US securities), which would capture non-US entities that lend US securities? Or is the scope limited to firms domiciled in the US, regardless of where the actual security being lent is?

How should the trades be reported under SEC Rule 10c-1?

For those that have been involved in trade and transaction reporting, there is a concept of reporting a trade with a unique trade identifier (UTI). The way this has worked for other regimes was that, typically, the UTI could be system-generated by a trading venue, or CCP-generated if trades are cleared or involved in dual sided regimes generated by one of the counterparties.

In the SEC proposal, however, it seems that subsequent modifications would need to be reported by a registered national securities association (RNSA)-assigned UTI. This means when a market participant submits a new trade to the RNSA, the RNSA would have to acknowledge the trade, assign a UTI to it, send it back and only then would the client be able to submit subsequent modifications associated with that trade with the same UTI. The SEC proposal around UTI is similar to the current CFTC derivatives obligations where a trade repository (Swap Data Repository) would create the UTI when the reporting party is a non-registered entity (non-SD, non-MSP, etc.)

The format, in which the reports need to be compiled, is still unspecified and there is an open question regarding whether this should be defined by the SEC or the RNSA. What we do know is that the reporting agent is required to submit the necessary information to the RNSA within 15 minutes after the securities loan is affected or the terms of the loan are modified. In addition, the proposal requires each lender to submit their on-loan balances, as well as their available-to-loan inventory at the end of each business day.

These three regulations and REFITS are only the tip of the regulatory iceberg hitting the physical and synthetic derivatives and securities finance ships. Among many others, the Monetary Authority of Singapore (MAS), the Australian Securities and Investments Commission (ASIC), the Hong Kong Monetary Authority (HKMA), the Japan Financial Services Agency (JFSA), are all going through some sort of REFIT, putting even more pressure on the firms trading those products in scope. It is the right time for each firm to take a hard look at its current process and to assert its scalability and sustainability in an increasingly demanding regulatory reporting environment.

Figure 2