Electronification is revolutionising the repo market, bringing greater transparency and delivering time and cost efficiencies. These advances mark the beginning of a new era for repo in which automation, trading tools and connections to other markets will unlock more value for clients, says James Kelly, head of European repo at Tradeweb

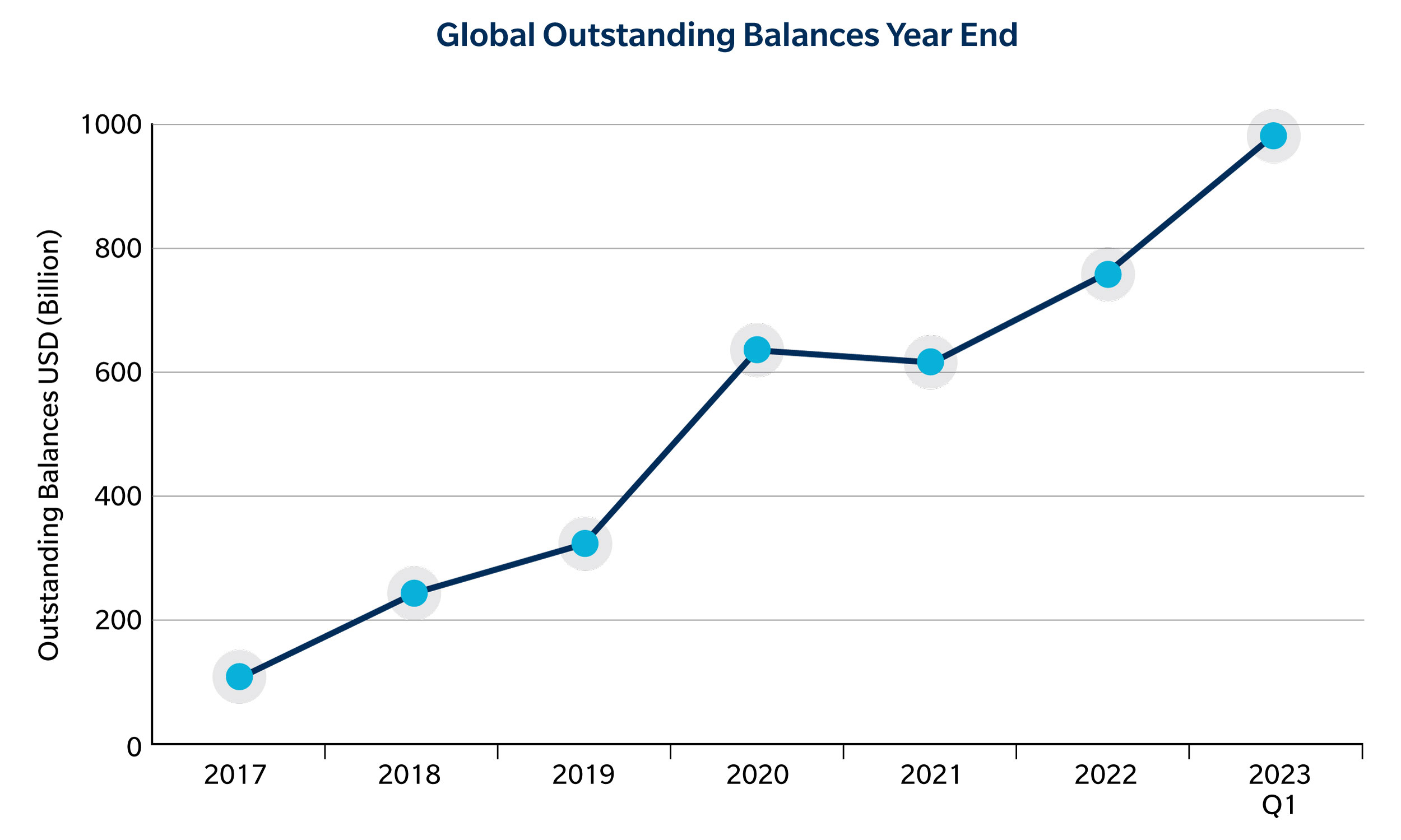

The electronification of the repo market is now well advanced and momentum is growing. At Tradeweb, we have seen our global average daily volumes of institutional repo trades rise by 16 per cent year-on-year to reach US$243 billion by the end of the first quarter of 2023, while outstanding balances stand at US$993 billion. This represents a near ten-fold increase in outstanding balances in the last five years.

There are 47 dealers signed up to our repo platform globally and more than 100 clients. Very soon the majority of repo trading will be electronic — a major transformation for a market long dominated by manual and voice trading.

Figure 1: Global outstanding balances year end

With increased market volatility, higher interest rates than we have seen for more than a decade and central banks shrinking their balance sheets, we expect to see funding spreads widen and repo trading flourish as participants look more to private funding markets. Electronification has already proven its potential and is set to be an invaluable tool in repo’s future.

The pioneer trail

Tradeweb was the pioneer in dealer-to-client electronification of repo. In 2016 we re-launched our repo trading service. The starting point was a core product for fixed-rate and fixed-term government bonds aimed squarely at hedge funds and other asset managers looking to leverage their assets.

The benefits of electronification are straightforward and immediate. Full electronification, integrating straight-through processing (STP), removes the task of manually booking trades and reduces errors. This cuts down operational risks and allows increasing traded volumes and scalability.

Some market participants had concerns that electronic trading could undermine the traditional one-to-one relationships between sell-side traders and clients, and buy-side’s access to dealer balance sheets. But, in practice, the exact opposite has proved to be the case. Electronification has freed traders from the burden of manual booking, releasing time and resources that can be used to build deeper relationships and to provide value-added services. If anything, electronification is a boon to relationships between traders and clients, allowing businesses to become more scalable and profitable.

Regulatory reform has been another significant catalyst for electronification. Trading repo on an electronic platform can help clients comply with the Securities Financing Transactions Regulation (SFTR) and can also help to reduce and minimise fails and potential penalties for fails or late deliveries as a consequence of the Central Securities Depositories Regulation (CSDR). Furthermore, the Basel regulatory agenda has pushed a growing number of binding constraints for the sell-side, who are increasingly focused on balance sheet and capital. Automation can help banks to efficiently address some of those constraints.

Since those early days of shifting behaviours towards more digital workflows, not only has the use of electronic trading for repo expanded, so too has our offering. Our platform has moved far beyond vanilla sovereign bonds into a true multi-asset class marketplace with live composite pricing, centralisation of trade flow, connections to order management system (OMS) providers, and, crucially, deep liquidity.

More recent developments include support for the lifecycle events of repo trades such as reprices, rerates, partials and closeouts. The facility — which we call our lifecycle blotter — is of particular value in the new environment of more frequent moves in central bank rates. Before electronification, a change in the central bank rate required rebooking trades — a time-consuming, manual exercise. But with the lifecycle blotter, hundreds of trades can be re-rated in a matter of seconds, helping to bring standardisation to this part of the market. In addition to the lifecycle blotter, we have improved workflow function around supporting GC basket trading and are expanding our footprint in cleared repo via the LCH sponsored clearing model.

Tomorrow’s repo

The user base for our electronic platform continues to expand, not just in sheer numbers but also in the types of institutions. For instance, central banks and sovereign wealth funds are holders of collateral that have historically traded repo manually; these types of institutions are now commencing the move to trading electronically.

There are two key platform enhancements we are working on at the moment. The first one is dealer axes, which will provide repo traders with an additional liquidity discovery tool, affording them the same levels of functionality typical in other markets, yet customised for bespoke requirements in the repo markets. The second development is the integration of repo trading into broader strategies involving a wider range of assets and instruments, which, in turn, will drive its growth and sophistication.

For example, connecting repo to other markets will allow users to leverage our swaps platform to hedge repo and manage rates risk. Another example would be a user looking to go short in the cash market, and we are looking at ways to give traders transparency on liquidity and potential borrowing costs.

Tradeweb is already well placed to offer these cross-product connections, having mature offerings in these markets. We believe electronification puts the repo market on the threshold of a new era. Aggregate market-level data on repo is another resource that electronification can unleash. Data services are increasingly regarded as standard for platforms catering to other markets and Tradeweb provides those in other products. Developing similar services for repo is a natural next step.

As a specialist in repo electronification, clients have come to Tradeweb to meet and facilitate their repo requirements. As activity and trade volumes have grown, clients have increasingly turned to us to ask what can be done around improving on the limited market data that exists today. Naturally, we are deeply aware of data-related sensitivities and we are taking considered steps regarding how we can best unlock our significant data resources, while ensuring the correct methodologies are applied and full client anonymity is preserved. The potential for data-driven, added-value services to drive trading profitability and enhanced risk management in the future is significant.

As well as promising ever greater depth and sophistication to repo trading, there is also the prospect of greater breadth as other markets accelerate their adoption of electronification. The Japanese Government bond market, for instance, is the third-largest sovereign market in the world and the wider Asian market represents a huge opportunity.

On the threshold

The electronification of repo trading has come a long way in a few short years and Tradeweb is proud to be a leader in its development. But the transformation has further to go, in both scale and complexity.

The future of repo lies in full STP trading, in which the wide community of institutions — from funds to asset managers and central banks — are part of an international electronic repo ecosystem. To take full advantage of this potential will require platforms that sit within a web of systems connected to other assets and instruments, so integrating repo fully into trading and investment strategies is essential.

Tradeweb has been, and continues to be, a pioneer in the electronification of repo and thousands of clients are already reaping the benefits of improved operational efficiency and profitability across our products. But as electronification advances, there is even greater value yet to be unlocked and we believe a multi-asset, multi-currency and multi-product marketplace like ours can help institutional repo trading unleash its full potential.