Industry participants discuss how investors and issuers can engage in the growing use of ETF lending and its future in the securities lending market. Carmella Haswell reports

Market participants are encouraging ETF managers to make securities lending a principal discussion, as ETF lending aims to enhance returns and improve performance. While the activity in this space becomes prevalent, firms are identifying opportunities in active ETF strategies and are venturing out to form their own ETF lending services.

“I would encourage asset managers, even if they are not currently interested in lending, to speak with their agents, or potential agents, around where they might see opportunity,” says Tom Poppey, head of product strategy for securities lending at Brown Brothers Harriman (BBH).

For issuers contemplating a securities lending programme for its ETFs, the first step is to have a securities lending agent review the holdings of the portfolio to determine what potential income could be generated from the programme, advises Frank Koudelka, global head of ETF solutions at State Street.

For investors looking to lend the ETF shares, Koudelka says they should be reaching out to the capital markets desk of the issuer to determine the market for lending the ETF shares.

Typically, there are two types of ETF securities lending. The first is the traditional lending programmes established by the issuers — otherwise known as ‘inside lending’ — which entails the issuer lending the underlying securities that comprise the ETF.

The second is referred to as ‘outside lending’, where the ETF investor lends its ETF shares. According to Koudelka, this area of lending has grown in popularity as more investors become aware of it. Outside lending provides the opportunity for investors to derive income from the ETF investment, therefore offsetting some or all of the costs to own it.

Historically, for inside lending, securities lending programmes have been geared towards passive (index-tracking) ETFs. These programmes are typically established to offset fees or to improve tracking. However, Koudelka says that most recent dynamic growth in this area has been in active ETFs. These strategies are now reaching scale, “having grown in aggregate from approximately US$100 billion to close to US$800 billion in the last five years”.

A liquid and active market

Fixed income ETFs were heavily borrowed in 2022, given the pace and size of interest rates moves. Matthew Chessum, director of securities finance at S&P Global Market Intelligence, indicates that this generated some of the “strongest returns ever seen” for ETF lending. However, ETF lending revenues have contracted during 2023 as inflation has cooled and interest rate hikes have slowed.

“As ETFs are a great way of gaining exposure to a sector or thematic, the ETF securities lending market often acts as a window into investor sentiment,” Chessum adds.

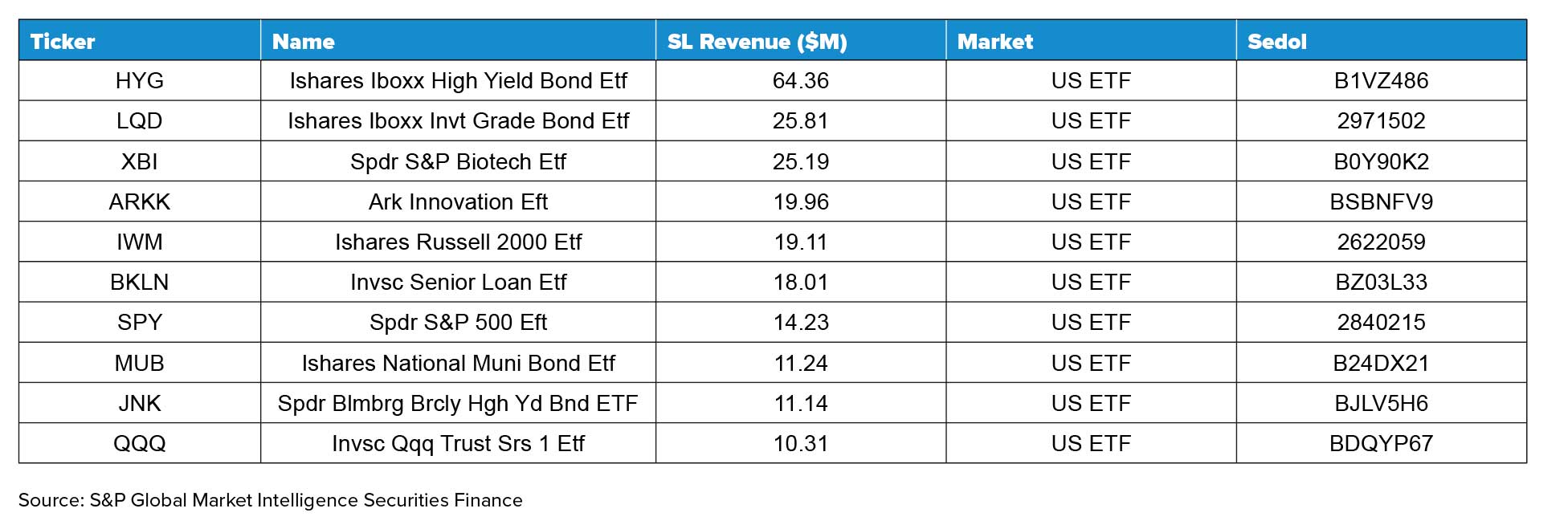

The top 10 highest securities lending revenue generating ETFs for 2023 included Ishares Iboxx High Yield Bond ETF (HYG) with US$64.36 million, Ishares Iboxx Invt Grade Bond ETF (LQD) with US$25.81 million, Spdr S&P Biotech ETF (XBI) with US$25.19 million and Ark Innovation ETF (ARKK) with US$19.96 million.

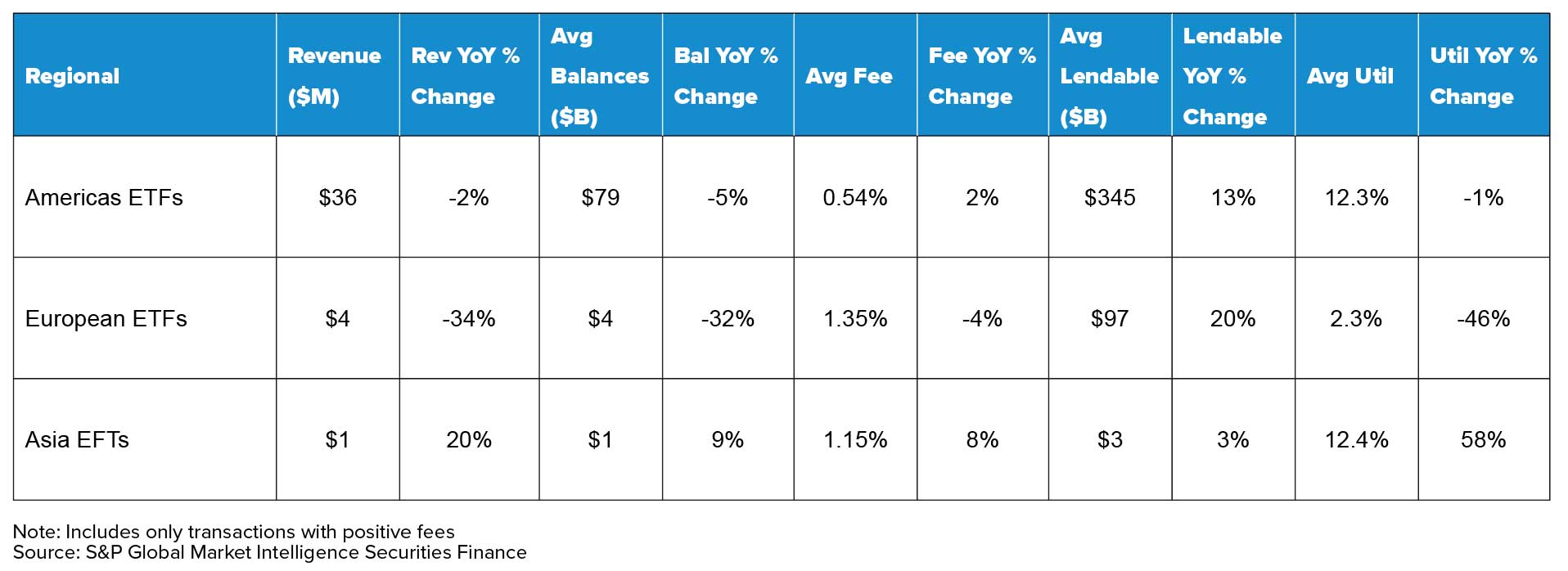

In terms of market dynamics, Chessum highlights that listed ETFs continue to see the most liquid and active securities lending market. During January 2024, lendable US ETFs had US$345 billion available for loan, EMEA ETFs had US$97 billion available and Asian ETFs had US$3 billion available. Lending activity and revenues continue to be dominated by US-listed assets, with US ETFs generating 84 per cent of total ETF revenues generated throughout January 2024, according to S&P Global Market Intelligence data.

Fig 1: Top 10 revenue generators in ETFs 2023

BBH’s Poppey has identified a number of trends within the ETF space. Firstly, there has been an increased flow of conversions of mutual funds into ETF structures — where BBH clients take existing product capabilities and convert them into ETFs.

The second is the growth of active ETF strategies which has provided an opportunity, from a lending standpoint, for BBH to create additional alpha for its clients’ products. The third reflects the growth of bond ETFs. “Overall, global ETFs are growing faster than the traditional mutual fund or cross border fund space,” Poppey states.

Speaking to SFT, Banu Apers, head of lending and borrowing at Clearstream, says the cutting of interest rates in 2024 by the central banks creates an “attractive environment for fixed-income assets” and, similarly, an “increased interest for fixed-income ETFs”. She further explains that in such market conditions, “ETFs are expected to play a crucial role in enabling investors to capture value against specific parts of the yield curve”.

“The market for ETFs has skyrocketed over the past quarter-century, with trillions of dollars at work in passive, index-tracking strategies,” she adds. The use of ETFs backing collateral arrangements, however, is still modest. In an economic environment where investment horizons are shortening, Apers believes ETFs “will become even more important in allowing fund selectors and investors to be more agile”.

At Clearstream, the firm is launching its own ETF lending service across all lending solutions in Q1 2024. The service will enable clients to add their strategic and fails lending schedules. The Deutsche Börse-owned company has enhanced its data universe to “a new level of granularity”, allowing complex feature selection for a bespoke lending pool creation.

Funds have been eligible for triparty collateral management at Clearstream for some time. The firm says that the addition of ETFs and the enhanced data selection approach “further makes our triparty collateral management offering even more attractive to clients” as they can now combine the benefits of the two.

A suitable pairing

The structuring and the implementation of a lending programme for an ETF product is very similar to any other globally-registered fund, with a couple of unique considerations at play, Poppey says.

Fig 2: Regional details on ETFs

In terms of the creation and redemption process, clients of New York-based firm BBH keep higher securities on reserve — commonly known as buffers. This allows clients to accommodate redemption activity that occurs. As a result, Poppey observes slightly higher holdbacks, or buffers, in his clients’ lendable positions.

“While we do enjoy lending broad market index ETFs, we have recently seen a growth of sector specific ETFs, or country specific ETFs. While the structuring of lending programmes is very similar to registered funds, we have observed that the returns can be quite outsized from participation and lending,” Poppey adds.

When discussing full service asset servicing opportunities with clients, in terms of custody, fund administration and fund accounting, lending is almost always part of the discussion for BBH. As managers look to introduce ETF structures, Poppey believes they should consider lending at the outset.

“In the past, lenders have typically waited until funds got to a certain size before they engaged in lending,” he explains. “It is our recommendation that they consider lending even at the formation or the seedling stage of the ETF, so that they can have the facility in place at the inception of the launch and a go-forward basis.”

The prevalence of lending in the ETF space has been driven by a number of factors. With ETFs that launched as a passive index strategy, the need to be highly competitive on cost and performance was paramount when these structures took root, Poppey highlights. He continues: “The acceptance and the engagement with lending was much more established as ETFs started to come on the scene, versus other funds structures that might have a longer history. The maturity of lending, along with the emergence of ETFs, really paired well together — they were both at mature stages of evolution.”

Concluding thoughts

Lendable supply continues to grow in the ETF space, which is positive for liquidity and market participants. The new supply, particularly in the US and Asia, does not seem to be dilutive to average fees, says Chessum. S&P Global Market Data indicates that ETFs have recently “exploded” to more than US$10 trillion in AUM as the asset class continues to steal assets from their mutual fund equivalents. Chessum can only see a growing role for ETFs across all regions in the future in both the securities lending and investor markets.

Similarly, Poppey says ETFs continue to grow faster than traditional funds. From an investor’s standpoint, ETFs are highly relevant in terms of being able to attain broad market exposure or more sector exposure in a timely manner.

For Poppey, the “impact to our business is going to be the additional supply flow into the product”. He adds: “The interesting dynamics of ETFs is that you can lend both the underlying securities and, if our clients actually own them, the ETF units themselves.”

The continued entry of active managers to the ETF marketplace will expand the adoption of securities lending programmes to active ETFs, explains Koudelka. Historically, the ETF investment wrapper has been viewed as a less expensive option than mutual funds, therefore enabling issuers to generate additional alpha.

Koudelka believes that securities lending programmes have the ability to further enhance returns and allow active managers to improve performance.

He concludes: “As ETF markets continue to grow, there is increased demand for ETF shares across the market ecosystem. As issuers lean into this demand, they will create more awareness to investors of the additional benefits to lend their shares. This will increase the percentage of ETFs participating in outside lending.”