The ‘Sharpe’ point of securities lending

22 April 2025

State Street’s Travis Whitmore, head of AI and trading analytics, and Derin Aksit, quantitative researcher, assess the diversification properties and risk-adjusted performance of securities lending and its power to unlock opportunities

Image: stock.adobe.com/T.Den_Team

Image: stock.adobe.com/T.Den_Team

When institutional investors assess investment opportunities, a key consideration is the expected incremental return relative to the marginal risk, as well as the diversification benefits the investment might bring to the entire portfolio. In this analysis, we take the same approach in evaluating securities lending.

We examine the historical performance of more than 5,000 anonymised and aggregated securities lending programmes over 15 years (2008-2023) to quantify the historical returns relative to losses and compute a reward-risk ratio (eg Sharpe ratio).

These metrics are evaluated over different market regimes and across regions.

The empirical findings suggest that securities lending risk-adjusted performance is significantly higher than that of benchmark stock and bond indices, and improve during periods of market drawdowns (eg ‘crisis’ periods) and tightening financial conditions. We also observe securities lending returns having a low or negative correlation with that of other asset classes, suggesting it brings favourable diversification benefits to a theoretical portfolio of traditional asset classes.

Previous literature

Our analysis draws inspiration from Atkins and Horner (2006), as published in ‘The Risk Management Association Journal’, in which the authors computed risk-adjusted returns for securities lending across various reinvestment vehicles and benchmarked the metrics against other traditional asset classes.

They found that lending returns were smaller than market index returns, but securities lending offered superior risk-adjusted performance. We extend the analysis in the following ways: (1) use more recent data from 2008-2023 to test if these findings still hold; (2) examine how securities lending risk metrics evolve during various market and interest rate regimes; (3) analyse key diversification aspects of securities lending; and (4) assess monetary policy implications on reinvestment spreads.

Reward-risk ratios of securities lending

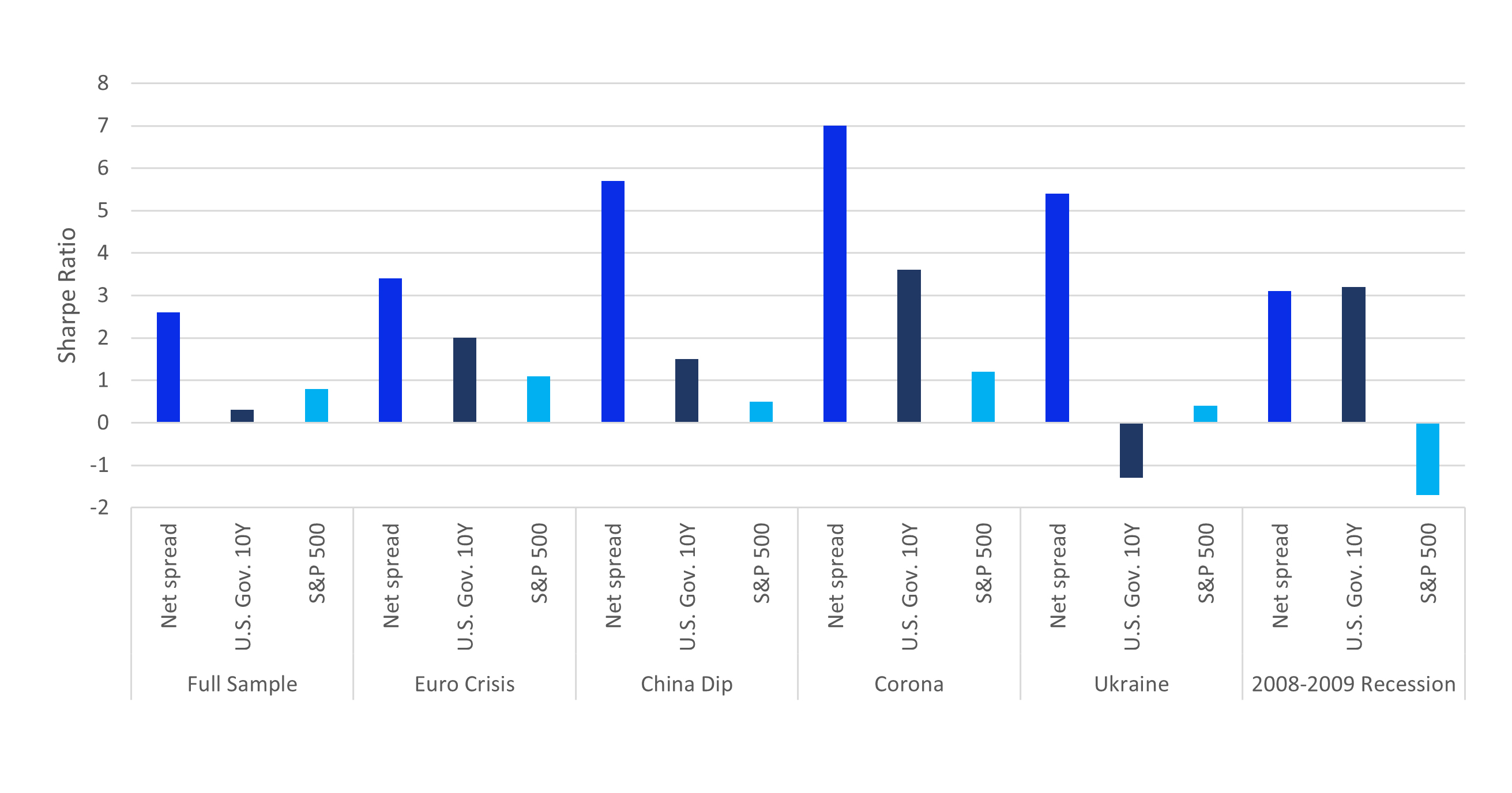

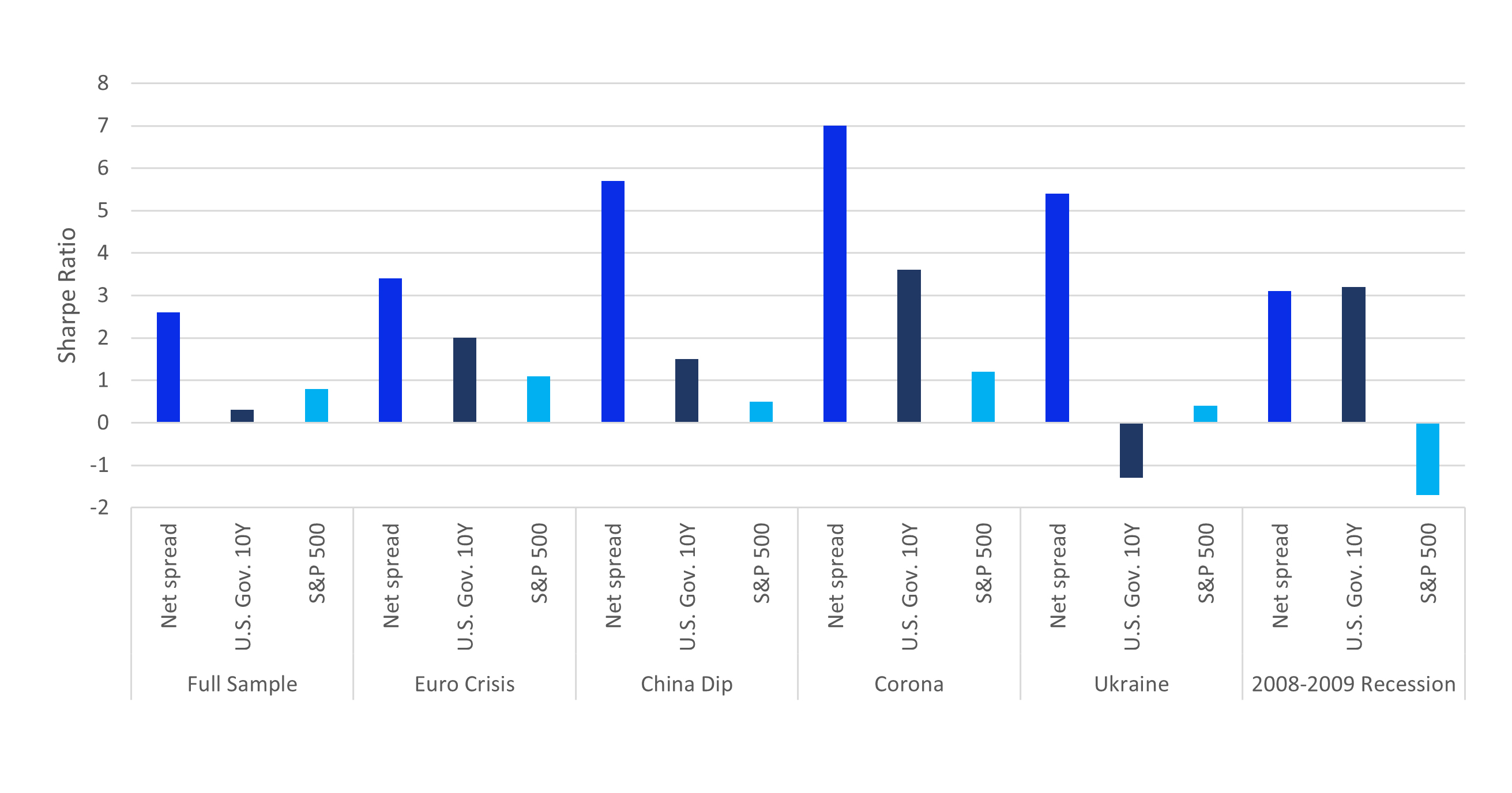

We compare the reward-risk ratios of securities lending returns (ie demand, reinvestment and net spreads) with that of benchmark stock and bond indices. It is important to note that the returns generated from securities lending can be earned on top of a given portfolio’s positions without the opportunity cost of reallocating from one asset to another.

We find that the mean excess return of securities lending for US and non-US clients is lower, on average, than returns of the benchmark indices over the full sample. However, the relative volatility of securities lending returns is much lower, implying higher Sharpe ratios for securities lending returns. Unlike the benchmark stock and bond indices, the securities lending spread distributions are positively skewed. Hence, only considering the downside volatility as the risk adjustment, the implied reward-risk ratio — ie Sortino ratio, which is the excess return per its downside standard deviation — is even higher for securities lending returns than the benchmark returns. In particular, the Sharpe ratio of securities lending net spreads for the US is 2.6, while its Sortino ratio is 7.9.

Figure 1

Another interesting feature of securities lending returns is its counter-cyclical nature. This could partly be captured by its returns’ low or negative correlation with that of other asset classes, which in turn suggests that securities lending could bring favourable diversification benefits during large market downturns.

We further show that the Sharpe ratios of securities lending returns improve during “crisis episodes”, while the benchmark indices perform worse than their average over the full sample during some of these periods, suggesting that securities lending could act as a hedging mechanism and diversify portfolios.

Efficiency frontier expansion by securities lending

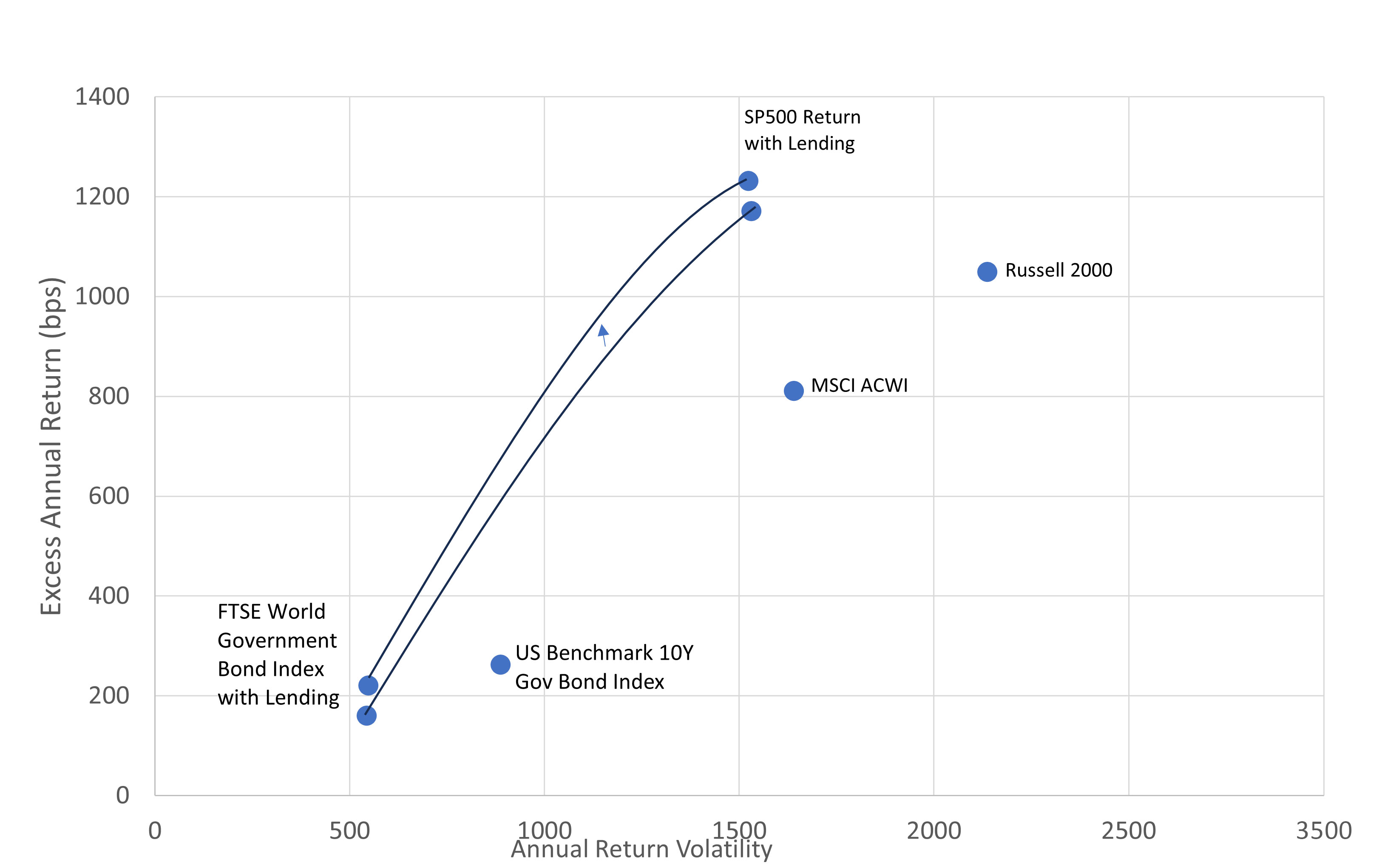

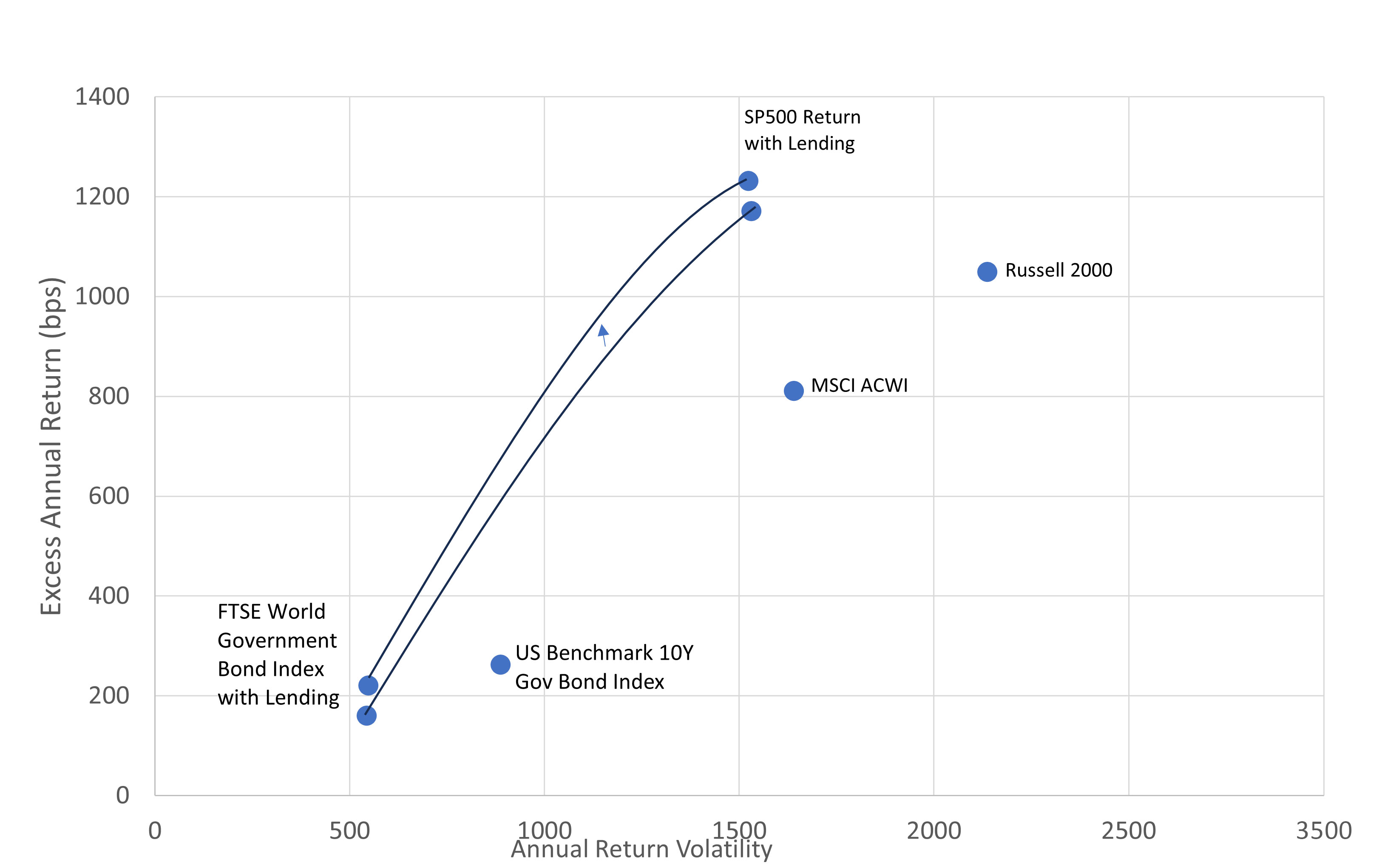

The benchmark stock and bond indices can be illustrated as benchmark portfolios on a scatter plot, in which the vertical axis is the excess annual return and the horizontal axis is the annual return volatility. Within our sample space, the S&P 500 and the FTSE World Government Bond Index (WGBI) portfolios have higher excess return per volatility (ie risk).

A hypothetical efficiency frontier between these two portfolios can be drawn as a combination of these two portfolios — ie a particular weight, ?, which is between 0 per cent and 100 per cent, is allocated to one of the corner portfolios while the rest, 1- ?, is allocated to the other, for all possible values of ?.

It is effectively shifted out by lending securities, assuming that the average net spread in our sample is earned upon lending out the securities. We show the degree to which such an efficiency frontier would shift using our sample period from January 2008 to June 2023 for US (shown below) and non-US clients, as well as during periods of non-zero interest rates, in which such outward shifts are larger.

Figure 2

Conclusion

Securities lending has long attracted the interest of asset owners and managers as a way of generating incremental returns, yet it is not fully embraced by all institutional investors. Some of this hesitation is rooted in the perception that the returns seem small on an absolute basis. However, just like any other investment decision, securities lending should be viewed through the lens of a reward-risk trade-off and its diversification properties.

From an empirical perspective, we find that the incremental return from securities lending is well above the marginal risk, and the returns generated from securities lending tend to have a low or negative correlation with traditional asset classes. This favourable diversification characteristic pushes out a hypothetical efficiency frontier of investors (even more so during market downturns), improving returns while maintaining the similar levels of risk.

We examine the historical performance of more than 5,000 anonymised and aggregated securities lending programmes over 15 years (2008-2023) to quantify the historical returns relative to losses and compute a reward-risk ratio (eg Sharpe ratio).

These metrics are evaluated over different market regimes and across regions.

The empirical findings suggest that securities lending risk-adjusted performance is significantly higher than that of benchmark stock and bond indices, and improve during periods of market drawdowns (eg ‘crisis’ periods) and tightening financial conditions. We also observe securities lending returns having a low or negative correlation with that of other asset classes, suggesting it brings favourable diversification benefits to a theoretical portfolio of traditional asset classes.

Previous literature

Our analysis draws inspiration from Atkins and Horner (2006), as published in ‘The Risk Management Association Journal’, in which the authors computed risk-adjusted returns for securities lending across various reinvestment vehicles and benchmarked the metrics against other traditional asset classes.

They found that lending returns were smaller than market index returns, but securities lending offered superior risk-adjusted performance. We extend the analysis in the following ways: (1) use more recent data from 2008-2023 to test if these findings still hold; (2) examine how securities lending risk metrics evolve during various market and interest rate regimes; (3) analyse key diversification aspects of securities lending; and (4) assess monetary policy implications on reinvestment spreads.

Reward-risk ratios of securities lending

We compare the reward-risk ratios of securities lending returns (ie demand, reinvestment and net spreads) with that of benchmark stock and bond indices. It is important to note that the returns generated from securities lending can be earned on top of a given portfolio’s positions without the opportunity cost of reallocating from one asset to another.

We find that the mean excess return of securities lending for US and non-US clients is lower, on average, than returns of the benchmark indices over the full sample. However, the relative volatility of securities lending returns is much lower, implying higher Sharpe ratios for securities lending returns. Unlike the benchmark stock and bond indices, the securities lending spread distributions are positively skewed. Hence, only considering the downside volatility as the risk adjustment, the implied reward-risk ratio — ie Sortino ratio, which is the excess return per its downside standard deviation — is even higher for securities lending returns than the benchmark returns. In particular, the Sharpe ratio of securities lending net spreads for the US is 2.6, while its Sortino ratio is 7.9.

Figure 1

Another interesting feature of securities lending returns is its counter-cyclical nature. This could partly be captured by its returns’ low or negative correlation with that of other asset classes, which in turn suggests that securities lending could bring favourable diversification benefits during large market downturns.

We further show that the Sharpe ratios of securities lending returns improve during “crisis episodes”, while the benchmark indices perform worse than their average over the full sample during some of these periods, suggesting that securities lending could act as a hedging mechanism and diversify portfolios.

Efficiency frontier expansion by securities lending

The benchmark stock and bond indices can be illustrated as benchmark portfolios on a scatter plot, in which the vertical axis is the excess annual return and the horizontal axis is the annual return volatility. Within our sample space, the S&P 500 and the FTSE World Government Bond Index (WGBI) portfolios have higher excess return per volatility (ie risk).

A hypothetical efficiency frontier between these two portfolios can be drawn as a combination of these two portfolios — ie a particular weight, ?, which is between 0 per cent and 100 per cent, is allocated to one of the corner portfolios while the rest, 1- ?, is allocated to the other, for all possible values of ?.

It is effectively shifted out by lending securities, assuming that the average net spread in our sample is earned upon lending out the securities. We show the degree to which such an efficiency frontier would shift using our sample period from January 2008 to June 2023 for US (shown below) and non-US clients, as well as during periods of non-zero interest rates, in which such outward shifts are larger.

Figure 2

Conclusion

Securities lending has long attracted the interest of asset owners and managers as a way of generating incremental returns, yet it is not fully embraced by all institutional investors. Some of this hesitation is rooted in the perception that the returns seem small on an absolute basis. However, just like any other investment decision, securities lending should be viewed through the lens of a reward-risk trade-off and its diversification properties.

From an empirical perspective, we find that the incremental return from securities lending is well above the marginal risk, and the returns generated from securities lending tend to have a low or negative correlation with traditional asset classes. This favourable diversification characteristic pushes out a hypothetical efficiency frontier of investors (even more so during market downturns), improving returns while maintaining the similar levels of risk.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

.jpg)