Difficult macroeconomic conditions for electric vehicle and software services sectors are unlikely to suddenly improve and these will continue to propel securities finance revenues, observes S&P Global Market Intelligence’s director of securities finance, Matthew Chessum

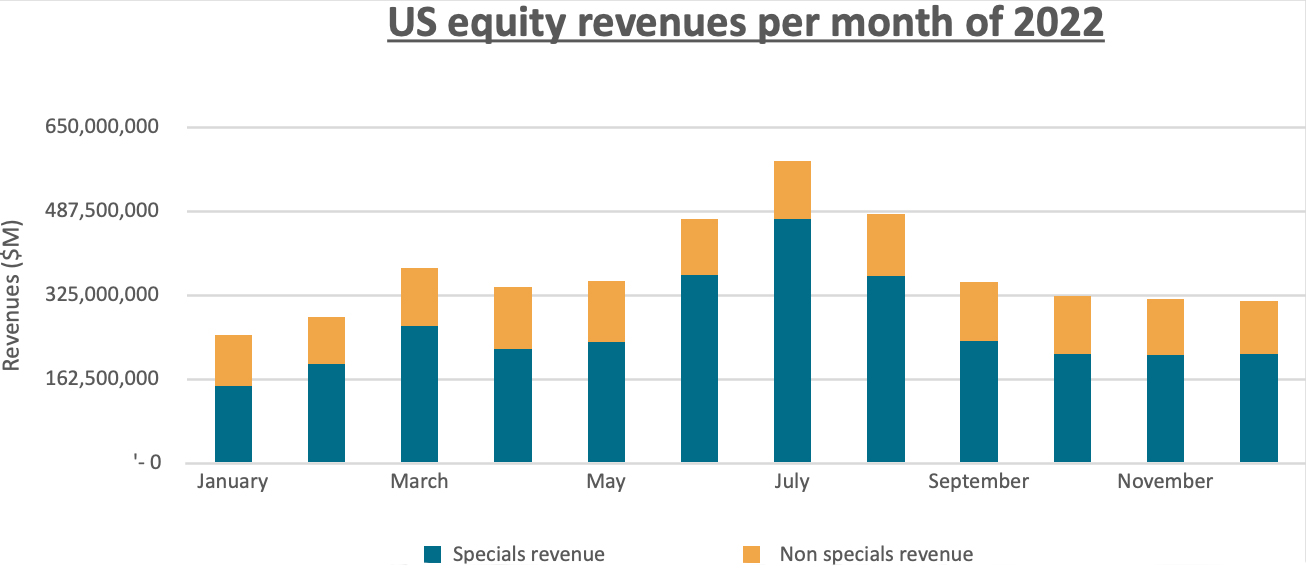

Throughout 2022, the lending of equity specials was a significant contributor to securities finance revenues. In the Americas, 70 per cent, or US$3.34 billion, of the year’s total revenues of US$4.77 billion were derived from specials activity alone. Specials are defined to be securities finance trades generating a fee greater than 500bps. During 10 of the 12 months of 2022, the amount of revenue originating from US equity specials surpassed US$200 million. Specials activity in Americas equities peaked throughout the summer months, reaching a high in July when an impressive US$450 million was generated. Over 80 per cent of all securities finance revenues generated by the asset class during this month were therefore attributable to specials activity alone.

The automobile and components and the software and services sectors both made sizeable contributions to these specials revenues throughout the year. Given the technological developments undertaken by both sectors, their impact on the future world economy could be considerable. Despite this, both sectors suffered from an absence of investor confidence given the significant macroeconomic uncertainty and market volatility throughout the year.

Automobile and components

Tesla was the original high value special that characterised this sector within the securities finance markets. During 2022, borrowing activity in Tesla was muted — despite the 47 per cent decline in its share price — and a different electric vehicle (EV) producer, Lucid Group (LCID), became the top grossing special of the year. The EV sector, consequently, became an important focal point for all securities finance market participants throughout 2022.

The share prices of electric vehicle makers remained under pressure throughout the year. The automobile and component sector’s short interest in North America, calculated as a percentage of its market capitalisation, increased to 1.79 per cent during H2 2022 as a result — up from 1.22 per cent in H2 2021 — and the sector became the sixth most shorted in North America.

Lucid Group (LCID) was the highest generating stock of the year, earning over US$267 million for lenders. Other common EV names included Fisker Inc (FSR), earning US$74 million, Faraday Future Intelligent Electric Inc (FFIE) which generated US$45.7 million, and Polestar Automotive Hld Cl A ADR (PSNY) which generated US$45.6 million. EV stocks were particularly prevalent borrows in the ADR market and several foreign companies have successfully raised capital from US investors through their use. One example of this, Xpeng (XPEV), was one of the top five ADR borrows of 2022, generating over US$9 million in revenues. The automobile and component sector produced over US$731 million in global securities finance revenues throughout the year.

The increase in borrowing activity within this sector over the past year is not surprising when we examine the many challenges facing the industry. The rapid increase in interest rates amplified the financing costs for new vehicles throughout the year, negatively impacting demand. Prices for new cars increased throughout 2022 as supply chain issues made integral car components, such as microchips, more expensive to source. In addition, the impact of a predicted recession, following the rapid increase in interest rates, exacerbated the downward pressure on the share price of electric vehicle makers. Recessionary fears not only impacted predicted sales volumes but also restricted the amount of reinvestment dollars available to these companies to finance the new technologies that often provide them with their competitive edge.

Despite the negative sentiment experienced by the sector over the past year, the agreement made at COP26 to phase out petrol car sales by 2030 — a commitment made by automobile makers and 30 countries worldwide — means that momentum in this important part of the automobile industry continues to grow. According to S&P Global Market Intelligence’s mobility team, 2026 will be the tipping point for the industry when the adoption of electric vehicles is expected to increase rapidly. By the year 2030, over one in every four cars sold globally is expected to be an electric vehicle. This fact alone will no doubt offer hope to the industry after a challenging 2022.

Software and services

During Q4 2022, the world’s financial markets were attentively following another market sector that has an increasingly prominent role to play within the world economy. With the price of bitcoin down nearly two thirds over the course of the year, the collapse of crypto exchange FTX, which was once valued at US$32 billion, seemed to be a natural crescendo to a challenging year experienced by crypto markets. The downward trend in the value of bitcoin, and the rapid increase in the cost of the energy needed to mine crypto currencies, encouraged investors to take a closer look at the viability of business models of numerous software companies.

The software and services sector saw increased borrowing activity because of a decline in investor confidence. An increasing percentage of the sector’s market capitalisation was borrowed from October onwards. Borrowing activity in the sector increased from 1.79 per cent in H2 2021 to 1.97 per cent in H2 2022. The sector became the third most borrowed sector, as a percentage of market capitalisation, in North America over the second half of 2022. Specials activity in the software and services sector generated over US$578 millon in securities finance revenues during the year.

The percentage of shares outstanding on loan for Marathon Digital Group (MARA), one of the largest US crypto miners, increased rapidly over the final quarter of the year, peaking in December at 52 per cent. According to the financial press, the company has continually missed daily bitcoin production targets and has repeatedly struggled to generate a profit since its inception. Other common borrows in this sector throughout the fourth quarter included Microstrategy Inc (MSTR), which reportedly holds a large proportion of its cash reserves in bitcoin, and Riot Blockchain Inc (RIOT), another bitcoin mining company. MSTR generated US$82 million in securities finance revenues over the period, while RIOT generated over US$7 million.

Figure 1

Despite the challenges faced by the crypto contingent of the software and services sector, the difficulties faced appeared to be well insulated with very limited spill over into more traditional financial assets. As the sector evolves, and with the growing popularity and adoption of stable coins which are collateralised by real world assets, controlling any contagion between the two is likely to become increasingly difficult in the future.

Heading into 2023, many of the macroeconomic conditions that have proved challenging for these two sectors do not appear to be improving at any great speed and their contribution to securities finance revenues remains robust. The US Inflation Reduction Act (IRA) does offer a glimmer of hope for electric vehicle makers as it contains provisions to help boost EV adoption and onshore EV and battery manufacturing. Bitcoin has also recovered approximately 20 per cent of its value since the beginning of the year, which may ease some of the cost pressures that crypto miners and crypto asset holders are facing. As these two sectors remain significant for both the future health and wealth of the planet, market participants are likely to remain both captivated and impacted by their future developments for many years to come.