S&P Global Market Intelligence’s director of securities finance, Matthew Chessum, and director for beneficial owner services, Rob Nunn, review securities lending market revenues during 2022 and provide pointers for expected market performance into 2023

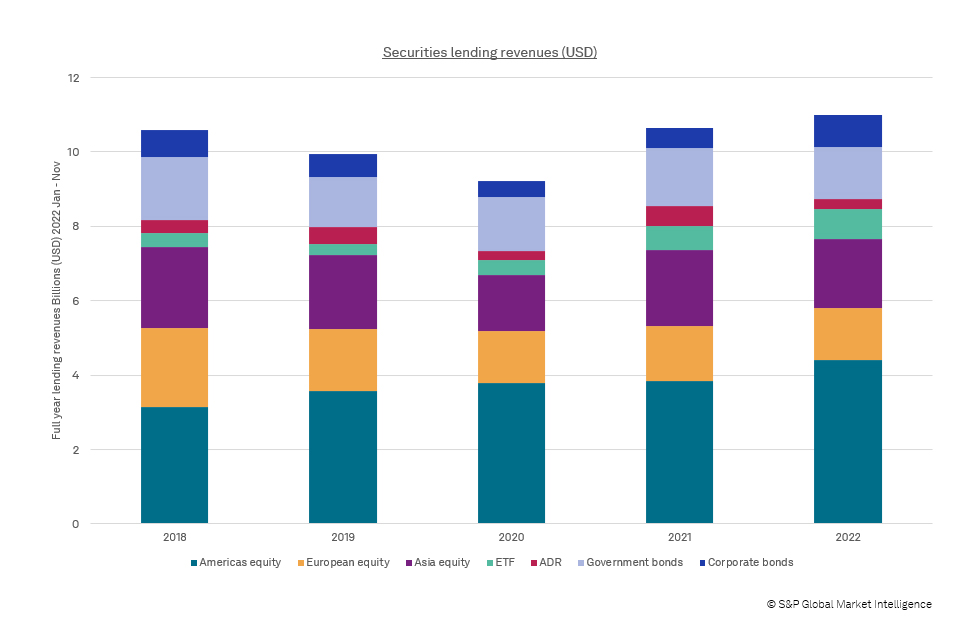

The securities finance markets have had a lot to be thankful for in 2022. The emergence of geopolitical risk and increased levels of volatility have reawakened short sellers and have collectively created the perfect conditions for securities finance revenues to reach highs not seen since 2008. Many asset classes beat their full year 2021 revenues in November with some, such as corporate bonds, as much as 60 per cent higher.

Throughout 2022 there were four stand out asset classes that outperformed when compared to recent years: US equities, ETFs, corporate bonds and government bonds.

Americas equities

Securities finance revenues generated by Americas equities increased steadily over the year, generating US$4.4 billion by the end of November. Several well-documented borrows have provided strong revenues for lenders throughout the year and most of the specials activity that took place in the equities markets can be attributed to Americas equities.

The first three quarters of 2022 generated more lending revenues from Americas specials than all four quarters of any other recent year. At the time of writing, the top revenue-generating stocks of 2022 are all Americas equities. Top specials of 2022 include Lucid Group (LCID) generating US$263 million to 15 December, Gamestop (GME) generating US$227 million to 15 December, and Beyond Meat (BYND) generating US$184.6 million.

Exchange-traded funds

ETFs benefited from the hawkish interest rate environment throughout 2022, with high yield and investment grade trackers seeing strong demand. The fall in corporate bond prices provided opportunities for both hedging and directional borrowing through ETFs. HYG (iShares iBoxx HY bond ETF) had generated US$109 million in revenues for lenders through to 15 December for example.

Other popular borrows that helped to push securities finance revenues higher were small and mid cap trackers such as IWM (iShares Russell 2000 tracker), which generated US$29.4 million for January to November.

ETFs that permit offshore investors to participate in operationally challenging markets such as CNYA (iShares MSCI China A shares) generated US$14.2 million (for January to November) and EWZ (iShares MSCI Brazil) also generated steady revenue flows of US$7.6 million (January to November). Americas ETFs dominated the ETF borrow market during 2022. Through the end of November, 86 per cent of all collective ETF revenues were attributable to Americas ETFs.

Corporate bonds

Corporate bonds became more expensive to borrow during 2022. Average fees climbed throughout the year, starting 2022 at an average of 29bps and finishing November at an average of 41bps. On-loan balances also increased significantly when compared to previous years. 2022 has been one of the best-performing years for corporate bonds on record and demand has remained widespread throughout the year. Specials have existed but demand for the asset class, as noted by a rapid increase in on-loan balances, has not been limited to specific bond issues. As interest rates continue to ratchet higher, pressure is likely to remain on corporate bond prices, providing further opportunities for both long and short investors in this asset class in 2023.

Government bonds

Government bonds remained attractive to borrowers throughout 2022. A general flight to quality, and the introduction of the final phase of the Uncleared Margin Rules (UMR) in Europe, all contributed to strong demand. Revenues increased steadily over the year, with only January failing to beat the same month in the previous year. By the end of November, revenues were 103 per cent of those generated throughout the whole of 2021.

Rob Nunn points out that despite 2022 being a strong year for the market-wide revenues, not all lenders have benefited from this trend. He indicates that if you held a broad range of US equities, ETFs and corporate bonds, you have probably had a good year. In contrast, if your asset pool is more concentrated, which is more the norm during times of heightened volatility, your revenues may not be reflective of those experienced by the broader market.

According to Nunn, global regulatory restrictions can also have a significant impact on the revenue generated from securities lending programmes. Regulations surrounding how UCITs funds or US 40 ACT funds can participate in securities lending activities, for example, can sometimes be restrictive if they are not fully understood or effectively managed.

As investment managers act as responsible stewards of client assets, independent oversight management of delegated functions, such as securities lending, is recommended by global regulators. It is important to understand the flexibility that beneficial owners have within regulatory obligations to optimise their returns, but also what data and tools are available to help to understand and manage a programme’s risk profile.

Several other factors can also impact a beneficial owner’s ability to generate revenues. These include regulation, collateral types (for example, cash, equities, government bonds, corporate bonds, ETFs), collateral transmission (pledge collateral versus title transfer), levels of margin, counterparty lists, trade durations, agent lender operational structures, as well as any minimum fee and recall policies.

Figure 1: Securities lending revenues (USD)

At S&P Global, we have developed numerous solutions to help manage securities lending programmes. These are designed to enhance transparency and build trust with stakeholders. This, in turn, ensures that securities lending is operating in the best interests of all parties. The solutions on offer help stakeholders to work proactively with their lending agents to enhance and improve performance, optimise and monetise new opportunities, effectively manage the liquidity profile of a programme’s assets, and help to improve risk management.

As we head into 2023, the securities finance markets are likely to continue to be driven by both inflationary and recessionary factors. Both fiscal and monetary policy will remain central to market movements as governments decide whether growth or deflation is the main driver of economic policy. As in 2022, the securities finance market is well positioned to take advantage of current economic trends and is expected to continue to generate important returns for all investors throughout 2023 no matter what side of the market they belong to.