Matthew Chessum, director of securities finance at S&P Global Market Intelligence, evaluates the first week of trading and lending in Bitcoin ETFs, following recent approval by the Securities and Exchange Commission

On 10 January 2024, the SEC approved 11 US-listed exchange traded funds (ETFs) that invest in Bitcoin. This has opened up a new asset class for many investors, as the move has simplified the process of gaining direct exposure to the cryptocurrency. The ease of investing in Bitcoin through an ETF structure will not only increase the popularity of this asset class, but is also likely to catapult it into the financial mainstream. One week after these new ETFs started trading, and following US$1.15 billion of net flows, S&P Global Market intelligence ETF data reveals the emergence of some interesting trends.

The iShares Bitcoin Trust (IBIT, US$1.2 billion) and the Fidelity Wise Origin Bitcoin Fund (FBTC, US$1 billion) experienced the largest inflows across all newly formed ETFs during the first week of trading. Blackrock and Fidelity have proven popular among investors, receiving a combined 68 per cent of all week one inflows (with BITI accounting for 37 per cent of these inflows, and FBTC 31 per cent).

The iShares Bitcoin Trust (IBIT) was the first of the group to amass more than US$1 billion in assets, accumulating the largest inflows during the week and boasting an AUM of US$1.17 billion on 18 January. The value of combined inflows into these two ETFs (US$2.2 billion) was equal to the value of the outflows seen across the Grayscale Bitcoin Trust (GBTC) during the period.

The Grayscale Bitcoin Trust (GBTC) experienced US$2,216.3 billion of outflows during the week. This ETF was the only fund to experience daily outflows during its first week of trading. The meteoric rise in the price of Bitcoin, which pushed ever higher as investors anticipated the approval of these new funds, appears to have led to profit taking by existing investors in the former closed-end fund. Now converted, existing units can be traded freely on exchange, which lowers the bid-offer spread for investors that would previously have had to trade over the counter, often at a substantial discount to the Bitcoin price.

Fund flows have been affected by the decision of some Bitcoin ETF issuers to charge 0 per cent fees for a limited amount of time, with the agreement to raise them when a defined AUM is reached. The majority of the funds are expected to charge between 0.2 per cent and 0.4 per cent in the future. The Grayscale Bitcoin Trust ETF (GBTC) continues to charge 1.5 per cent, highlighting its track record as its differentiating competitive factor. When looking outside the fee, the Grayscale ETF had the lowest average trading spread across the group during the week and experienced the highest trading volumes and values (fig 1). This suggests that liquidity and price remain important factors for a substantial proportion of the investor base.

In the securities lending markets, ETFs generated US$635 million in revenues during 2023, which was a decline of 25 per cent YoY. The asset class has focused upon a handful of high revenue producing stocks such as iShares IBOXX High Yield Bond ETF (HYG), iShares IBOXX Investment Grade Bond ETF (LQD) and Invesco Senior Loan ETF (BKLN) over the last few years, as the change in the interest rate environment has created a number of opportunities for investors looking to take advantage of the change in the yield environment.

With the emergence of the new Bitcoin ETFs, a new driver of revenues for 2024 may be in the making. Given the level of investor demand and the fact that the asset class does not provide a yield — as returns are based solely upon pricing speculation — these most recently approved ETFs are likely to represent the start of a growing trend of investment strategies designed to generate returns across this increasingly popular asset.

At the time of writing in mid-January, average short interest across all 11 newly approved ETFs stands at 1.7 per cent of their free float. When looking at the percentage of shares outstanding on loan, the Fidelity Wise Origin Bitcoin Fund (FBTC) is the most popular among borrowers with 6.5 per cent of its outstanding shares currently being borrowed. This is followed by the iShares Bitcoin Trust (IBIT), with 2.6 per cent of outstanding shares on loan, and the Invesco Galaxy Bitcoin ETF (BTCO) at 1.8 per cent.

While these numbers remain relatively low, the average volume weighted average fee across all 11 Bitcoin ETFs currently exceeds 38 per cent. The fee is expected to fall over time as supply builds, with the addition of new ETFs based on other crypto currencies and associated strategies. Consequently, crypto currency ETFs may be the product to watch in 2024.

The value of Bitcoin has declined around 20 per cent since the new ETFs started trading. A number of factors may explain this. One is the outflows seen in the Greyscale Bitcoin Trust (GBTC), as investors can now transact in a more efficient manner. Another is that speculators are becoming more cautious about the potential impact of the product on their investment portfolios. The macro environment continues to play a large role in the valuation of Bitcoin and, as rates have been rallying and the USD has started to strengthen, a more bearish sentiment has started to prevail.

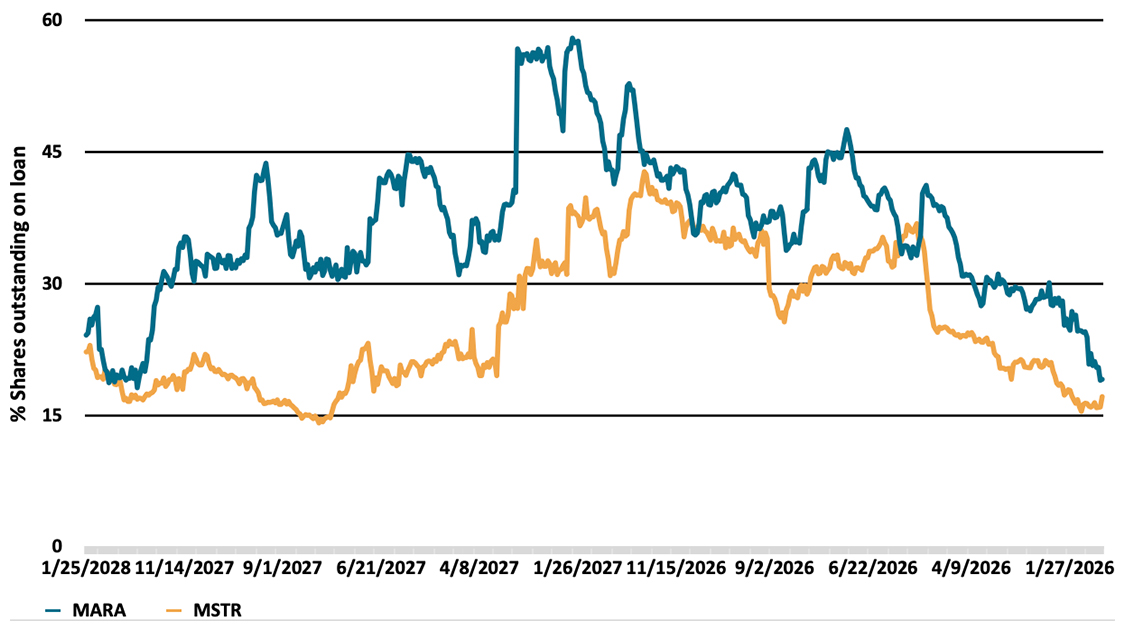

Fig 1: % shares outstanding on loan, MARA and MSTR

The price of Bitcoin has a knock-on effect upon the valuation and the level of short interest seen across a range of companies and sectors. This was particularly evident during Q4 2022 with the collapse of the crypto exchange FTX. Microstrategy Inc (MSTR) and Marathon Digital Holdings Inc (MARA) were two stocks that have experienced sustained borrowing activity throughout 2022. Both are linked to the crypto currency market. Microstrategy Inc (MSTR) is a company that has recently pivoted to blockchain technology and owns a substantial number of Bitcoins. Marathon Digital Holdings Inc (MARA) is a Bitcoin mining company. During 2023, these two companies generated a combined US$114 million in revenues for lenders.

The arrival of Bitcoin ETFs was highly anticipated and marks a significant step in turning crypto currencies into a mainstream investment vehicle. Despite the significance of the move, the realisation that the bitcoin bull run is not going to materialise — or at least not as quickly as some presumed — is likely to mean that these assets will be a mainstay of the securities lending market for some time to come. Given their implicit volatility, and their elevated lending fees, they have the potential to become some of the strongest revenue earners across the ETF asset class for securities lenders during 2024.