After a prolonged period of low growth, low interest rates and relative calm, the markets reawakened during 2023 and volatility has returned. Matthew Chessum, director of securities finance at S&P Global Market Intelligence, analyses the factors driving securities lending revenues over the past 12 months and the expectation of another great year during 2024

For securities lending markets, 2023 has been a year like no other. After a prolonged period of low growth, low interest rates and relative calm, the markets reawakened during 2023 and volatility returned. Over the year, interest rates moved to levels not witnessed since before the global financial crisis and bond yields experienced more volatility in the space of a few months than they have seen for several years. Equities also moved significantly higher, following their Q4 2022 dip, and securities lending markets have been thriving once more, generating important incremental returns for asset owners. Given the level of change and opportunity, 2023 proved to be a very busy year for securities finance market participants.

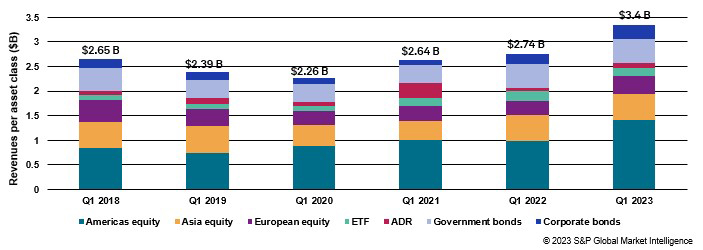

Q1

Q1 2023 was one of the most financially tumultuous quarters since the end of the global financial crisis in 2008. The quarter started with market participants believing that the end of the interest rate hiking cycle across most major world economies was coming to an end. This was reflected in government bond markets, where positive sentiment led to a decline in bond yields.

Equity markets started to recover from their Q4 2022 lows. This was particularly evident within the tech sector, with mega cap tech stocks leading the charge and recovering the majority of any losses from the previous quarter. Growth stocks did particularly well during Q1 2023, outpacing any recovery seen in value stocks.

Throughout the period, economic data showed that inflation was stickier than anticipated and, as a result, central banks continued their tightening cycle. Benchmark interest rates continued to rise, albeit in smaller increments than previous increases. The Bank of England, Federal Reserve Bank and the European Central Bank all voted to raise rates twice over the quarter, making it clear that reducing inflation down to 2 per cent would be their ultimate goal.

Heading into March, events within the finance sector unfolded at an unprecedented speed with the collapse of Silicon Valley Bank and Signature Bank in the US. Credit Suisse also agreed to a buyout by UBS as a result of financial pressures on its balance sheet. The issues in the banking sector once again focused market participants’ minds on credit risk, driving a flight to quality with deposits being drawn out of regional banks in the US and placed into USD money market vehicles.

In the securities lending markets, participants generated a massive US$3.415 billion in revenues, which was 24 per cent higher than during Q1 2022. Broken down by asset class, US$2.6 billion was generated from equities lending and just under US$800 million from fixed income.

The majority of asset classes experienced double-digit increases when compared with Q1 2022. Securities lending revenues from American equities rose 45 per cent YoY, with EMEA equities up 36 per cent and revenue from lending APAC equity down 4 per cent for Q1 2023 YoY (fig 1). Average fees increased across the board, apart from a very small decrease for APAC equities and a 9 per cent decline across exchange-traded funds (ETFs). Americas equities were the standout asset class, with a 47 per cent increase in average fees when compared with Q1 2022. ADRs had a good quarter, with average fees up 107 per cent to 138bps and revenues up 94 per cent YoY to US$102 million.

Fixed income fees moved higher over the period. The momentum established during 2022 continued to grow, with government bond fees increasing 35 per cent in Q1 2022 and corporate bond fees increasing a massive 60 per cent. Average fees for corporate bonds reached an incredible 46bps during the quarter.

Fig 1: Q1 securities lending revenue by asset class, 2018-2023

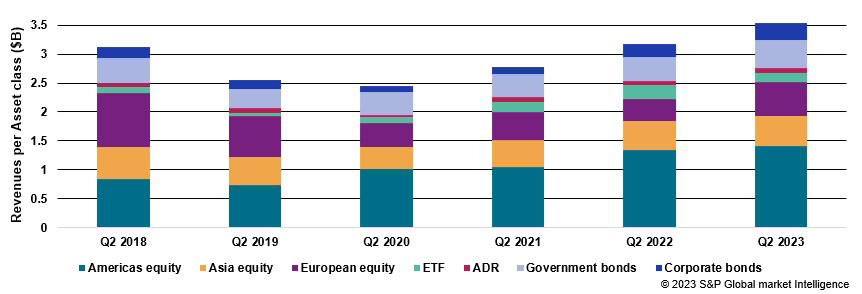

Q2

Global economies remained glued to economic data throughout the quarter as central banks continued to fight inflation with higher interest rates. In the US, interest rates finished the quarter at a 16-year high, following the fastest hiking cycle in four decades. The Bank of Canada was one of the first central banks to take a pause in its hiking cycle to digest the economic data, but it concluded that further increases were necessary during June. In Europe, the European Central Bank raised rates to a 22-year high and the Bank of England, despite being one of the first central banks to start hiking, carried on its path to a higher-than-expected terminal rate, as core inflation remained stubbornly high.

There was also evidence of this general tightening cycle in the APAC region, despite inflation being less acute. The only two outliers were the Bank of Japan, which maintained its yield curve controls and loose monetary policy throughout the quarter, and the People’s Bank of China, which cut its main policy rate for the first time in 10 months as new data worries heightened concerns about a weakening post-Covid rebound in the country’s economy. The second quarter marked a point of divergence for global central banks and the fight against inflation as economies increasingly started to move to local rhythms.

In the US, debt ceiling discussions found their way into the headlines towards the end of the quarter as market participants positioned their portfolios for what seemed likely to be one of the biggest showdowns between Republicans and Democrats to date. Despite an increase in borrowing of T-Bills which expired towards the infamous X-date — a trend which impacted both the repo and securities finance markets — an agreement was reached with little to no effect upon the broader financial sector.

The second half of the quarter experienced an explosion of interest in artificial intelligence. The arrival of Chat GPT and other similar large language models prompted a desire to understand more about the impact that generative AI could bring to company profits and workflows. Consequently, technology companies — including microchip and semiconductor manufacturers and information technology firms — saw their share prices rally. The NASDAQ experienced its best opening six months of the year ever. Likewise, the S&P 500 gained approximately 13 per cent during H1, helping it recoup any losses incurred since the Fed started to raise interest rates during March 2022. The index moved into bull market territory following a 20 per cent increase from its most recent low point on 12 October 2022.

A similar story has been replicated across the globe. The Nikkei in Japan reached a 33-year high as the country felt the benefits of continuing divestment from China and recent changes to its corporate governance policy. Across Europe, many stock markets marched higher and the German DAX reached an all-time high. In the securities lending markets, this led to short covering and a reduction in balances.

Securities finance markets generated revenues of US$3.605 billion over the quarter, driven by US$2.8 billion from equities lending and US$800 million from fixed income. This represents the best Q2 period since 2008.

Over the first half of the year, US$7.02 billion in securities lending revenues were generated globally, representing a 16 per cent increase on a near-record year during 2022. Q2 revenues were some of the highest observed in recent history, second only to those witnessed in 2008 when US$8.4 billion was generated during the first half of the year.

The majority of asset classes experienced strong lending revenues when compared with Q2 2022. Equity revenues were up 5 per cent YoY globally, with American equities rising 13 per cent, EMEA equities up 3 per cent and APAC equity rising 4 per cent. Fixed income assets also continued their impressive run, with revenues for government bonds increasing 9 per cent YoY to US$484 million and corporate bond revenues rising an incredible 28 per cent YoY to US$296 million.

When compared quarter-on-quarter, revenues across Americas equities (-1 per cent), exchange-traded products (ETPs) (-4 per cent) and corporate bonds (-1 per cent) all slightly decreased, with all other asset classes experiencing gains.

Average fees continued to increase across the board, with the exception of ETPs. Comparatively high average fees were one of the most important contributors to revenue growth throughout the quarter. Balances continued to decline across all asset classes, apart from Asian equities, and utilisation fell across the board.

The boost to returns during the quarter was attributable to the ongoing strength seen across average fees. This was particularly true for fixed income assets, which experienced some of the largest improvement in average fees YoY. In comparison to Q1 2023, fees for both corporate and government bonds remained flat, but this was contrary to what had been seen during previous quarters.

Borrowing activity continued to decline across ETPs over the quarter. Average fees fell 22 per cent YoY, utilisation was down 17 per cent YoY and balances also fell by 17 per cent YoY. This had a negative impact on revenues, which contracted 35 per cent to US$155 million over the quarter.

Fig 2: Q2 securities lending revenue by asset class, 2018-2023

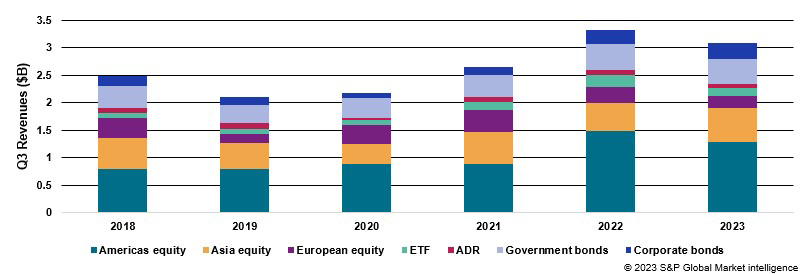

Q3

With the US debt ceiling and bank solvency concerns in the rear-view mirror, financial markets reverted to the familiar themes of growth, inflation and central bank decision making during the quarter. Across most developed markets, inflation moderated and investor focus moved to peak rates and the end of tightening policy.

Interest rates continued to rise throughout the quarter across all the major economies. However, the pace of increases slowed and, towards the end of the quarter, the majority of central banks chose to pause — rather than to persist with further increases — as economic data started to reflect the impact of the most recent rate rises.

The US was stripped of its top-tier sovereign credit grade by Fitch Ratings during the quarter, shrinking the world’s AAA debt options. The agency criticised the country’s ballooning deficit and “erosion of governance” that has led to repeated debt limit clashes over the past two decades.

The bullish sentiment that lifted shares out of a bear market at the end of last year started to fade. The idea that interest rates would be staying higher for longer and that any central bank pivots to lower rates may not be until mid-to-late 2024 started to impact equity markets. The term “higher for longer” became popular among market analysts and bond yields surged towards multi-year highs. Prices in both equities and fixed income assets fell in tandem, even across those AI-inspired tech stocks that had driven most of the market rally experienced during the year.

In the securities finance markets, revenues started to slow. Q3 produced US$3.131 billion in revenues. This represented a 7 per cent decrease YoY, but it is important to remember that Q3 2022 was the highest revenue generating quarter of 2022.

In the equity markets, revenues declined pretty much across the board. APAC equities were the standout asset class, offering a 20 per cent increase in revenues YoY as well as increases in balances and average fees. Americas equities were affected by a fall in specials revenues throughout the month of September and EMEA equities performed poorly during both August and September. Over the quarter, there was also a significant decline of 27 per cent in EMEA equity balances.

ETPs continued to experience a fall in both revenues and borrowing demand, following a banner year during 2022. ADRs suffered a strong decline in both average fees and revenues.

In the fixed income markets, the changing interest rate environment continued to enhance the performance of both government and corporate bonds. Government bonds saw a 2 per cent decrease in revenues YoY to US$464 million, but benefited from a 9 per cent increase in average fees which helped to offset the 10 per cent decline in balances. Corporate bonds continued to offer double-digit increases in revenues. Balances remained flat, but average fees increased 13 per cent YoY to 42bps.

Fig 3: Q3 securities lending revenue by asset class, 2018-2023

Q4

At the start of Q4, market participants were suggesting that the Fed would probably need to raise interest rates once more during 2023 and then hold them at higher levels for some time. Other central banks moved from a pause to a hold in their hiking cycles as economic data started to point to a marked slowdown in inflationary pressures.

Central bankers reinforced their message of “higher for longer”, however, which sent bond prices falling once again. The US 10-year Treasury reached a 5 per cent yield for the first time since 2007 as traders braced themselves for an extended period of elevated rates. This was replicated around the globe, with German 10-year yields reaching their highest levels since 2011 as investors started to demand greater compensation for holding long-dated debt.

Geopolitical risk increased throughout the quarter, fuelled by renewed tensions in the Middle East and US plans to tighten measures restricting China’s access to advanced semiconductor and chipmaking gear. This proved to be an ongoing theme throughout the year.

Across Asia, pressure on the central bank of Japan continued to grow as the JPY continued to weaken against the USD. As the BoJ maintained its stance of negative interest rates — in spite of a prolonged period of inflation — the widening interest rate gap between the JPY, EUR and USD continued to intensify.

Despite the tightening conditions within the bond market, spreads across US investment grade and high yield bonds remained below their 20-year averages.

Heading into the second half of the quarter, an extension to the interest rate pauses by the Bank of England, the European Central Bank and the US Federal Reserve, coupled with continued disinflationary momentum in Europe and the US, sent bond yields tumbling. This came as traders started to price in multiple rate cuts for 2024 — despite warnings by central bankers. This led to a further surge in growth stocks, with the “magnificent seven” coming close to topping 100 per cent return for the year.

Across Asia, South Korea implemented a short selling ban, stating that big banks had been breaking naked short selling rules. In contrast, the Philippines introduced short selling in a bid to attract international capital flows. Across Japan, the Nikkei reached a new year high, as corporate governance reforms, a weaker yen, disinvestment from China and strong earnings continued to push the index higher.

At the time of writing, securities lending revenues were continuing to decline, with November posting the lowest monthly revenues of the year. Revenues from US equities contracted further with the drop off in specials activity. Revenues and average fees continued to fall across the fixed income markets, with both corporate bond and government bonds generating less revenue month-on-month, quarter-on-quarter and year-on-year. APAC equities continued their resurgence, which started towards the end of the Spring, but revenues slowed as balances started to decline across both Japan and South Korea. Activity across European equities remained subdued, with monthly revenues reaching lows not seen for many years.

Despite the general slowdown in revenues, a decline in balances and an acceleration in the decline of average fees, revenues remained on track to surpass those of 2022. To the end of November, market revenues reached 95 per cent of the total achieved during 2022 having already surpassed those generated during 2021 and 2020. Over the last few years, revenues during December typically increased when compared to those during November and, if this remains the case, market revenues are set to surpass those of 2022.

As this quick run through of the year shows, 2023 has been defined by both geopolitical and macro-economic themes. Despite another year of near record revenues, low dispersion across both equity markets and securities lending specials activity has meant that not all investors have felt the benefit of these revenues to the same degree. One clear example of this can be seen in the Americas specials market which contributed over US$3 billion in revenues alone, US$650 million of which came from lending one stock, AMC.

Heading into 2024, volatility and uncertainty remain key factors for securities finance markets. Despite a slowdown in revenues, a higher interest rate environment, volatility in yields and robust equity markets are all likely to help to produce a fertile ground for another great year during 2024.