Asia outlook

07 March 2023

The APAC region remains highly significant in terms of the pace of growth of its securities finance market and its contribution to global revenues, says S&P Global Market Intelligence’s director of securities finance, Matthew Chessum

Image: Shutterstock

Image: Shutterstock

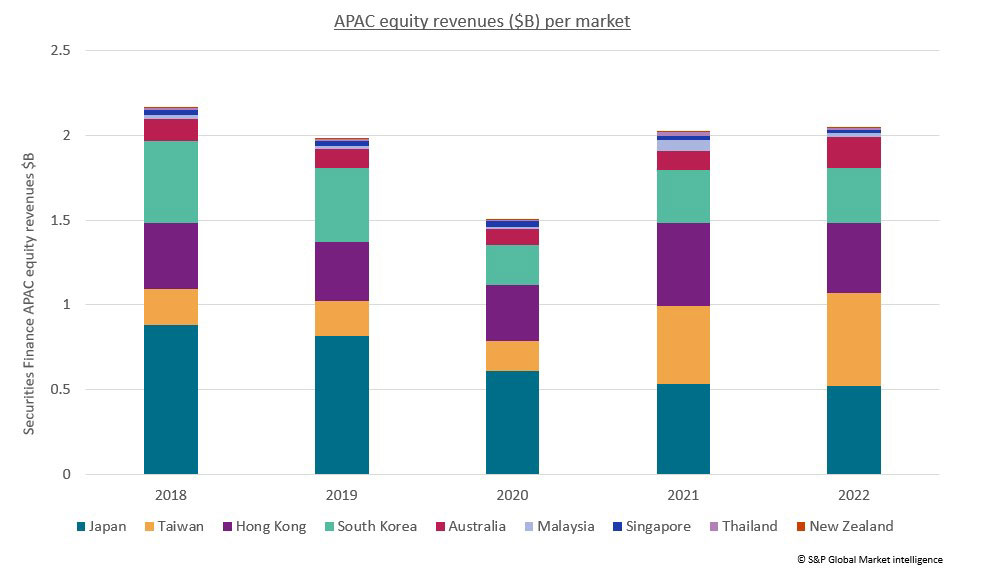

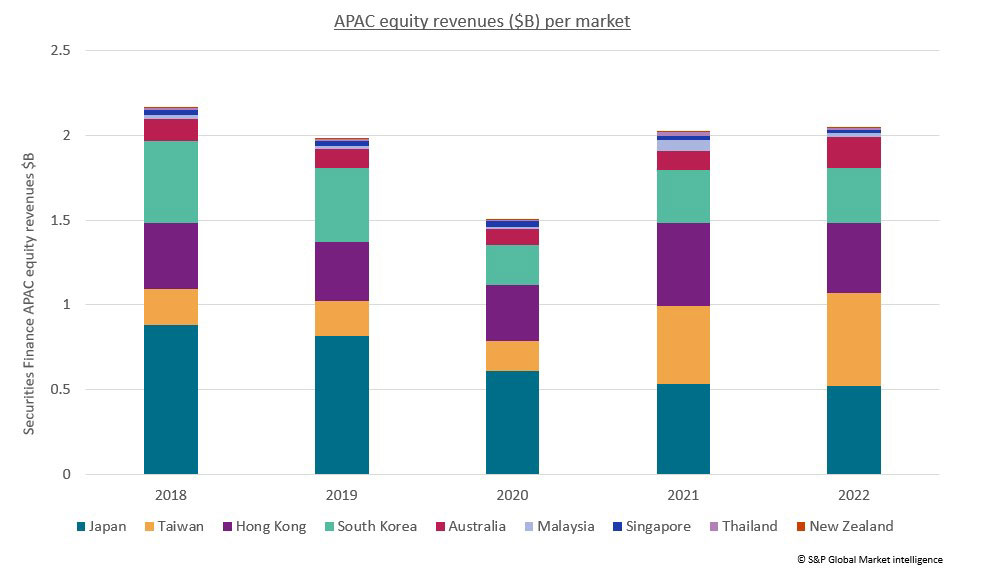

The Asia-Pacific region continues to be an important driver of securities finance revenues for market participants. Since 2018, the region has continually generated more than 20 per cent of annual equity revenues. This is expected to grow in the future, as the region is well placed to exploit additional opportunities in new markets such as Indonesia, India and mainland China.

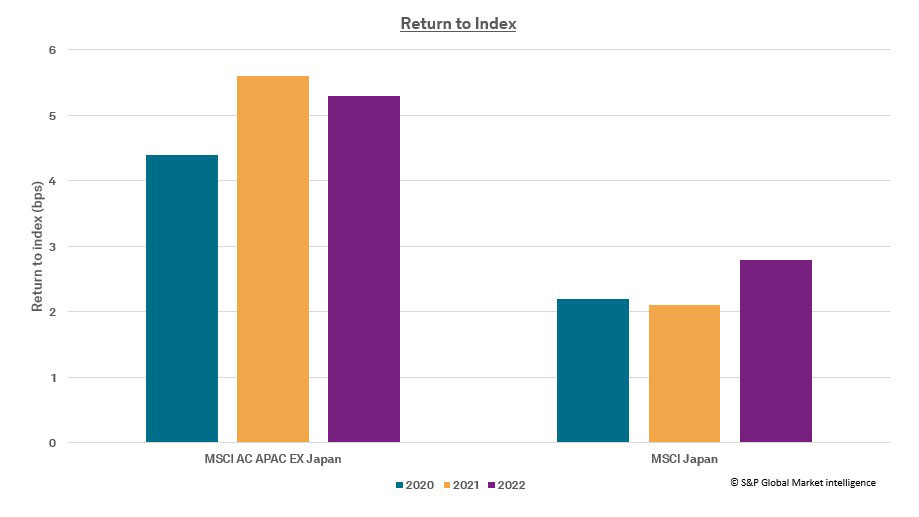

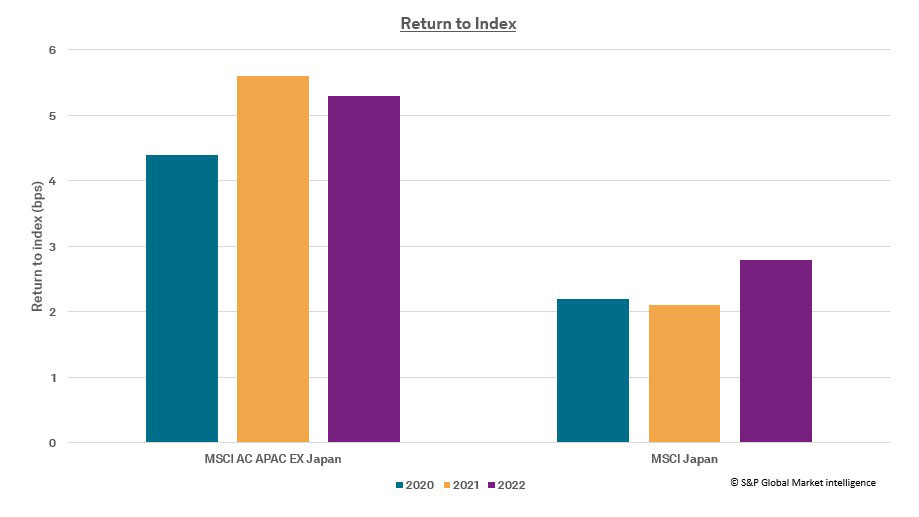

Lending fees tend to be higher within the APAC region due to a combination of operational nuances, increased levels of recall risk and the resulting liquidity premium. Average fees increased 3 per cent across APAC equities during 2022 to 97bps and the return to lendable for the MSCI AC APAC ex-Japan index was 5.3bps in 2022, down from 5.6bps in 2021. Specials activity — which we class as any loan traded with a fee greater than 500bps — hit an all-time high during 2018 when over US$102 million in revenues were generated, but this declined to US$76 million in 2022.

As the PASLA conference is due to take place on 7-8 March, it seems appropriate to analyse the performance of markets across the APAC region and to see where any new opportunities may lie.

Fig 1: APAC equity revenues (US$) per market

Japan

Japan is not only the host country for the PASLA conference but, until last year, it has always been the most lucrative market in terms of APAC equity revenues. In 2022, the revenues generated by Japanese equities, at US$520.8 million, were surpassed by Taiwan, at US$547.6 million. Looking back to 2018, when Japanese equities generated US$878.9 million, revenues in the country have been decreasing year-on-year. Average fees have also been in decline. In 2018, the average fee was 90bps and during 2022 this more than halved to 42bps. Despite this fall in average fees, the return to lendable vs MSCI Japan index increased to 2.8bps in 2022, from 2.1bps in 2021 and 2.2bps in 2020.

Japan is a significant market in Asia for fixed income assets. Government bond lending in Japan has recently become more expensive, with the volume-weighted average fee for Japanese Government Bonds (JGBs) hitting 29bps. Average fees for JGBs have increased as investors look for additional sources of liquidity and place directional trades, speculating that yields will move higher if the central bank changes its target range policy on the 10-year JGB. During 2022, revenues generated by JGB lending increased by 17.5 per cent YoY, more than doubling the US$22.9 million generated in 2020.

Fig 2: Return to Index

Taiwan

Taiwan is a relative newcomer when compared to the more traditional APAC lending markets such as Japan and Australia. As an automatic buy-in market, it also remains operationally intensive, requiring greater coordination in relation to recalls, with pre-sale notification often a standard market requirement for lenders. Despite this, it is a significant contributor to overall revenues generated in the region and its contribution continues to grow year-on-year. In 2018, revenues from the lending of Taiwanese assets accounted for just 10 per cent of all regional revenues, but in 2022 this increased to 27 per cent. Since 2018, revenues have more than doubled, hitting US$547.6 million during 2022. Average fees also hit a recent high in 2022, averaging 258bps over the year, with an all-time quarterly high of 273bps achieved during the third quarter of 2022.

With a technology heavy economy, the market remains affected by the health of the global economy. It also remains sensitive to the geopolitical climate. Despite this, the revenues on offer continue to grow and show no signs of abating in the future.

South Korea

South Korea is an important market for securities finance activity within the Asia Pacific region. During 2022, US$326 million was generated in securities finance revenues, placing it in fourth place among its regional peers after Japan, Taiwan and Hong Kong. Average fees remain elevated in South Korea as a result of the strict settlement regime — South Korea is considered a no-fails market — and the level of small and mid-cap equity borrowing. The 2022 average fee stood at 201bps, which was a 4 per cent decrease when compared with 2021. Both average fees and revenues have declined in the country since 2018, when over US$480 million in revenues was generated (at an average fee of 350bps).

As a result of a heavy retail presence within the investment landscape and the small and mid-cap nature of the assets often traded, the local regulator remains sensitive to falls in the main index. As a result, the regulations regarding short selling change on a frequent basis and this has a direct impact upon securities finance revenues.

As further hedging and market making tools are developed in South Korea, particularly in support of the KOSDAQ constituents, securities lending and borrowing activity are expected to grow, as PASLA itself has noted. As the market develops, securities finance activity is expected to broaden to encompass a larger proportion of large cap borrowing. South Korea has punched above its weight with regards to revenues and remains comfortably in the “one to watch” category for future market developments.

Hong Kong

Hong Kong is one of the most actively traded markets within the region. The market is continually well represented in the top 10 borrowed stock lists for the region and continues to generate considerable revenues for market participants. Securities finance revenues reached US$491 million in 2021, but declined in 2022 to US$414 million. When considered as a percentage of overall APAC equity revenues, the importance of the market has increased since 2020 — representing 18 per cent of the market in 2018, 17 per cent in 2019, 22 per cent in 2020, 24 per cent in 2021 and 21 per cent in 2022. On loan balances were significantly lower last year relative to 2021, contracting 24 per cent to US$33 billion. Despite this, average fees increased 10 per cent YoY to 126bps.

Hong Kong remains one of the only Chinese equity markets that is accessible to offshore investors. As a result, it has an important role to play in the management of investors' exposure to mainland China and offers a great deal of potential for the future.

Others

Australia contributed 10 per cent of APAC equity revenues during 2022, at US$185 million. Last year was one of the best in terms of revenue generation for the country as mining, natural resource and financial stocks listed in the country commanded ever higher fees.

Revenues in Malaysia fell dramatically to US$18.8 million during 2022, after reaching all-time highs of US$63 million during 2021. A similar story also took place in Thailand — with revenues contracting from US$19.2 million in 2021 to US$16.1 million in 2022 — and in New Zealand, where revenue fell from US$5 million to US$4 million.

Revenues in Singapore dropped to US$18.7 million in 2022 from US$31.2 million for the preceding year, resulting in its contribution to aggregate APAC equity revenues shrinking from 2 to 1 per cent.

The APAC region remains significant in terms of the growth of the securities finance market and in its importance to market revenues. Looking ahead, the region offers strong opportunities in Indonesia and the Philippines. If the capital markets open to offshore participants in China and India, and a viable solution can be found to operate with their CCP structures, then the contribution of APAC equities to overall securities finance revenues will swell, consolidating its position as the second-highest revenue generating region for securities finance activity.

Lending fees tend to be higher within the APAC region due to a combination of operational nuances, increased levels of recall risk and the resulting liquidity premium. Average fees increased 3 per cent across APAC equities during 2022 to 97bps and the return to lendable for the MSCI AC APAC ex-Japan index was 5.3bps in 2022, down from 5.6bps in 2021. Specials activity — which we class as any loan traded with a fee greater than 500bps — hit an all-time high during 2018 when over US$102 million in revenues were generated, but this declined to US$76 million in 2022.

As the PASLA conference is due to take place on 7-8 March, it seems appropriate to analyse the performance of markets across the APAC region and to see where any new opportunities may lie.

Fig 1: APAC equity revenues (US$) per market

Japan

Japan is not only the host country for the PASLA conference but, until last year, it has always been the most lucrative market in terms of APAC equity revenues. In 2022, the revenues generated by Japanese equities, at US$520.8 million, were surpassed by Taiwan, at US$547.6 million. Looking back to 2018, when Japanese equities generated US$878.9 million, revenues in the country have been decreasing year-on-year. Average fees have also been in decline. In 2018, the average fee was 90bps and during 2022 this more than halved to 42bps. Despite this fall in average fees, the return to lendable vs MSCI Japan index increased to 2.8bps in 2022, from 2.1bps in 2021 and 2.2bps in 2020.

Japan is a significant market in Asia for fixed income assets. Government bond lending in Japan has recently become more expensive, with the volume-weighted average fee for Japanese Government Bonds (JGBs) hitting 29bps. Average fees for JGBs have increased as investors look for additional sources of liquidity and place directional trades, speculating that yields will move higher if the central bank changes its target range policy on the 10-year JGB. During 2022, revenues generated by JGB lending increased by 17.5 per cent YoY, more than doubling the US$22.9 million generated in 2020.

Fig 2: Return to Index

Taiwan

Taiwan is a relative newcomer when compared to the more traditional APAC lending markets such as Japan and Australia. As an automatic buy-in market, it also remains operationally intensive, requiring greater coordination in relation to recalls, with pre-sale notification often a standard market requirement for lenders. Despite this, it is a significant contributor to overall revenues generated in the region and its contribution continues to grow year-on-year. In 2018, revenues from the lending of Taiwanese assets accounted for just 10 per cent of all regional revenues, but in 2022 this increased to 27 per cent. Since 2018, revenues have more than doubled, hitting US$547.6 million during 2022. Average fees also hit a recent high in 2022, averaging 258bps over the year, with an all-time quarterly high of 273bps achieved during the third quarter of 2022.

With a technology heavy economy, the market remains affected by the health of the global economy. It also remains sensitive to the geopolitical climate. Despite this, the revenues on offer continue to grow and show no signs of abating in the future.

South Korea

South Korea is an important market for securities finance activity within the Asia Pacific region. During 2022, US$326 million was generated in securities finance revenues, placing it in fourth place among its regional peers after Japan, Taiwan and Hong Kong. Average fees remain elevated in South Korea as a result of the strict settlement regime — South Korea is considered a no-fails market — and the level of small and mid-cap equity borrowing. The 2022 average fee stood at 201bps, which was a 4 per cent decrease when compared with 2021. Both average fees and revenues have declined in the country since 2018, when over US$480 million in revenues was generated (at an average fee of 350bps).

As a result of a heavy retail presence within the investment landscape and the small and mid-cap nature of the assets often traded, the local regulator remains sensitive to falls in the main index. As a result, the regulations regarding short selling change on a frequent basis and this has a direct impact upon securities finance revenues.

As further hedging and market making tools are developed in South Korea, particularly in support of the KOSDAQ constituents, securities lending and borrowing activity are expected to grow, as PASLA itself has noted. As the market develops, securities finance activity is expected to broaden to encompass a larger proportion of large cap borrowing. South Korea has punched above its weight with regards to revenues and remains comfortably in the “one to watch” category for future market developments.

Hong Kong

Hong Kong is one of the most actively traded markets within the region. The market is continually well represented in the top 10 borrowed stock lists for the region and continues to generate considerable revenues for market participants. Securities finance revenues reached US$491 million in 2021, but declined in 2022 to US$414 million. When considered as a percentage of overall APAC equity revenues, the importance of the market has increased since 2020 — representing 18 per cent of the market in 2018, 17 per cent in 2019, 22 per cent in 2020, 24 per cent in 2021 and 21 per cent in 2022. On loan balances were significantly lower last year relative to 2021, contracting 24 per cent to US$33 billion. Despite this, average fees increased 10 per cent YoY to 126bps.

Hong Kong remains one of the only Chinese equity markets that is accessible to offshore investors. As a result, it has an important role to play in the management of investors' exposure to mainland China and offers a great deal of potential for the future.

Others

Australia contributed 10 per cent of APAC equity revenues during 2022, at US$185 million. Last year was one of the best in terms of revenue generation for the country as mining, natural resource and financial stocks listed in the country commanded ever higher fees.

Revenues in Malaysia fell dramatically to US$18.8 million during 2022, after reaching all-time highs of US$63 million during 2021. A similar story also took place in Thailand — with revenues contracting from US$19.2 million in 2021 to US$16.1 million in 2022 — and in New Zealand, where revenue fell from US$5 million to US$4 million.

Revenues in Singapore dropped to US$18.7 million in 2022 from US$31.2 million for the preceding year, resulting in its contribution to aggregate APAC equity revenues shrinking from 2 to 1 per cent.

The APAC region remains significant in terms of the growth of the securities finance market and in its importance to market revenues. Looking ahead, the region offers strong opportunities in Indonesia and the Philippines. If the capital markets open to offshore participants in China and India, and a viable solution can be found to operate with their CCP structures, then the contribution of APAC equities to overall securities finance revenues will swell, consolidating its position as the second-highest revenue generating region for securities finance activity.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times