Spotlight on cash reinvestment

04 April 2023

As 2023 advances and the interest rate versus inflation debate edges towards a natural conclusion, the market can be confident that cash collateral will continue to play a key role in generating risk-adjusted returns for lenders, says S&P Global Market Intelligence’s director of securities finance, Matthew Chessum

Image: Shutterstock

Image: Shutterstock

The phrase “cash is king” is widely used within financial markets, but during a period of heightened market volatility and technological change, is it still true? Everyday, there are numerous stories in the financial press that report on the development of new crypto currencies, central bank digital currencies and the tokenisation of financial assets. In our day-to-day lives, cash plays a diminished role as the advent of mobile banking and digital wallets has changed the ways in which we transact.

Despite ongoing technological change within the securities finance market, cash has always remained a solid and well used form of collateral. Until recently, the abundance of cash in the financial markets has led to a severely diminished interest rate environment. Given the increases in interest rates seen throughout 2022, S&P Global Market Intelligence Securities Finance data shows that cash collateral, within the Americas in particular, is still alive and kicking and becoming more popular among market participants.

After an unprecedented and protracted period of low interest rates, the end of the pandemic and the reopening of global economies acted as a tipping point for the global financial system. As demand strengthened and supply chains struggled to revert to their pre-covid norms, inflation took hold and a significant change took place in monetary policy. During 2022, the Federal Open Market Committee (FOMC) raised rates at breakneck speed, increasing the benchmark interest rate in the US by nearly 500bps over the year.

This pace of change in global monetary policy is unparalleled. In the UK, the Bank of England (BoE) followed suit with the benchmark interest rate rising from 0.25 to 3.5 per cent and even the European Central Bank (ECB), that had a zero or negative interest rate for the best part of 10 years, increased rates from zero to 2.5 per cent over the year. While the future path of rate increases remains a hot topic among economists and market observers, the move towards a normalisation in the interest rate environment has been reflected in an increase in the amount of cash collateral being used within the Americas.

Despite a decline in balances seen over 2022, predominantly due to a fall in asset prices, the percentage of all securities balances collateralised by cash collateral increased over the year. At the beginning of 2022, approximately 29 per cent of all securities balances were collateralised versus cash collateral (US$815.5 billion), peaking at 37 per cent (US$1.024 trillion) on 28 September before declining again towards year end to 31 per cent (US$810.4 billion) on 30 December.

Across European equities, balances versus cash collateral started the year at 16 per cent (US$32.3 billion), peaking at 28 per cent (US$91.2 billion) during May before falling to 18 per cent (US$40.4 billion) at year end.

Across Asian equities, balances versus cash collateral averaged 23 per cent over the year, with relatively little change seen throughout the period.

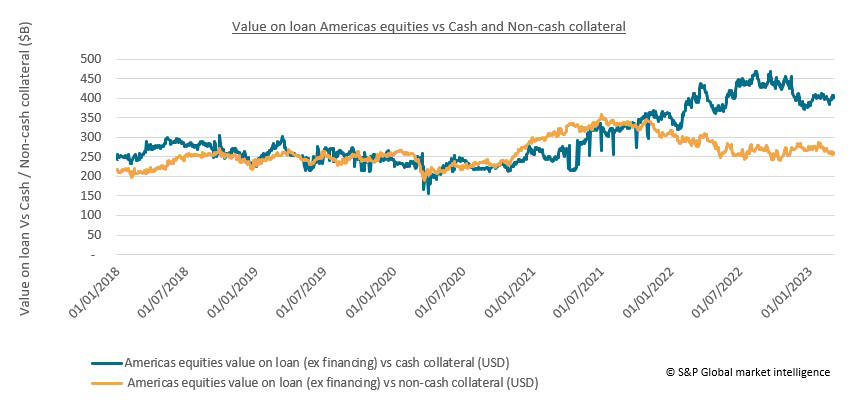

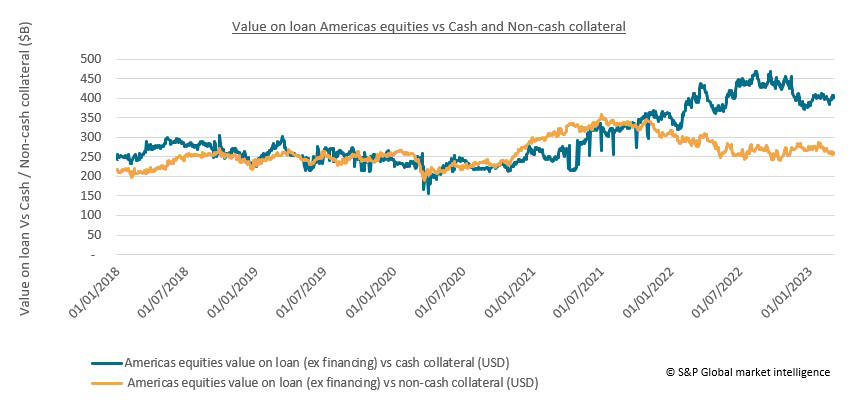

Historically, the US market has always experienced the greatest share of cash collateral. Following the Global Financial Crisis, non-cash collateral increased in popularity, with the proportion of transactions collateralised by non-cash assets in the US trending within a narrow range around 50 per cent of all loans. Since 2018, cash collateral has reestablished itself as the predominant form of collateral within the Americas equities market, growing from 53 per cent (US$242 billion) at the beginning of 2018 to just over 60 per cent (US$389 billion) at the end of 2022. The percentage of transactions of Americas equities collateralised versus cash reached a recent high of 65 per cent (US$467 billion) on 20 September 2022.

Cash reinvestment

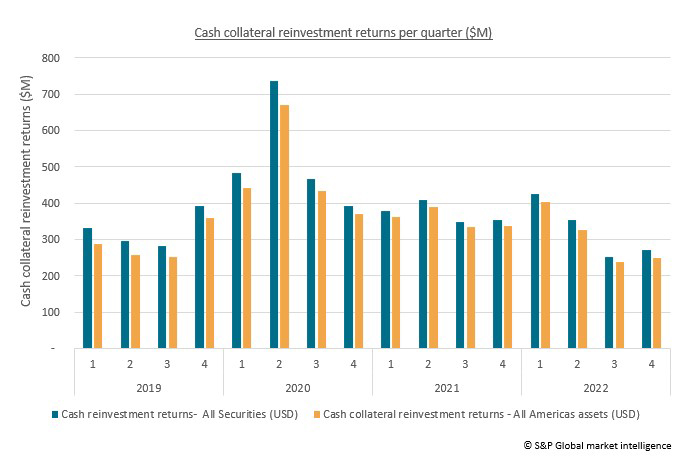

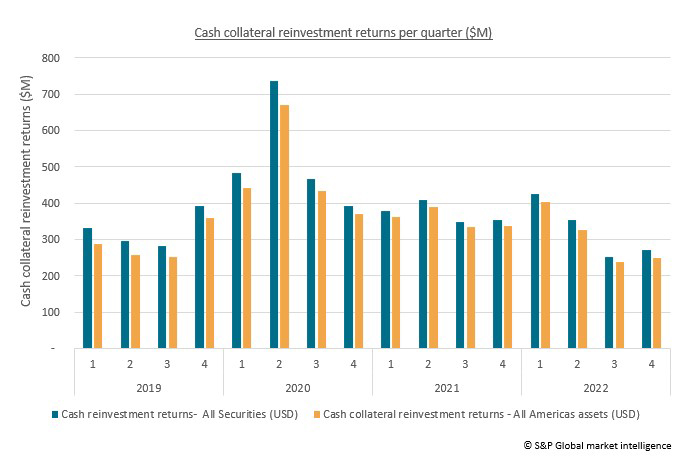

When examining reinvestment returns over a similar period, the value of the additional revenues generated from the reinvestment of cash collateral decreased during the first three quarters of 2019. It then spiked following the onset of the Coronavirus pandemic during the second quarter of 2020. The additional revenues generated by the reinvestment of cash collateral for all securities during Q2 2020 reached approximately US$735 million during the second quarter. During this period, capital markets experienced a period of uncertainty as economies went into lockdown and central banks instigated unprecedented fiscal and monetary measures to ensure that global economies could cope with the prevailing volatility.

Over 2022, despite the rapid rise in global interest rates, cash collateral reinvestment returns declined between January to September before increasing slightly towards the end of the year (specifically US$424 million in Q1, US$353 million in Q2, US$251 million in Q3, US$272 million in Q4). Reinvestment returns during 2022, at approximately US$1.3 billion, were equal to those generated throughout 2019 when interest rates remained at near all-time lows.

When reinvesting cash collateral, numerous variables exist. Interest rates are only one of several factors that need to be considered. The type of reinvestment vehicle, the risk profile of the reinvestment pool, regulatory guidelines, and the shape of the yield curve, all have a significant impact on the returns on offer. In normal markets, an increase in the interest rate often proves to be advantageous for clients as opportunities to generate additional yield across the yield curve are potentially greater. Investors typically seek to stagger reinvestment maturities to manage duration risk. This ensures that investments continue to mature in a controlled manner and that cash is always available. Cash is then reinvested across the yield curve to ensure that this remains the case.

After an increase or decrease in interest rates, rebate rates on securities lending transactions are immediately updated to reflect the change. Cash reinvestment vehicles typically lag these changes by a period of weeks or sometimes months due to the laddering of the maturities across the multiple investments within the reinvestment vehicle. This duration mismatch can prove to be either positive or negative when reflected across investment returns depending upon whether rates are increasing or decreasing. The multiple interest rate rises seen in recent times have taken place in quick succession, which is likely to have increased the likelihood of keeping investments relatively short dated to ensure that any rate increases can be captured within a shorter period of time.

By not reinvesting cash further out along the yield curve, where rates are usually higher, reinvestment vehicles can sometimes restrict their average returns. In recent months, the fluctuation in US treasury yields, uncertainty surrounding interest rate decisions, and secondary market liquidity in certificates of deposit (CDs) and commercial paper (CP) have all had an impact on the reinvestment rates on offer. Substantially higher interest rates will therefore not always equate to substantially higher reinvestment returns, which is what the data has been showing over recent months.

As the amount of cash collateral increases across Americas equities, along with interest rates and market volatility, it appears that cash, in this market at least, is playing a more prominent role. Cash collateral remains an important tool to manage exposures within the securities lending ecosystem and remains one of the most flexible and accessible forms of collateral. As we have noted, even during times of near zero interest rates, cash collateral has had an important role to play in the risk management of securities lending transactions.

As the year progresses and the interest rate versus inflation debate edges closer towards a natural conclusion, the market can be confident that cash collateral will continue to play an essential role in generating those all-important risk-adjusted returns for lenders.

Figure 1

Figure 2

Despite ongoing technological change within the securities finance market, cash has always remained a solid and well used form of collateral. Until recently, the abundance of cash in the financial markets has led to a severely diminished interest rate environment. Given the increases in interest rates seen throughout 2022, S&P Global Market Intelligence Securities Finance data shows that cash collateral, within the Americas in particular, is still alive and kicking and becoming more popular among market participants.

After an unprecedented and protracted period of low interest rates, the end of the pandemic and the reopening of global economies acted as a tipping point for the global financial system. As demand strengthened and supply chains struggled to revert to their pre-covid norms, inflation took hold and a significant change took place in monetary policy. During 2022, the Federal Open Market Committee (FOMC) raised rates at breakneck speed, increasing the benchmark interest rate in the US by nearly 500bps over the year.

This pace of change in global monetary policy is unparalleled. In the UK, the Bank of England (BoE) followed suit with the benchmark interest rate rising from 0.25 to 3.5 per cent and even the European Central Bank (ECB), that had a zero or negative interest rate for the best part of 10 years, increased rates from zero to 2.5 per cent over the year. While the future path of rate increases remains a hot topic among economists and market observers, the move towards a normalisation in the interest rate environment has been reflected in an increase in the amount of cash collateral being used within the Americas.

Despite a decline in balances seen over 2022, predominantly due to a fall in asset prices, the percentage of all securities balances collateralised by cash collateral increased over the year. At the beginning of 2022, approximately 29 per cent of all securities balances were collateralised versus cash collateral (US$815.5 billion), peaking at 37 per cent (US$1.024 trillion) on 28 September before declining again towards year end to 31 per cent (US$810.4 billion) on 30 December.

Across European equities, balances versus cash collateral started the year at 16 per cent (US$32.3 billion), peaking at 28 per cent (US$91.2 billion) during May before falling to 18 per cent (US$40.4 billion) at year end.

Across Asian equities, balances versus cash collateral averaged 23 per cent over the year, with relatively little change seen throughout the period.

Historically, the US market has always experienced the greatest share of cash collateral. Following the Global Financial Crisis, non-cash collateral increased in popularity, with the proportion of transactions collateralised by non-cash assets in the US trending within a narrow range around 50 per cent of all loans. Since 2018, cash collateral has reestablished itself as the predominant form of collateral within the Americas equities market, growing from 53 per cent (US$242 billion) at the beginning of 2018 to just over 60 per cent (US$389 billion) at the end of 2022. The percentage of transactions of Americas equities collateralised versus cash reached a recent high of 65 per cent (US$467 billion) on 20 September 2022.

Cash reinvestment

When examining reinvestment returns over a similar period, the value of the additional revenues generated from the reinvestment of cash collateral decreased during the first three quarters of 2019. It then spiked following the onset of the Coronavirus pandemic during the second quarter of 2020. The additional revenues generated by the reinvestment of cash collateral for all securities during Q2 2020 reached approximately US$735 million during the second quarter. During this period, capital markets experienced a period of uncertainty as economies went into lockdown and central banks instigated unprecedented fiscal and monetary measures to ensure that global economies could cope with the prevailing volatility.

Over 2022, despite the rapid rise in global interest rates, cash collateral reinvestment returns declined between January to September before increasing slightly towards the end of the year (specifically US$424 million in Q1, US$353 million in Q2, US$251 million in Q3, US$272 million in Q4). Reinvestment returns during 2022, at approximately US$1.3 billion, were equal to those generated throughout 2019 when interest rates remained at near all-time lows.

When reinvesting cash collateral, numerous variables exist. Interest rates are only one of several factors that need to be considered. The type of reinvestment vehicle, the risk profile of the reinvestment pool, regulatory guidelines, and the shape of the yield curve, all have a significant impact on the returns on offer. In normal markets, an increase in the interest rate often proves to be advantageous for clients as opportunities to generate additional yield across the yield curve are potentially greater. Investors typically seek to stagger reinvestment maturities to manage duration risk. This ensures that investments continue to mature in a controlled manner and that cash is always available. Cash is then reinvested across the yield curve to ensure that this remains the case.

After an increase or decrease in interest rates, rebate rates on securities lending transactions are immediately updated to reflect the change. Cash reinvestment vehicles typically lag these changes by a period of weeks or sometimes months due to the laddering of the maturities across the multiple investments within the reinvestment vehicle. This duration mismatch can prove to be either positive or negative when reflected across investment returns depending upon whether rates are increasing or decreasing. The multiple interest rate rises seen in recent times have taken place in quick succession, which is likely to have increased the likelihood of keeping investments relatively short dated to ensure that any rate increases can be captured within a shorter period of time.

By not reinvesting cash further out along the yield curve, where rates are usually higher, reinvestment vehicles can sometimes restrict their average returns. In recent months, the fluctuation in US treasury yields, uncertainty surrounding interest rate decisions, and secondary market liquidity in certificates of deposit (CDs) and commercial paper (CP) have all had an impact on the reinvestment rates on offer. Substantially higher interest rates will therefore not always equate to substantially higher reinvestment returns, which is what the data has been showing over recent months.

As the amount of cash collateral increases across Americas equities, along with interest rates and market volatility, it appears that cash, in this market at least, is playing a more prominent role. Cash collateral remains an important tool to manage exposures within the securities lending ecosystem and remains one of the most flexible and accessible forms of collateral. As we have noted, even during times of near zero interest rates, cash collateral has had an important role to play in the risk management of securities lending transactions.

As the year progresses and the interest rate versus inflation debate edges closer towards a natural conclusion, the market can be confident that cash collateral will continue to play an essential role in generating those all-important risk-adjusted returns for lenders.

Figure 1

Figure 2

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times