Powering a strong first quarter

02 May 2023

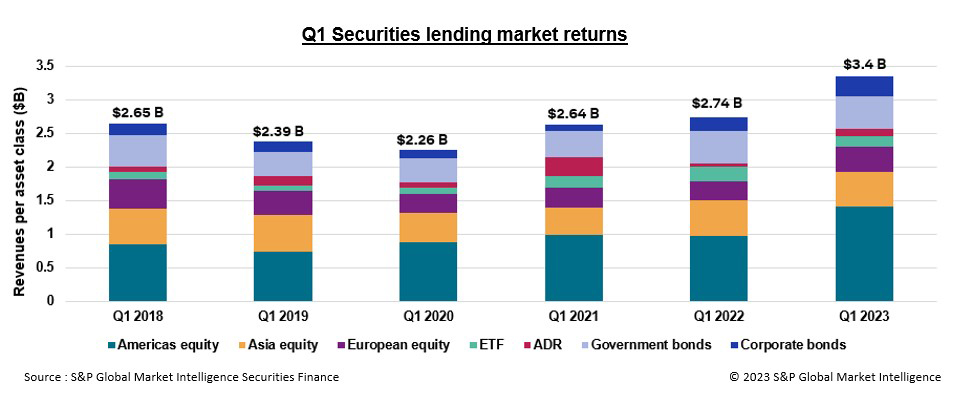

Securities finance revenues flourished during Q1 2023, rising almost 25 per cent YoY to US$3.42 billion. S&P Global Market Intelligence’s Matthew Chessum explains why the first quarter was one of the best for many years

Image: Shutterstock

Image: Shutterstock

The first quarter of 2023 was one of the most financially tumultuous since the end of the global financial crisis (GFC) in 2008, with both fixed income and equity markets experiencing some of the most extreme repositioning ever witnessed.

As the year started, signs of easing inflation led many market participants to believe that central banks would be slowing their hiking cycles sooner than expected. This quickly changed, however, as economic data reported higher inflation numbers and government bond yields climbed as a result. In equity markets, tech stocks, which were the big losers of Q4 2022, became the new champions of Q1 as mega-cap technology companies outperformed every other sector. Growth stocks outperformed value stocks once again. The quarter concluded with the banking turmoil in the US leading to the largest bank bankruptcy since the GFC. Spill over was seen across the European banking sector with the buy-out of Credit Suisse by UBS.

Despite this, securities finance revenues flourished, and the first quarter of 2023 was one of the best for many years. Along with Bitcoin (up 71.2 per cent) and tech stocks (the Nasdaq 100 was up 20.5 per cent), securities finance was one of the big winners during Q1 2023.

Specifically, the first quarter of 2023 generated US$3.415 billion in securities finance revenues, reflecting a 24.5 per cent increase on Q1 2022. Revenues exceeded the US$1 billion mark during every month of Q1 2023, with February being the lowest revenue generating month at US$1.054 billion, slightly below January revenues of US$1.116 billion.

The Q1 2023 average fee of 53bps was 39 per cent higher than the Q1 2022 average fee rate of 38bps. Over the period, balances declined by 10 per cent YoY and utilisation declined by 1 per cent, illustrating a more expensive borrowing environment.

The standout asset classes during Q1 2023 were similar to those that generated strong revenues during 2022. Fixed income assets delivered both higher revenues and higher fees, while equity revenues, led by US equity specials and an increase in EMEA average fees towards the end of March, continued to push higher.

Global equities

Equity revenues hit a Q1 high of US$2.596 billion globally, driven by US$1.417 billion in revenue from Americas equities, US$513 million from APAC and US$376 million from EMEA. Alongside these contributions, US$102 million was generated from American Depositary Receipts (ADRs) and US$161 million from exchange-traded products (ETPs) over the period. The average fee across all equities over the quarter was 84bps, representing a 29 per cent increase on Q1 2022.

Figure 1

Average fees increased significantly in North America, up 47 per cent, and in EMEA, rising 40 per cent YoY, while declining slightly across APAC (-1 per cent).

Over the period, Americas equities were the standout contributor to these impressive returns. Following on from 2022, specials activity — denoting any loan made with a fee greater than 500bps — delivered US$1.015 billion in revenues, representing approximately 71 per cent of all revenues from this region. AMC was key to driving these stellar returns, generating more than US$233 million alone. Other well known ongoing specials such as Bed Bath and Beyond (BBBY, generating US$34 million in revenue), Gamestop (GME, generating US$49 million) and Beyond Meat (BYND, generating US$89 million) also continued to contribute good returns for lenders.

In Canada, average fees over the period were 69bps, which represents a 17 per cent increase over Q1 2022. Final Q1 revenues for the quarter were US$107.6 million, with March offering the most fruitful month for Canadian revenues at US$40.4 million generated. An impressive average fee of 72bps, up 15.8 per cent YoY, helped push revenues higher.

EMEA equities experienced one of the strongest starts to the year in recent history, with Q1 revenues of US$376 million marking a 36 per cent increase on Q1 2022. Despite a modest fall in balances over the period, average fees were 40 per cent higher YoY at 67bps. The majority of EMEA markets witnessed double-digit increases in revenues and average fees over the period, with the exception of Italy, Spain and Belgium. Revenues in Sweden and Switzerland were particularly strong, with both markets beating previous Q1 figures by some margin.

APAC was the only region to experience a decline in average fees and revenues over the quarter. The region generated US$513 million in revenues, down 4 per cent YoY, and average fees declined 1 per cent to 90bps. Japan was the standout market in the APAC region, with quarterly revenues strengthening 24 per cent to US$173 million and with average fees rising 20 per cent YoY to 49bps. Q1 is typically a strong quarter for Japan, with the bulk of dividends going ex in March. However, the revenues this quarter benefited from a US$9 billion public offering from Japan Post Bank (7182), with demand to borrow this GC stock peak at 90 per cent.

Despite lower revenues in South Korea and Taiwan, Q2 and Q3 activity is expected to increase as volatility declines and short selling restrictions are eased.

Fixed income

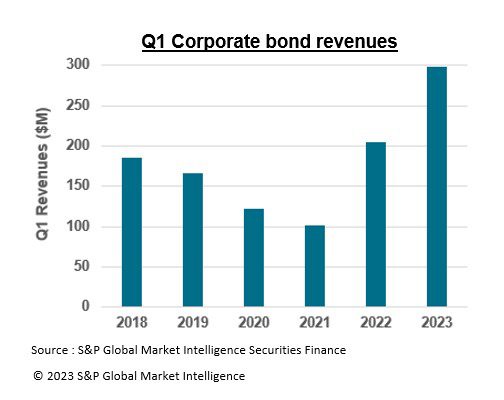

Fixed income assets continued to produce impressive returns over Q1. Both corporate and government bonds delivered strong revenues and maintained or increased the elevated fees that were seen during 2022.

Borrowing activity has persisted in corporate bonds and, despite the uncertainty surrounding future interest rate moves, this asset class remains very popular among borrowers with revenues increasing 45 per cent YoY to US$298 million. Monthly revenues surpassed US$102 million for the first time during the quarter, after declining month-on-month during February. A combination of market liquidity and directional opportunities continue to push revenues in the asset class higher for the benefit of lenders, with Q1 average fees up 60 per cent YoY at 46bps.

Government bonds followed along a similar vein, with this asset class continuing to make an important contribution to returns across all securities lending programmes. Q1 revenues were 12 per cent higher YoY at US$482.3 million, the strongest Q1 revenue figures for many years — with January delivering the highest monthly revenues, at US$168 million, as a follow-on from year-end positioning carried over into the new year.

Average fees for the quarter climbed 35 per cent YoY to 18bps, which is only 1bps lower than the average seen during Q4 2022. Despite the higher revenues and the rise in average fees, utilisation was down by 13 per cent during Q1 to 21.8 per cent.

These performance figures confirm that the securities finance industry had a highly successful quarter despite, or most probably because of, the market volatility evidenced throughout Q1. For fixed income assets, lenders have benefited substantially from the elevated average fees across corporate and government bonds, with the general preference typically being for shorter-dated government bonds. In the equity markets, the benefits will be more restricted. With an incredibly profitable group of stocks driving most of the revenues one has, as they typically say, “got to be in it to win it”!

Figure 2

Figure 3

As the year started, signs of easing inflation led many market participants to believe that central banks would be slowing their hiking cycles sooner than expected. This quickly changed, however, as economic data reported higher inflation numbers and government bond yields climbed as a result. In equity markets, tech stocks, which were the big losers of Q4 2022, became the new champions of Q1 as mega-cap technology companies outperformed every other sector. Growth stocks outperformed value stocks once again. The quarter concluded with the banking turmoil in the US leading to the largest bank bankruptcy since the GFC. Spill over was seen across the European banking sector with the buy-out of Credit Suisse by UBS.

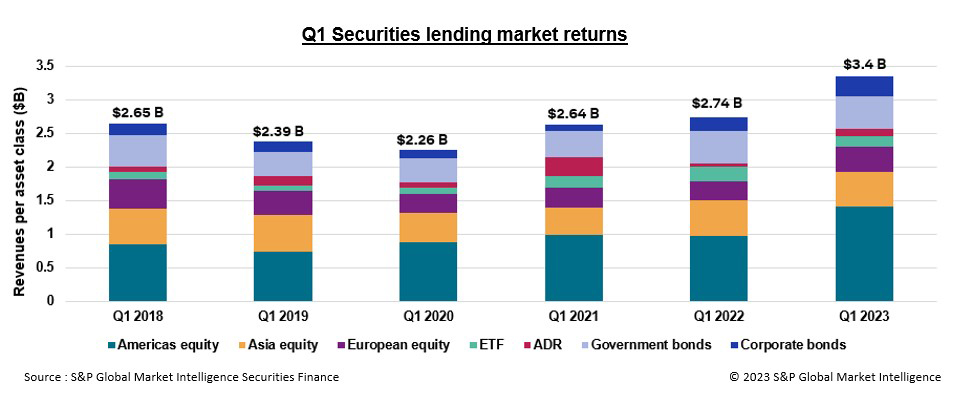

Despite this, securities finance revenues flourished, and the first quarter of 2023 was one of the best for many years. Along with Bitcoin (up 71.2 per cent) and tech stocks (the Nasdaq 100 was up 20.5 per cent), securities finance was one of the big winners during Q1 2023.

Specifically, the first quarter of 2023 generated US$3.415 billion in securities finance revenues, reflecting a 24.5 per cent increase on Q1 2022. Revenues exceeded the US$1 billion mark during every month of Q1 2023, with February being the lowest revenue generating month at US$1.054 billion, slightly below January revenues of US$1.116 billion.

The Q1 2023 average fee of 53bps was 39 per cent higher than the Q1 2022 average fee rate of 38bps. Over the period, balances declined by 10 per cent YoY and utilisation declined by 1 per cent, illustrating a more expensive borrowing environment.

The standout asset classes during Q1 2023 were similar to those that generated strong revenues during 2022. Fixed income assets delivered both higher revenues and higher fees, while equity revenues, led by US equity specials and an increase in EMEA average fees towards the end of March, continued to push higher.

Global equities

Equity revenues hit a Q1 high of US$2.596 billion globally, driven by US$1.417 billion in revenue from Americas equities, US$513 million from APAC and US$376 million from EMEA. Alongside these contributions, US$102 million was generated from American Depositary Receipts (ADRs) and US$161 million from exchange-traded products (ETPs) over the period. The average fee across all equities over the quarter was 84bps, representing a 29 per cent increase on Q1 2022.

Figure 1

Average fees increased significantly in North America, up 47 per cent, and in EMEA, rising 40 per cent YoY, while declining slightly across APAC (-1 per cent).

Over the period, Americas equities were the standout contributor to these impressive returns. Following on from 2022, specials activity — denoting any loan made with a fee greater than 500bps — delivered US$1.015 billion in revenues, representing approximately 71 per cent of all revenues from this region. AMC was key to driving these stellar returns, generating more than US$233 million alone. Other well known ongoing specials such as Bed Bath and Beyond (BBBY, generating US$34 million in revenue), Gamestop (GME, generating US$49 million) and Beyond Meat (BYND, generating US$89 million) also continued to contribute good returns for lenders.

In Canada, average fees over the period were 69bps, which represents a 17 per cent increase over Q1 2022. Final Q1 revenues for the quarter were US$107.6 million, with March offering the most fruitful month for Canadian revenues at US$40.4 million generated. An impressive average fee of 72bps, up 15.8 per cent YoY, helped push revenues higher.

EMEA equities experienced one of the strongest starts to the year in recent history, with Q1 revenues of US$376 million marking a 36 per cent increase on Q1 2022. Despite a modest fall in balances over the period, average fees were 40 per cent higher YoY at 67bps. The majority of EMEA markets witnessed double-digit increases in revenues and average fees over the period, with the exception of Italy, Spain and Belgium. Revenues in Sweden and Switzerland were particularly strong, with both markets beating previous Q1 figures by some margin.

APAC was the only region to experience a decline in average fees and revenues over the quarter. The region generated US$513 million in revenues, down 4 per cent YoY, and average fees declined 1 per cent to 90bps. Japan was the standout market in the APAC region, with quarterly revenues strengthening 24 per cent to US$173 million and with average fees rising 20 per cent YoY to 49bps. Q1 is typically a strong quarter for Japan, with the bulk of dividends going ex in March. However, the revenues this quarter benefited from a US$9 billion public offering from Japan Post Bank (7182), with demand to borrow this GC stock peak at 90 per cent.

Despite lower revenues in South Korea and Taiwan, Q2 and Q3 activity is expected to increase as volatility declines and short selling restrictions are eased.

Fixed income

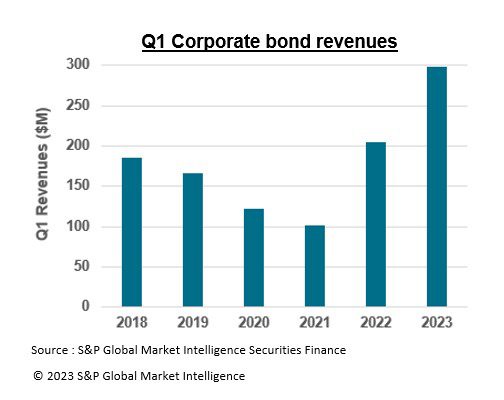

Fixed income assets continued to produce impressive returns over Q1. Both corporate and government bonds delivered strong revenues and maintained or increased the elevated fees that were seen during 2022.

Borrowing activity has persisted in corporate bonds and, despite the uncertainty surrounding future interest rate moves, this asset class remains very popular among borrowers with revenues increasing 45 per cent YoY to US$298 million. Monthly revenues surpassed US$102 million for the first time during the quarter, after declining month-on-month during February. A combination of market liquidity and directional opportunities continue to push revenues in the asset class higher for the benefit of lenders, with Q1 average fees up 60 per cent YoY at 46bps.

Government bonds followed along a similar vein, with this asset class continuing to make an important contribution to returns across all securities lending programmes. Q1 revenues were 12 per cent higher YoY at US$482.3 million, the strongest Q1 revenue figures for many years — with January delivering the highest monthly revenues, at US$168 million, as a follow-on from year-end positioning carried over into the new year.

Average fees for the quarter climbed 35 per cent YoY to 18bps, which is only 1bps lower than the average seen during Q4 2022. Despite the higher revenues and the rise in average fees, utilisation was down by 13 per cent during Q1 to 21.8 per cent.

These performance figures confirm that the securities finance industry had a highly successful quarter despite, or most probably because of, the market volatility evidenced throughout Q1. For fixed income assets, lenders have benefited substantially from the elevated average fees across corporate and government bonds, with the general preference typically being for shorter-dated government bonds. In the equity markets, the benefits will be more restricted. With an incredibly profitable group of stocks driving most of the revenues one has, as they typically say, “got to be in it to win it”!

Figure 2

Figure 3

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times