Three predictions for H2 2023

Matthew Chessum, director of securities finance at S&P Global Market Intelligence, shares his predictions for how securities financing activity will unfold during the second half of 2023

Image: Shutterstock

Image: Shutterstock

The first half of 2023 held many surprises for investors. Following a rapid decline in valuations during Q4 2022, the NASDAQ experienced its best opening six months of the year ever. Likewise, the S&P 500 gained 13 per cent so far this year, helping it to recoup any losses incurred when the US Federal Reserve started to raise interest rates during March 2022. The index remains approximately 22 per cent higher than its most recent low on 12 October 2022, firmly placing it in bull market territory.

All of this has taken place against a backdrop of financial market stress, rapidly increasing interest rates, stubborn inflation and further geopolitical risk. Given the uncertainty and confusion that exists in financial markets heading into H2, it is probably slightly incongruous to start predicting what may happen in the securities finance markets during H2. Nonetheless, looking at the big themes, some predictions are clearly gathering momentum.

Interest rates continue to rise

First, interest rates will continue to climb, maintaining the attractiveness of fixed income assets. Given the stickiness of core inflation across the globe, interest rate increases remain a reality. The Fed may have paused for a month during June, but so did the Bank of Canada and the Reserve Bank of Australia during May before recommencing interest rate hikes the following month. The Fed is expected to raise rates twice before the end of the year and the Bank of England and the European Central Bank clearly have more work to do to get inflation back to the 2 per cent target.

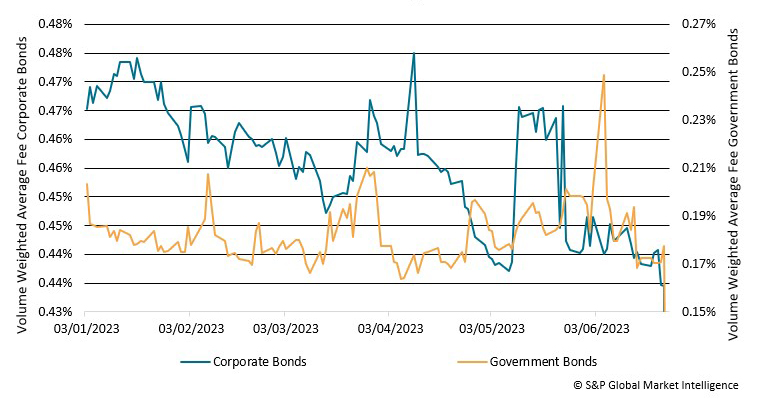

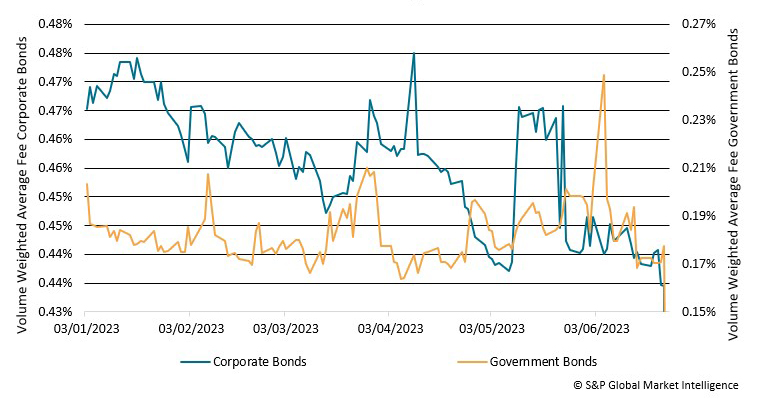

Fixed income assets have performed very well from a securities lending perspective over H1 (fig 1). An increase in benchmark interest rates has made short-dated government bonds trade special, pushing average fees up to 19bps for January to May. Hedging strategies and general liquidity have been strong drivers of demand. Across corporate bond portfolios, the increase in interest rates has had a similar impact. Average fees have increased to 46bps for January to May and lenders have experienced record-breaking revenues.

fig 1: Volume-weighted average fee: fixed income assets H1 2023 (ex-financing)

As interest rates climb ever higher and the risk of recession increases as a result, pressure on this asset class is expected to increase as refinancing rates edge higher and credit issues start to appear because of recessionary pressures. Utilisation and balances are also expected to increase — with May utilisation up 5.8 per cent and balances rising to US$264 billion — as a result. A decrease in risk appetite for equities is likely to increase liquidity requirements for investment grade corporate bonds and an increase in negative sentiment regarding non-investment grade corporate bonds is expected to provide opportunities for investors that are looking to take advantage of any weakness.

Prominence of specials activity

Second, equity revenues will become increasingly reliant upon specials activity. Not only has the S&P 500 recently entered bull market territory, but the DAX in Germany hit an all-time high and the Nikkei in Japan hit a 33-year high. Recent financial reports suggest that the most recent AI inspired bull runs are starting to broaden out as investors look to reallocate to the equity markets to capture some of the recent gains. Looking at the options markets, the CBOE Skew index, which is a measure of potential tail risk, is trading at its lowest level since 2019. Call index options linked to the S&P 500 have also reached record highs. A gamma squeeze is reportedly taking place, given the speed of market increases, pushing markets higher still. This signifies that traders are confident that the index will keep rising. Many investors that were short allocations to equities are now playing catch up and reallocating to the asset class, which is also contributing to the recent gains across global indices.

Higher, single directional equity markets usually translate into a decline in borrowing activity in securities finance markets. During May, balances declined as short covering took place and revenues were increasingly driven by specials activity only. This is likely to remain the case heading into H2. Opportunities do exist in this market segment, however, as recessionary pressures and the furor surrounding artificial intelligence are likely to create fertile ground for short sellers. Higher interest rates are also likely to impact some sectors more than others which, in turn, will add to the breadth of specials stocks in demand.

During H1, specials activity across all equities generated approximately 70 per cent of revenues, at US$2.4 billion.

Increased use of cash collateral

As interest rates normalise and the rate of return available in money market funds and reinvestment vehicles climb, the expectation is that this will result in greater use of cash collateral. Excess cash balances will be put to work and increasingly used as collateral for securities finance trading. In an environment where money markets are fully priced in the expected terminal rates of central banks, cash reinvestment returns will continue to strengthen. Since the beginning of the year, the average return on cash reinvestment across all equities has climbed from 15.75bps on 2 January to 19.7bps on 23 June.

As uncertainty persists regarding any potential pivot in interest rates — as experienced during 2020, during a declining interest rate environment — lenders can expect to receive strong returns from cash reinvestment activity. Reinvestment vehicles invest across maturities to produce higher average rates. As interest rates decline, reinvestment rates offer higher returns due to the maturity spread of their investments. Year to date, through to 23 June, cash reinvestment across all equites has generated approximately US$329 million in revenues for lenders.

Conclusion

During the first half of 2023, securities finance markets performed exceptionally well. Market conditions remained volatile, with changes to monetary policy leading to the biggest bank failures since 2008. Uncertainty remains, looking towards the second half of the year. Given the events of H1, it is difficult to know exactly what to expect in H2 — but, using H1 as the benchmark, tighten your seat belts and hold on tight. It is likely to be a bumpy ride.

All of this has taken place against a backdrop of financial market stress, rapidly increasing interest rates, stubborn inflation and further geopolitical risk. Given the uncertainty and confusion that exists in financial markets heading into H2, it is probably slightly incongruous to start predicting what may happen in the securities finance markets during H2. Nonetheless, looking at the big themes, some predictions are clearly gathering momentum.

Interest rates continue to rise

First, interest rates will continue to climb, maintaining the attractiveness of fixed income assets. Given the stickiness of core inflation across the globe, interest rate increases remain a reality. The Fed may have paused for a month during June, but so did the Bank of Canada and the Reserve Bank of Australia during May before recommencing interest rate hikes the following month. The Fed is expected to raise rates twice before the end of the year and the Bank of England and the European Central Bank clearly have more work to do to get inflation back to the 2 per cent target.

Fixed income assets have performed very well from a securities lending perspective over H1 (fig 1). An increase in benchmark interest rates has made short-dated government bonds trade special, pushing average fees up to 19bps for January to May. Hedging strategies and general liquidity have been strong drivers of demand. Across corporate bond portfolios, the increase in interest rates has had a similar impact. Average fees have increased to 46bps for January to May and lenders have experienced record-breaking revenues.

fig 1: Volume-weighted average fee: fixed income assets H1 2023 (ex-financing)

As interest rates climb ever higher and the risk of recession increases as a result, pressure on this asset class is expected to increase as refinancing rates edge higher and credit issues start to appear because of recessionary pressures. Utilisation and balances are also expected to increase — with May utilisation up 5.8 per cent and balances rising to US$264 billion — as a result. A decrease in risk appetite for equities is likely to increase liquidity requirements for investment grade corporate bonds and an increase in negative sentiment regarding non-investment grade corporate bonds is expected to provide opportunities for investors that are looking to take advantage of any weakness.

Prominence of specials activity

Second, equity revenues will become increasingly reliant upon specials activity. Not only has the S&P 500 recently entered bull market territory, but the DAX in Germany hit an all-time high and the Nikkei in Japan hit a 33-year high. Recent financial reports suggest that the most recent AI inspired bull runs are starting to broaden out as investors look to reallocate to the equity markets to capture some of the recent gains. Looking at the options markets, the CBOE Skew index, which is a measure of potential tail risk, is trading at its lowest level since 2019. Call index options linked to the S&P 500 have also reached record highs. A gamma squeeze is reportedly taking place, given the speed of market increases, pushing markets higher still. This signifies that traders are confident that the index will keep rising. Many investors that were short allocations to equities are now playing catch up and reallocating to the asset class, which is also contributing to the recent gains across global indices.

Higher, single directional equity markets usually translate into a decline in borrowing activity in securities finance markets. During May, balances declined as short covering took place and revenues were increasingly driven by specials activity only. This is likely to remain the case heading into H2. Opportunities do exist in this market segment, however, as recessionary pressures and the furor surrounding artificial intelligence are likely to create fertile ground for short sellers. Higher interest rates are also likely to impact some sectors more than others which, in turn, will add to the breadth of specials stocks in demand.

During H1, specials activity across all equities generated approximately 70 per cent of revenues, at US$2.4 billion.

Increased use of cash collateral

As interest rates normalise and the rate of return available in money market funds and reinvestment vehicles climb, the expectation is that this will result in greater use of cash collateral. Excess cash balances will be put to work and increasingly used as collateral for securities finance trading. In an environment where money markets are fully priced in the expected terminal rates of central banks, cash reinvestment returns will continue to strengthen. Since the beginning of the year, the average return on cash reinvestment across all equities has climbed from 15.75bps on 2 January to 19.7bps on 23 June.

As uncertainty persists regarding any potential pivot in interest rates — as experienced during 2020, during a declining interest rate environment — lenders can expect to receive strong returns from cash reinvestment activity. Reinvestment vehicles invest across maturities to produce higher average rates. As interest rates decline, reinvestment rates offer higher returns due to the maturity spread of their investments. Year to date, through to 23 June, cash reinvestment across all equites has generated approximately US$329 million in revenues for lenders.

Conclusion

During the first half of 2023, securities finance markets performed exceptionally well. Market conditions remained volatile, with changes to monetary policy leading to the biggest bank failures since 2008. Uncertainty remains, looking towards the second half of the year. Given the events of H1, it is difficult to know exactly what to expect in H2 — but, using H1 as the benchmark, tighten your seat belts and hold on tight. It is likely to be a bumpy ride.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times

100% ON RETURNS If you invest in only one securities finance news source this year, make sure it is your free subscription to Securities Finance Times