Sam Pierson, director of securities finance at IHS Markit, analyses the boom-bust cycle that continues for US equity specials demand

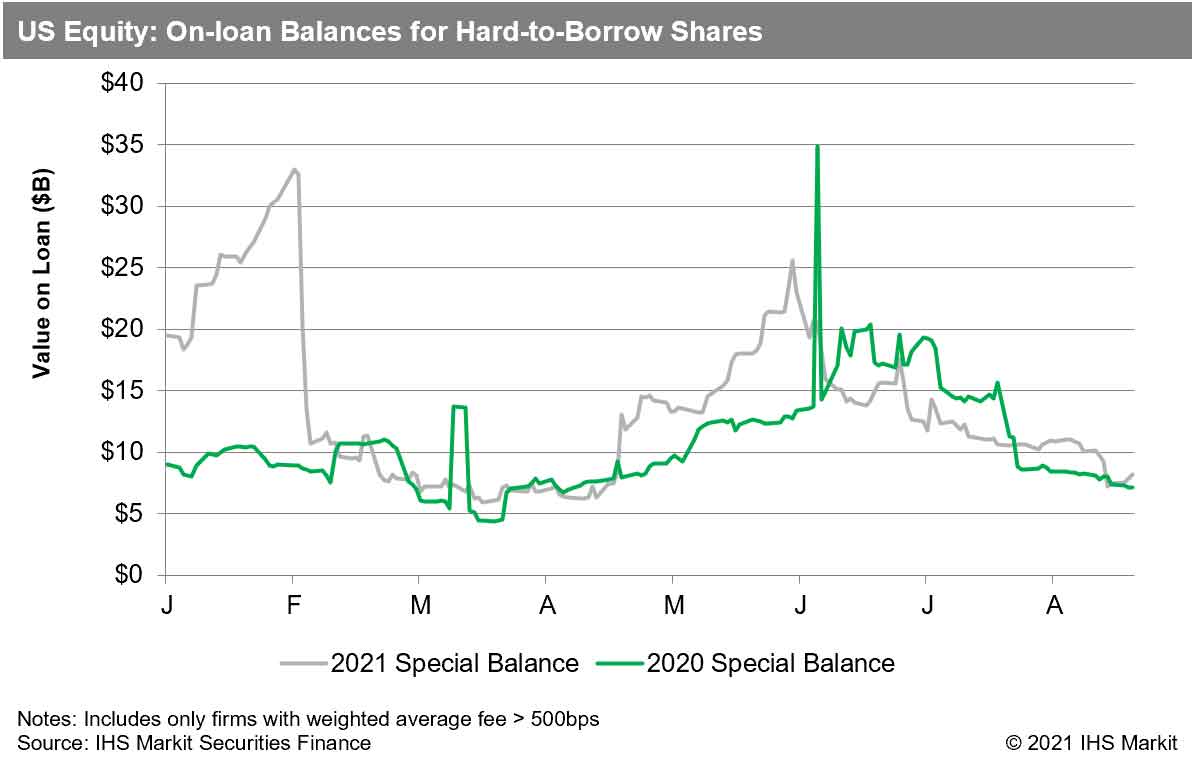

It has been a wild ride for US equity special on-loan balances for the year to date. January and June 2021 both saw broad short squeezes in hard-to-borrow US equities, with January having the highest average special balance for any month on record.

After the late-May and early-June squeeze, specials balances declined when compared with 2020. However, stable specials balances in late-July resulted in 2021 balances pushing back to a year-on-year (YoY) increase. Month-to-date (MTD) August special balances of US$9.67bn reflect a 27 per cent YoY increase.

Unless otherwise specified, special balances in this note refer to on-loan balances with fees greater than 500bps annualised.

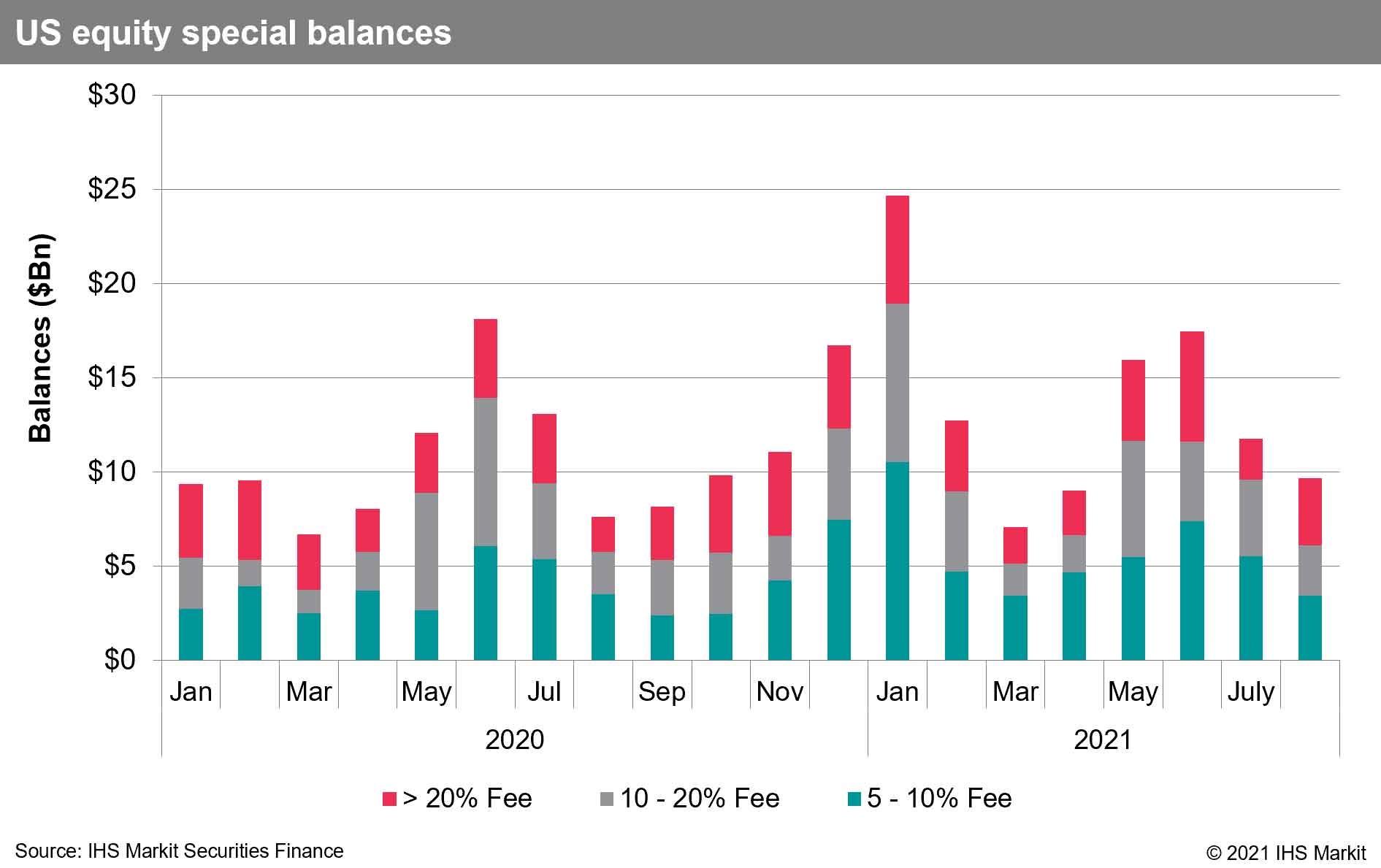

Breaking specials out by fee range, we see that while overall specials balances have declined during August MTD, the balances with annualised fees greater than 20 per cent more than doubled month-on-month. Compared with 2020, balances with fees greater than 20 per cent increased by 90 per cent. For balances with fees of 5-10 per cent, fees declined by 2 per cent YoY. While, for balances with fees of 10-20 per cent, fees increased by 19 per cent.

March 2021 had the lowest special balances year-to-date (YTD), with just over $7bn in balances with fees greater than 5 per cent annualised fee. August only managed a small improvement relative to March, with nearly all growth in specials balances relative to the YTD low point being observed in higher fee ranges.

The largest contributor to US equity special balances in early August was Coupang Inc., ahead of lockup expiry for pre-IPO investors. Pembina Pipeline Corp, Blink Charging Co. and Cureva Nv. also contributed to the YoY growth in US equity special balances in August.

Special-purpose acquisition companies (SPACs) have also been a key contributor to special demand YTD. In August, firms which went public via SPAC transactions in 2020 or 2021 contributed 25 per cent of average special balances. The largest individual contributors to special balances in August MTD are Churchill Capital IV Corp., Quantumscape Corp. and Skillz Inc.

Conclusion

Demand for US equity specials varies from crowded directional short positions, hedges for convertible bond holders and corporate actions.

After building steadily from the 2020 low-point in August to the blowout in January 2021, specials balances pulled back sharply in early February.

The trend for Q2 was similar to the prior year, with June having the greatest specials balances for the quarter.

The Q3 trend is shaping up to be like 2020, in terms of declining from a stellar June. However, the YoY increase in specials, particularly those with the highest fees, augurs well for returns heading into September.

Figure 1

Figure 1