Paul Wilson, managing director and global head of securities finance at IHS Markit, finds that global securities finance revenues increased year-on-year, sustained particularly by equity values and returning demand in APAC as markets removed short-selling bans

IHS Markit Securities Lending Returns to Lendable reports cover 12 broad based indices across equity and fixed income markets and allow market participants to understand potential portfolio returns from securities lending programmes. The reports use IHS Markit’s proprietary analytics to track the current and five-year historical lending returns on the constituents of each index, index short interest levels, contribution by securities lending fee categories and top performing sectors and regions for these indices.

This intelligence and insight can help securities lenders — particularly asset managers and pension funds — to analyse the value of their lending portfolios more effectively across markets and asset classes. The reports are made available to the public every month via the securities finance page on the IHS Markit website: Securities Lending Return to Lendable Reports

Return to Lendable reports for the financial year (FY) ending 2021 highlight that global securities finance revenue increased year-on-year, buoyed by equity values and returning demand in Asian equity, particularly in Taiwan and Korea with the lifting of short-selling bans. Corporate bonds provided momentum as inflation expectations began to rise and heavily indebted Chinese property developers defaulted on debt.

MSCI Equity Index Returns

Increased asset values resulted in an overall fall in Returns to Lendable (RTL) across equity indices, except for AC APAC Ex Japan and Emerging Markets. Short interest was broadly down, except for APAC as the removal of short-selling bans in Korea and supply chain issues boosted demand for Taiwan securities. Software and telecommunication services were two of the highest revenue-generating sectors, contributing over 20 per cent of lending revenue in December. The average global equity fee dropped from 31 bps in 2020 to 28.4 bps in 2021, indicating a reduction of special activity.

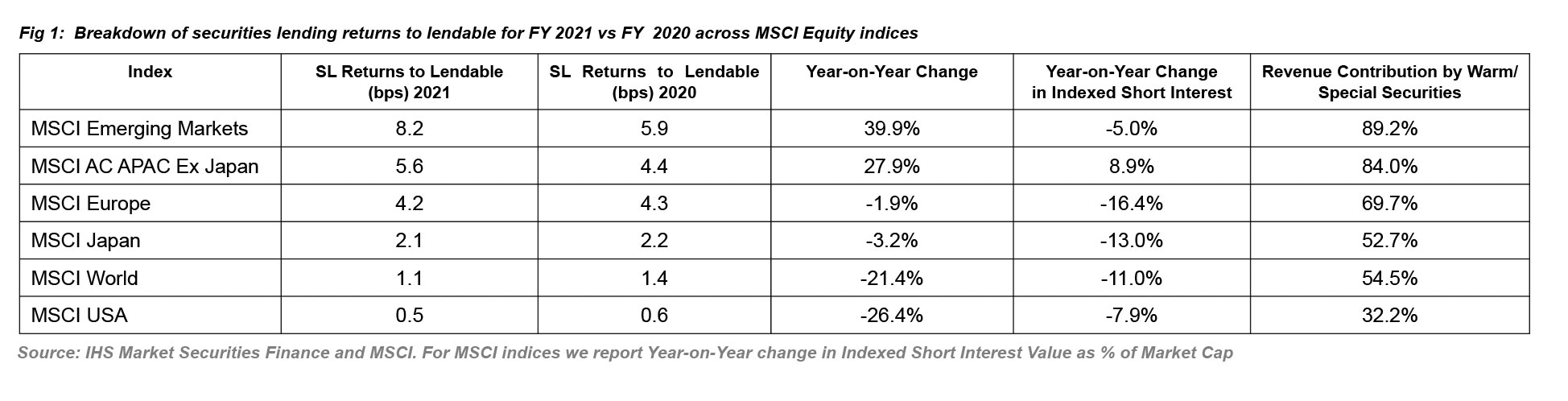

The table below shows the breakdown of securities lending returns to lendable for FY 2021 versus FY 2020 across MSCI Equity indices (fig 1):

Figure 1

• MSCI World: Increased assets value resulted in a 21 per cent drop YoY in RTL. Buoyant market returns cooled short interest, which was down 11 per cent YoY.

• MSCI USA: Overall RTL was down 26 per cent as year-on-year returns normalised after the spike in Q2 2020 owing to the COVID-19 outbreak. Short interest continued to drop; our indexed short interest is down 30 per cent since 2018.

• MSCI Europe: YoY returns finally stabilised in 2021 after years of structural reforms around dividend trading. Short interest declined 16.4 per cent YoY.

• MSCI Japan: Only 6 per cent of the Japan revenues was generated by specials, yet the returns were only down slightly YoY. Food, Beverage and Tobacco was the stand-out sector with 16 per cent revenue contribution in December 2021.

• MSCI AC Asia Pacific Ex Japan: RTL increased 28 per cent YoY, buoyed by a poor 2020 (owing to the impact of COVID) and Korea’s return. RTL was down 30 per cent in comparison to 2019 levels.

• MSCI Emerging Markets: A similar story to APAC, RTL was up 40 per cent with more than 75 per cent of return contributed by special stocks.

iBoxx Fixed Income Index Return

The growth story in terms of securities lending returns to lendable was dominated by corporate bonds, with increased demand to borrow and short corporate debt. Year-on-year indexed utilisation and RTL declined for global governments and US Treasuries.

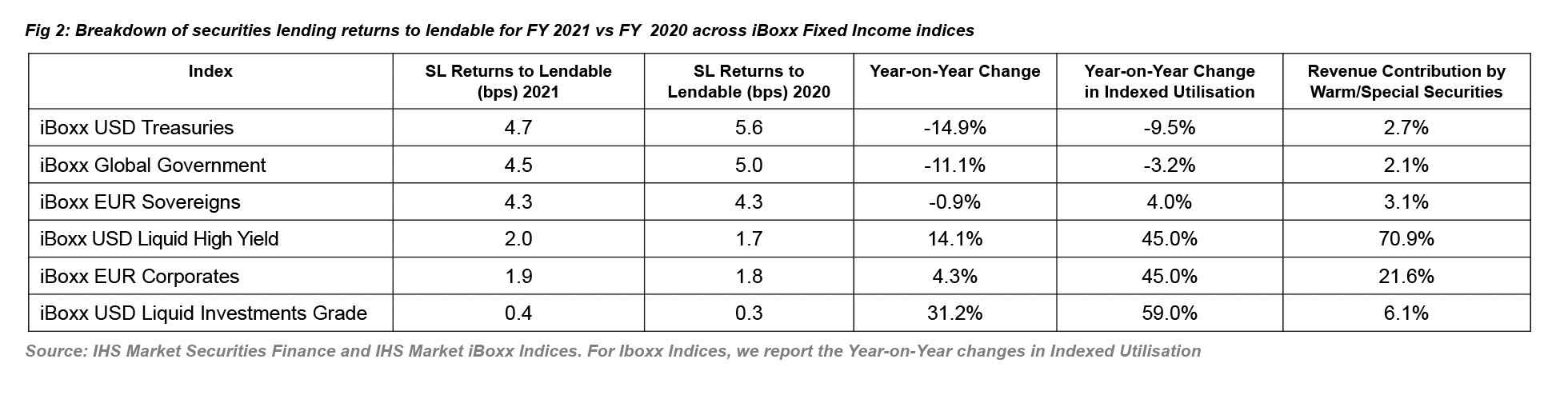

The table below (fig 2) shows the breakdown of securities lending returns to lendable for FY 2021 versus FY 2020 across iBoxx Fixed Income indices:

Figure 2

• iBoxx USD Treasuries: Increased asset values resulted in a 15 per cent drop in YoY RTL, with GC bonds contributing 97 per cent of the return.

• iBoxx Global Government: Overall RTL was down 11 per cent, while utilisation saw a 3 per cent YoY drop-off.

• iBoxx EUR Sovereigns: YoY RTL was flat at 4.3 bps. However, utilisation saw a slight uptick in comparison to 2020 levels.

• iBoxxUSD Liquid Investment Grade: This continued with the YoY uptrend, with RTL rising by 31 per cent and with 72 per cent of the revenue contributed from bonds with 7+ years to maturity in December 2021.

• iBoxx USD Liquid High Yield: RTL increased 14 per cent YoY, driven by nearly 41 per cent specials revenue. Utilisation grew by 45 per cent YoY.

• iBoxx EUR Corporates: RTL increased steadily since the end of Q3, with an YoY bump of 4 per cent. Nearly 70 per cent of the revenue was from BBB-rated credit in December 2021.