If markets continue to trend higher and the recent volatility continues, these could be perfect conditions for securities finance revenues to deliver impressive returns during H2, observes Matthew Chessum, director, securities finance, S&P Global Market Intelligence

The first half of 2022 saw significant volatility return to financial markets. As fears of a Russian invasion of Ukraine crystalised and inflationary concerns started to outweigh those of economic growth, equity and bond markets around the world started to fall. In the US, the S&P 500 fell 20 per cent, which was the biggest six-month decline since the 1970s, and the Nasdaq fell 30 per cent. In Europe, the Eurostoxx 600 was down 20 per cent. Central banks around the world started to increase benchmark interest rates in efforts to fight off inflation and the VIX index traded over the psychological 20 barrier for the whole six-month period. Even Bitcoin was down circa 60 per cent!

A period of heightened uncertainty, volatility and a more general “risk off” appetite can have a negative impact in many areas of financial markets, but this was not the case for securities finance. Revenues for the first half of 2022 were just over US$6.1 billion, which was the best half year performance since 2008 — fourteen years ago. First half revenues increased 12 per cent and on loan balances grew 11 per cent over the first half of 2021. Exchange-traded products (ETPs) and US equity special balances hit four-year highs and corporate bonds experienced strong demand, which generated impressive returns. For those lenders holding the right mix of assets, 2022 could in fact be turning into a vintage year.

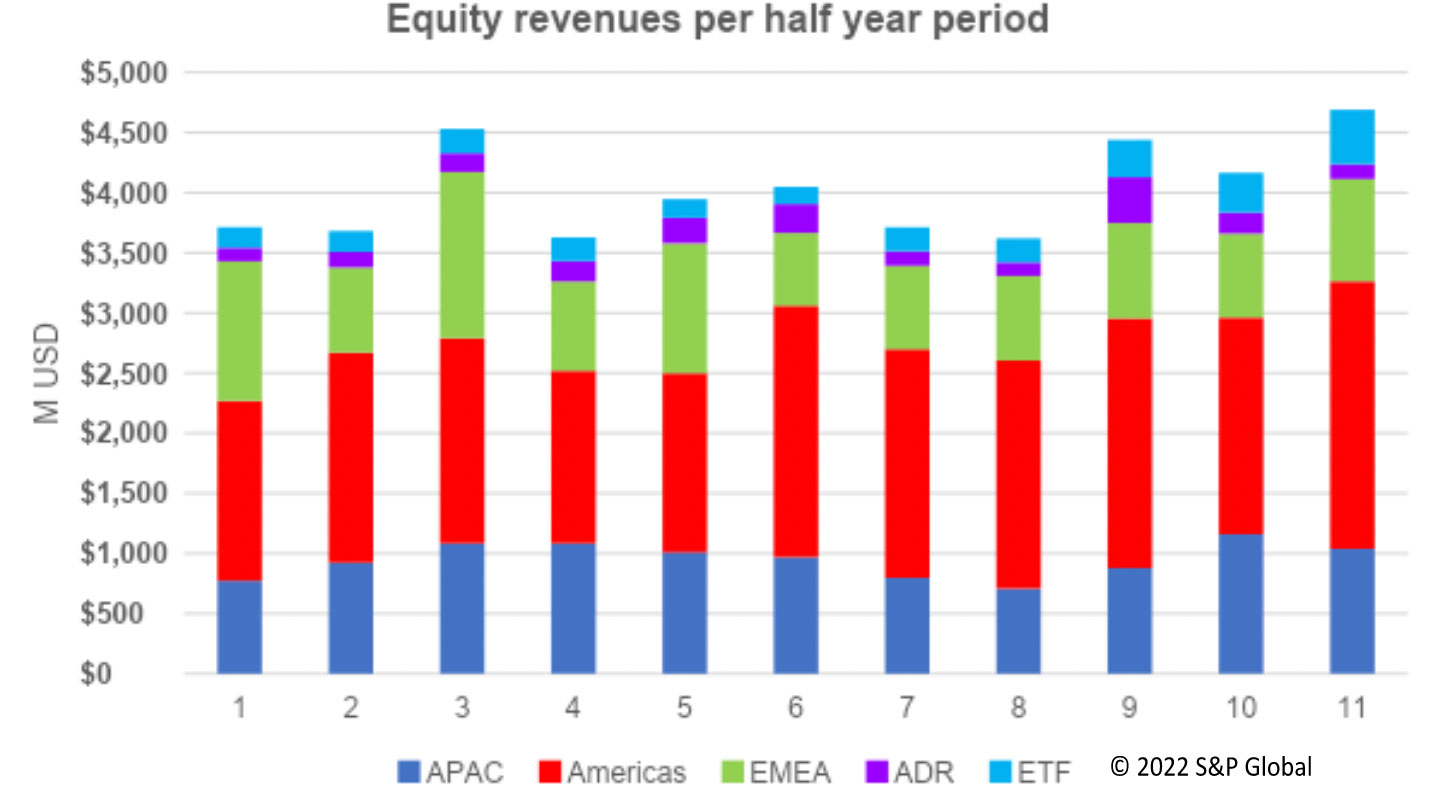

Figure 1

The three standout asset classes to note for the first half of the year were corporate bonds, US equity specials and exchange-traded products.

Corporate bonds

Corporate bond demand remained strong throughout the first six months of the year. Rising interest rates, coupled with investor fears over the growing possibility of recession, increased levels of investor concerns regarding non-investment grade credit. As concerns grew regarding higher default rates and the increased cost of debt servicing, prices started to fall and yields started to increase. This, in turn, led to greater directional demand from borrowers which translated into an increase in the demand to borrow. Revenues increased 97 per cent YoY to US$437 million, on loan balances increased 30 per cent YoY, average fees increased 51 per cent to 0.31 per cent, and utilisation increased 32 per cent YoY to 5.6 per cent. Data shows that demand was widespread for the asset class throughout the period and while there were some popular borrows, the top five revenue generating bonds only contributed a very small percentage to the overall revenues. This trend continued into July. Looking towards the second half of 2022, corporate bonds (especially those that are non-investment grade) are expected to continue to see strong demand and continue to produce the impressive revenues that they have generated in the first half of the year.

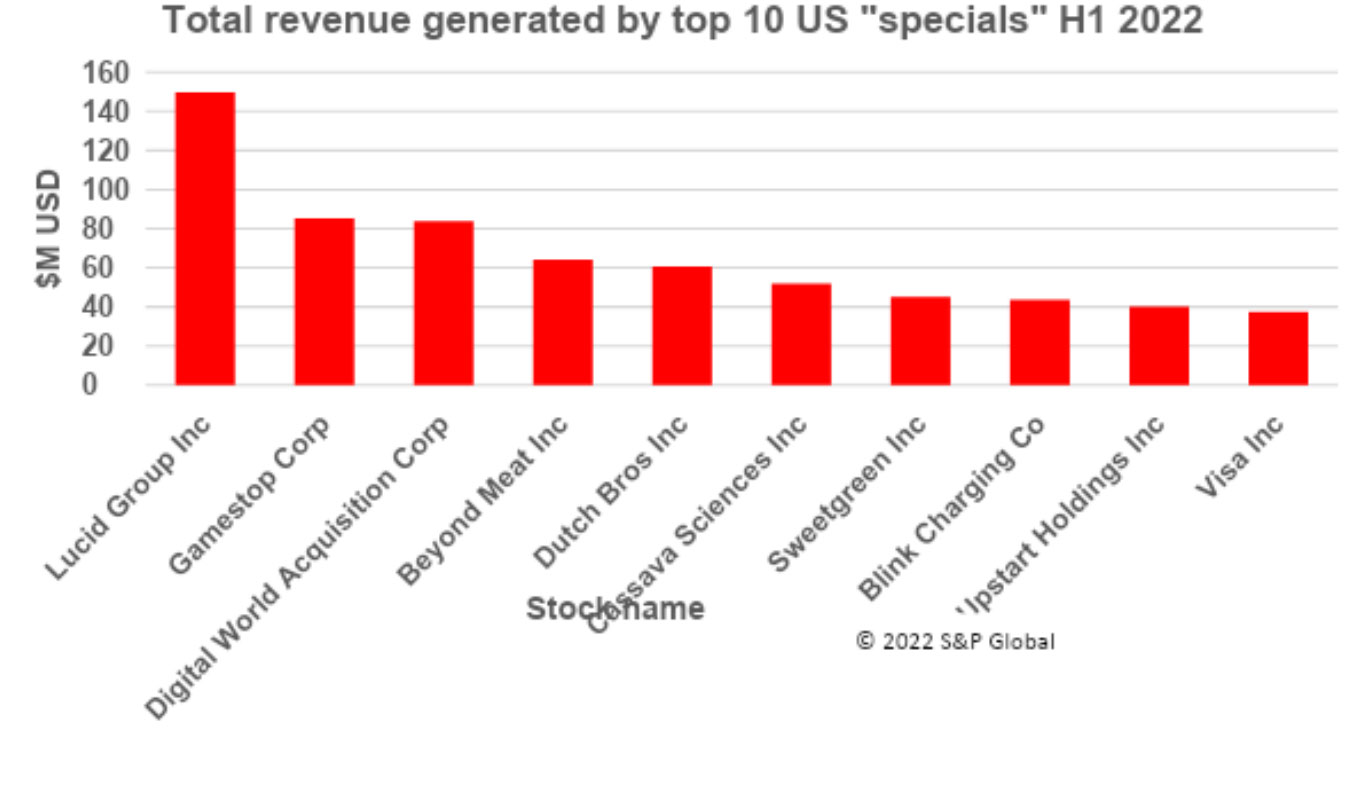

US equity specials

When looking at the Americas region, equity finance revenues were US$2.2 billion for the first half of 2022, which is an impressive 9 per cent increase YoY. Specials balances rebounded spectacularly, nearing US$18 billion on average, as the second quarter of the year set a four year high. It was the specials balances in the US that really boosted returns for this region. Many of the hard-to-borrow stocks in the US continued to generate remarkable revenues. The top ten revenue generators accounted for over 30 per cent of the entire revenues for the region for the six-month period.

Looking towards the second half of 2022, this trend is expected to continue. Hedge fund leverage is down, which usually equates to lower overall balances, and the share prices of those companies that are not considered to offer “essential services” are likely to remain under pressure as discretionary spending is curtailed by high inflation and a higher interest rate environment. Increased pressure on companies to restructure their debt and raise finance will also lead to more corporate activity, which is likely to drive the specials market going into the second half of the year.

Figure 2

Exchange-traded products

Exchange-traded product returns saw a marked increase during the first half of 2022. The asset class generated US$453 million during the first six months of 2022, which is an increase of 48 per cent YoY and a 37 per cent increase when compared with the second quarter of 2021. Average fees, on-loan balances and lendable assets all increased YoY. The success of ETPs was two-fold during the period. ETFs tracking corporate bond and equity indices benefited from the increased volatility seen throughout the period. ETFs were being borrowed for delta hedging as market valuations fell. The ETFs, used to gain exposure or hedge in markets where an efficient offshore securities lending capability is not yet established, also contributed to the increase seen in revenues. As markets start to settle, borrowing activity in ETFs has curtailed during July. Despite this, the asset class is still producing impressive returns as its versatility in terms of trading strategies and collateral management continues to grow.

The other markets

Other markets which contributed to the impressive first half revenues included Taiwan and South Korea. Average fees of 2.52 per cent in Taiwan (a 47 per cent increase YoY) and 2.13 per cent in South Korea (an increase of 29 per cent YoY) helped these two Asian markets generate US$285 million and US$183 million respectively. Specials activity picked up in Australia as mining stocks saw a large uptick in demand (BHP Group Ltd was the fourth highest generating stock in the region following the delisting of the UK line) and the general sell-off in the technology sectors was particularly beneficial to this region as directional trading activity targeted semiconductor and technology hardware producers. The Asia region generated US$1.039 billion in revenues during the first half of the year.

Looking towards the second half of 2022, there is a reasonable level of consensus amongst market observers that, despite the recent market recovery, there is more volatility to come. If markets continue to trend higher and the recent volatility continues, these could be perfect conditions for securities finance revenues to continue to produce impressive returns. Government bonds are expected to see stronger demand with the next phase of UMR coming in September, and as interest rate differentials start to emerge there are also likely to be more opportunities for global macro strategies to play out.

There is little doubt that 2022 will be a very strong year for the securities finance industry based on the first six months of the year. Demand is expected to remain rather specific in terms of sectors and asset classes, however, and not all asset owners are expected to benefit to the same degree. But as an industry, despite the doom and gloom in other areas of the financial press, securities finance should continue to shine.