In the securities lending markets, corporate bonds have experienced significant increases in on-loan values and revenues over the last two years. S&P Global Market Intelligence’s Matthew Chessum analyses the primary drivers

As interest rates have risen aggressively over the last 18 months, investor interest in corporate bonds has grown. Despite an initial assumption that the rise in rates would put global economies into recession, market data has remained resilient and this has amplified investor confidence in an asset class that is offering increasingly higher yields against a buoyant market backdrop. When looking at investment performance, the S&P high yield corporate bond index has increased 6.95 per cent over the past year, while the S&P Global Developed investment grade corporate bond index has increased by 3.38 per cent.

Corporate bonds have been issued at a record pace throughout the year and September has seen some of the busiest days on record. Not only has September recorded the busiest day since March 2020 for issuance, but the total issuance for the week ending 15 September exceeded US$50 billion. One trend that has been apparent throughout the recent spate of issuance has been the focus on the short end of the curve. As 30-year Treasury yields have been trading at their highest levels in more than a decade, many issuers have been reluctant to lock in the higher funding costs.

Shorter duration debt has therefore been the preference in the hope that interest rates fall next year and refinancing can take place to lock in lower rates. A focus on shorter dated debt has also been a theme within the securities lending markets. Eight out of the top 10 highest revenue generating corporate bonds of the year so far from a securities lending perspective have all had maturities of under five years.

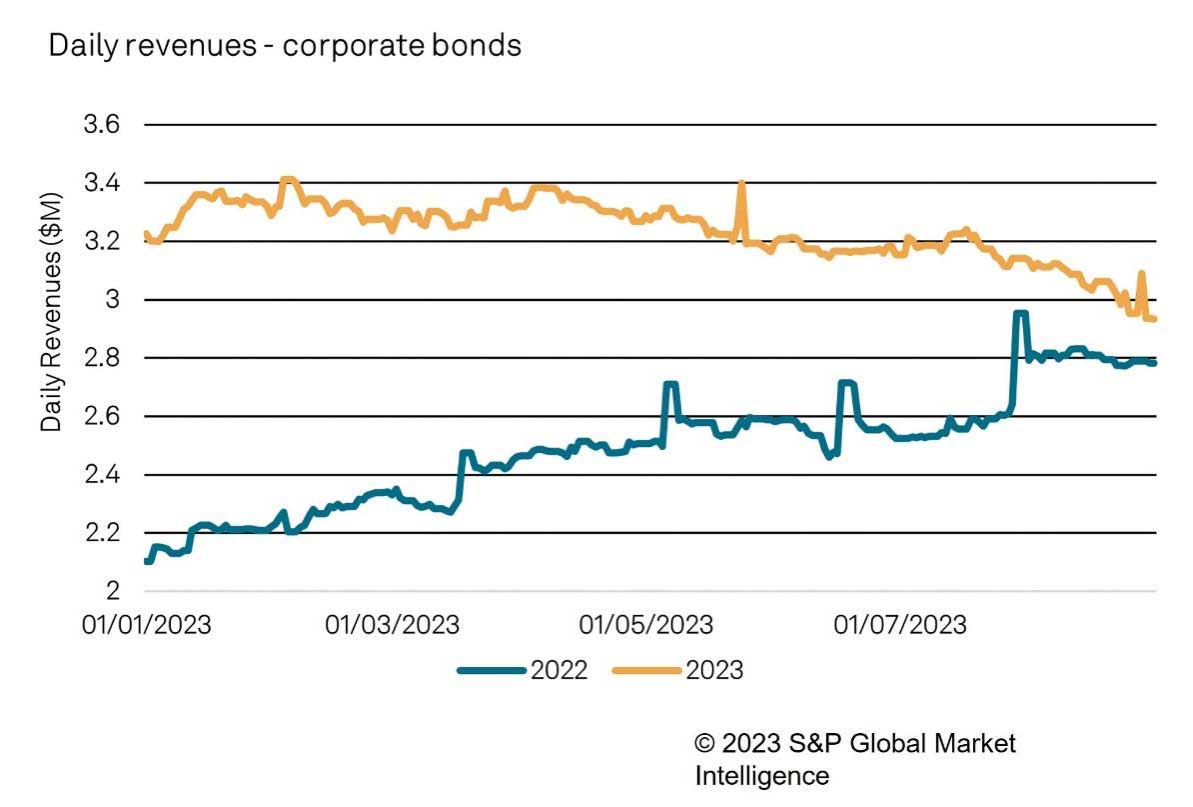

In the securities lending markets, corporate bonds have experienced significant increases in on-loan values and revenues over the last two years. An increased level of certainty behind central bank rate increases and a requirement for additional market liquidity has led to a period of increasing fees for corporate bond lenders as the demand to borrow has grown. By the end of August, corporate bond lending had generated US$787 million. Monthly revenues have been on average 30 per cent higher during every month of 2023, when compared YoY. These remarkable revenues are the result of significantly higher fees. Corporate bonds have been trading at an average fee of 45bps throughout the year which is, again, significantly higher than the 32bps fee that was seen during the same period in 2022. These revenues have been generated, despite YoY declines in balances, lendable and utilisation.

Fig 1: Daily revenues - corporate bonds

Corporate bond lending is not just restricted to physical corporate bonds, however. Exchange traded funds have often played an important role in both hedging and gaining exposure to the asset class. HYG, the iShares iBoxx high yield fund, is well known in this space and produces a large proportion of the revenues generated by US-listed ETFs. Over the last three months, securities lending revenues for HYG have been rising once again, which signifies a growing interest in the corporate bond market. Revenues for September are, at the time of writing, likely to be the highest of 2023 so far. According to data provided by S&P Global Market Intelligence ETF solutions, corporate bond ETFs have seen net inflows of circa US$65 billion year-to-date, with inflows targeting those funds offering exposure to shorter maturities.

Opportunities for market participants have been created by an interest rate environment that has been defying the normal playbook. Continued hawkish sentiment has ensured that, until very recently, the likelihood that central banks would continue increasing rates has been very high. Given the fact that those short-dated maturities remain very sensitive to any changes in interest rates, hedge funds have been able to take advantage of readjustments in prices as yields climbed higher to reflect the new risk-free rate. In addition, the inverted yield curve in the US has created a similar effect across corporate credit curves. Recently issued Nasdaq bonds were offered with a 3-year coupon at 5.65 per cent and a five-year bond with a coupon of 5.35 per cent. This means that investors are being paid more for taking on less duration risk. These situations are also leading to arbitrage opportunities for end borrowers.

Default rates

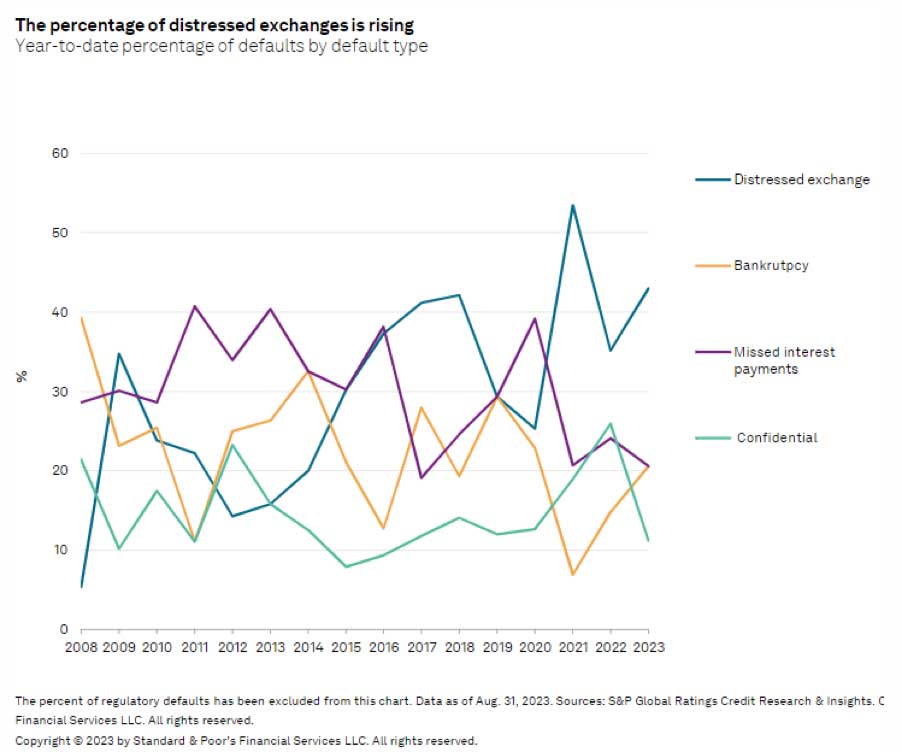

Despite the optimism surrounding the corporate bond market, a recent report issued by S&P Global Ratings discovered that defaults during August hit their highest level since 2009. The increase was down to a growing number of distressed exchanges. This is where a company proposes that existing debt holders either take a haircut on their current holdings, or offer a new security that has a longer maturity or lower value to avoid bankruptcy. Most defaults during the period also took place in either the US or Europe, with both regions seeing notable increases YoY. The report noted that, in Europe, monthly defaults in August reached their highest levels since October 2020 as the European default tally reached almost three times the levels seen during 2022. Media and entertainment was the sector most affected by defaults, accounting for one third of all defaults in the US, and consumer products in Europe, which posted a 50 per cent increase on 2022.

Fig 2: The percentage of distressed exchanges is rising

Year-to-date percentage of defaults by default type

Despite the recent increase in default rates, an assumption of higher for longer is bound to benefit the corporate bond market. Higher coupons will remain attractive to investors as the underlying growth outlook and economic data remain healthy. This will encourage selective risk taking and is likely to lead to greater inflows into corporate bond funds.

Key risks do still exist for the asset class, however. These include the future trajectory of inflation, overtightening by central banks leading to a slowdown in economic growth, the ability to refinance debt and any potential flare up in geopolitical risk.