Matthew Chessum, director of securities finance at S&P Global Market Intelligence, reflects on how a YoY dip in Q3 securities lending revenues belies strong YtD performance and potential for record lending revenues for the second consecutive year

With the US debt ceiling and bank solvency concerns in the rear-view mirror, financial markets reverted to the familiar themes of growth, inflation and central bank decision making during the third quarter. Across most developed markets, inflation moderated and investor focus moved to peak rates and the end of tightening policy.

During the quarter, the bullish sentiment that lifted shares out of a bear market at the end of last year started to fade. The idea that interest rates would be staying higher for longer, and that any central bank pivots to lower rates may not be triggered until mid-to-late 2024, started to impact equity markets. The term “higher for longer” became popular among market analysts and bond yields started surging to multi-year highs as a result. Prices in both equities and fixed income assets fell in tandem, even across those AI-inspired tech stocks that have driven most of the market rally experienced this year.

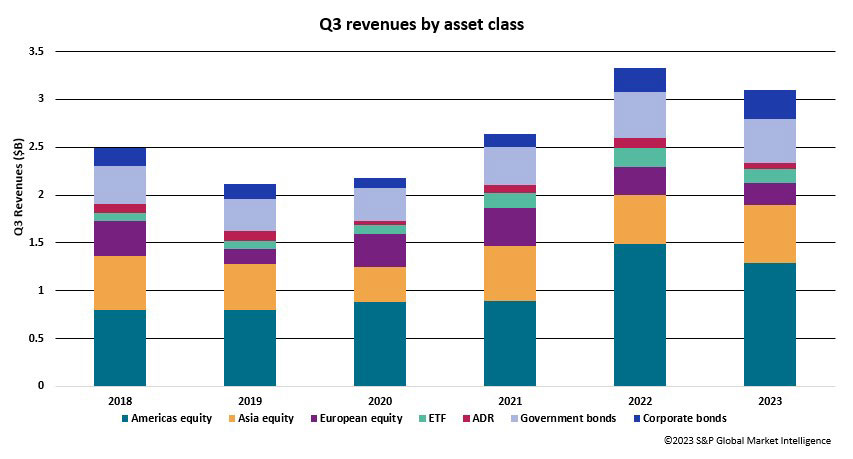

In the securities finance markets, revenues started to slow as Q3 produced US$3.131 billion in revenues. This represents a 7 per cent decrease YoY, but it is important to remember that Q3 2022 was the highest revenue-generating quarter of last year.

Equities generated just under US$2.4 billion during the quarter. This represents a decline of 10 per cent YoY. The largest contributor to these revenues were Americas equities, which generated US$1.3 billion.

In the Americas, US equities generated the lion’s share of the revenues, producing US$1.18 billion alone, which is a 15 per cent reduction YoY. In the other markets that make up this category — Canada, Brazil and Mexico — revenues all increased YoY with Brazil positing a 191 per cent increase over the period. All of these markets also experienced YoY increases in average fees and Canada was one of the only countries globally to not experience a reduction in utilisation.

In the EMEA region, securities lending revenues suffered substantial YoY declines during both August and September, pushing the quarterly total down 25 per cent YoY. Balances declined by 27 per cent and utilisation fell by 35 per cent. When looking across the individual markets, there were no real bright sparks to be seen. Finland and the Netherlands did experience increases in revenues YoY but their contribution to the total revenues for the asset class were minimal, hence their lack of impact on the final numbers.

Fig 1: Q3 revenues by asset class

APAC equities did offer some relief to market participants. Not only was there a 20 per cent increase in YoY revenues, but also an 8 per cent increase in balances and an 11 per cent increase in average fees. Revenues were buoyed by a substantial increase in revenues within South Korea, where returns increased by an impressive 92 per cent YoY, as well as ongoing strong performance in Japan (+21 per cent) Taiwan (+10 per cent) and Hong Kong (+6 per cent). Australia was the only major market within the region to buck this trend, falling 44 per cent.

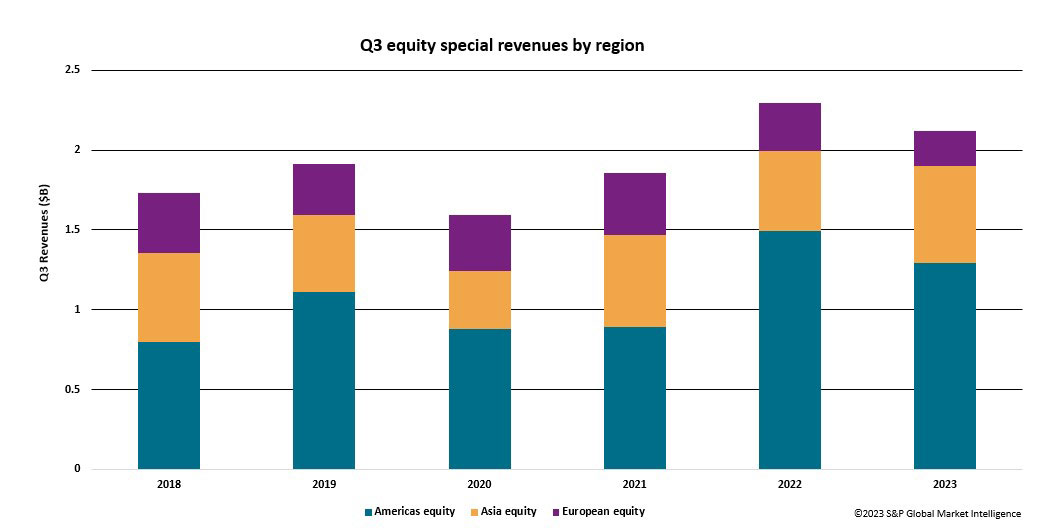

Equity specials

Equity specials have been a huge driver of revenues for lenders over the last few quarters. US equity special revenues reached US$909.7 million during Q3, accounting for, on average, 70 per cent of all US equity revenues over the period. Specials activity declined significantly during September, however, as both the AMC and Johnson & Johnson (JNJ) trades completed. With a decline of over 60 per cent experienced between August and September, Americas equity revenues are likely to suffer a substantial rebasing heading into Q4.

Fig 2: Q3 equity special revenues by region

APAC specials activity increased again over the third quarter, producing US$311 million. The increase was driven by a growing number of specials in South Korea, Hong Kong and Taiwan. You may have read in a recent commentary note that was released by S&P Global Market Intelligence about the advent of a meme stock phenomenon in South Korea that has been pushing stock prices in certain sectors, such as electric vehicles (EVs), to all-time highs. These stocks have been increasing demand to borrow shares as short interest naturally grows, when valuations are deemed disproportionate and investors expect a market correction.

EMEA specials decreased over the period, with only US$93 million being generated throughout Q3. Samhallsbyggnadsbolaget I Norden AB (SBB B) and Nagarro SE (NA9) were the highest revenue-generating EMEA stocks that continued to trade special over the quarter.

Government bonds

Government bond yields remained volatile throughout the quarter, with large moves sparked by further increases in interest rates and the expectation of higher-for-longer terminal rates. The US was stripped of its top-tier sovereign credit grade by Fitch Ratings, shrinking the world’s AAA debt options. The agency criticised the country’s ballooning deficit and “erosion of governance” that has led to repeated debt limit clashes over the past two decades.

In Japan, speculation of an end to yield curve controls sent 10-year yields to their highest levels since 2014, causing global bond yields to fall further on the fear that Japanese investors may start to look towards repatriating cash to the domestic market. In the UK, HM Treasury released plans to end the ban on naked short selling of sovereign debt.

All this volatility continued to bode well for government bond lending markets. Revenues declined YoY by 2 per cent to US$464 million over the quarter. Q3 was the lowest revenue-generating quarter of the year so far after US$482 million and US$483 million being generated during Q1 and Q2 respectively. US treasuries continued to dominate the revenues, followed by German and UK bonds.

YoY revenue growth in corporate bonds continued. US$279 million was generated throughout Q3, reflecting an 11 per cent increase YoY. This was despite a 2 per cent YoY decline in balances and a 3 per cent decline in utilisation over the quarter. Higher average fees continued to support revenues. Despite the continued increases, it does appear that we may have now reached the peak of corporate bond activity. When looking at the data on a month-on-month basis over the quarter, there has been a decline in balances and average fees which has led to a decline in revenues over the quarter.

As we head towards the end of the year, the likelihood of another year of record revenues does start to become less clear. Geopolitical risk is increasing in the Middle East, and between the US, Europe and China, and the ability of global economies to withstand such an intense period of hawkish monetary policy remains uncertain.

Despite all of this, YTD revenues remain strong. As noted, US$10.15 billion has been generated by the securities lending markets during January to September, which is 7 per cent higher than the US$9.487 billion that had been generated at the same point during 2022. So we may still be looking at record revenues for a second year running.