Securities lending activity in Japan has surged during 2023, with revenues generated by Japanese equities increasing by 26 per cent year-on-year. Matthew Chessum, director of securities finance at S&P Global Market Intelligence, evaluates the factors shaping market sentiment

Japanification is a term that is used to refer to an economy that has slow economic growth and little inflation, despite low interest rates and ultra loose monetary policy. This scenario, as you may have guessed from the title, has been the case in Japan since the early 1990s. Japan remains one of the only countries in the world to maintain negative interest rates and have exceptionally low levels of inflation. Japan’s monetary policy remains very loose, with the current policy rate set at negative 0.1 per cent. S&P Global Ratings anticipates that the policy rate will increase by 10 basis points this year and by another 10 basis points next year.

Active monetary policy, in the form of yield curve controls, continues to be a strong theme within the Japanese government bond market. Yield curve controls are used to ensure that government bond yields remain positive during a period of negative interest rates. In an attempt to stimulate the economy, the Bank of Japan has been an active participant in the fixed income markets buying or selling bonds to ensure that their yields remain within a specified range. In July 2018, the BOJ set the yield on the 10-year bond to a range of 0.1 per cent above or below zero. In March 2021, the bank widened the range to 0.25 per cent in either direction in an attempt to breathe life back into a market that the central bank’s buying had paralysed.

More recently, as a result of the volatility seen across government bond yields caused by the message “higher for longer”, as communicated by other central banks, the 10-year yield breached the 0.5 per cent threshold. This caused heavy bond buying by the central bank and increased the expectation that the BOJ will have to amend its policy or raise its threshold in the near future.

With the potential for higher interest rates, the advent of corporate governance reforms, an increase in domestic consumption and a rise in geopolitical tensions, the Nikkei 225, Japan’s benchmark equity market index, has increased by 24.8 per cent year-to-date. This has led to an increase in interest in Japanese assets. This has also had a positive impact on securities lending activity within the market, with revenues across both equities and Japanese government bonds (JGBs) increasing significantly throughout 2023.

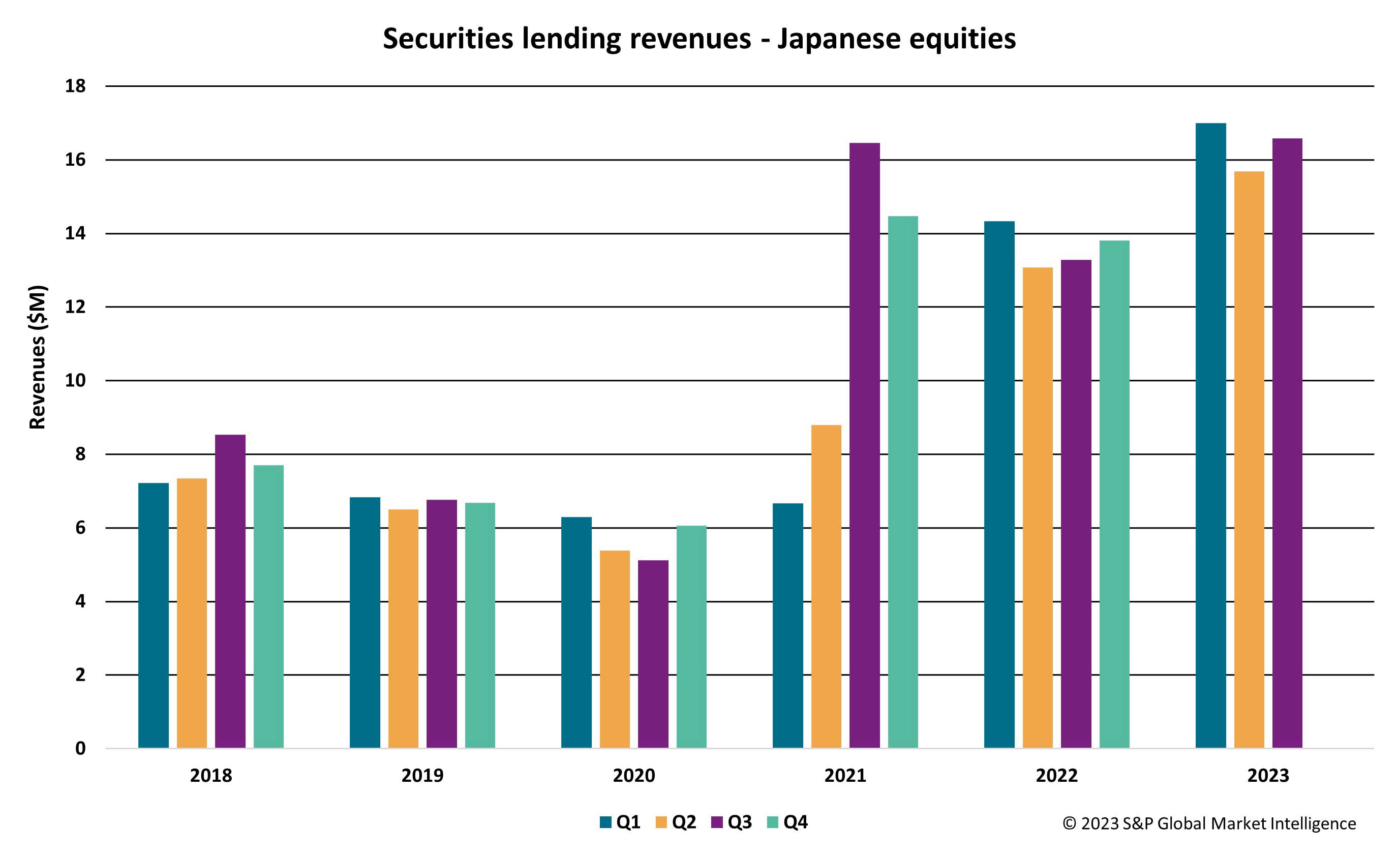

Securities lending activity in Japan has surged during 2023, with revenues generated by Japanese equities increasing by 26 per cent year-on-year (fig 1). To the end of October, year-to-date revenues of US$554 million surpassed those generated during the entirety of 2022, at US$520.8 million. Higher average fees have been one of the drivers of this impressive increase. Average fees hit 60bps during March, which is a multi-year monthly high. Year-to-date, average fees have been 18 per cent higher than during 2022. Heading into October, fees maintained their positive trajectory increasing once more to reach 54bps during October.

Fig 1: Securities lending revenues — Japanese equities

Across the fixed income markets, Japanese government bonds have been setting some records of their own. Average monthly revenues for the January to October period have been 23.5 per cent higher when compared year-on-year and, as in the equity market, year-to-date revenues of U$54.9 million have now exceeded those generated during the entirety of 2022 (at US$54.5 million). Across Japanese equities, average fees have also experienced a very healthy run over the year. The Q1 average fee was 29bps, a rise of 16 per cent YoY. For Q2 2023, the average fee was 24bps (up 1 per cent YoY) and in Q3 this was 26bps (a 4 per cent rise YoY).

Liquidity squeeze

As pressure on the Bank of Japan to maintain yields has increased and the bank has become a forced buyer of bonds to suppress yields, a liquidity squeeze has taken place. This has subsequently led to a lucrative opportunity for securities lenders to provide additional market liquidity. Utilisation currently stands at 7.7 per cent for JGBs, which is on average 132.8 per cent higher than during 2022.

Many investors in Japan point to the fact that during the current period of Japanification, similar stock rallies have appeared only to end in disappointment and decline. Previous rallies have reportedly been triggered by policy responses to preceding periods of crisis. The current situation may therefore be different to those experienced in the past. When looking at the economic data, it remains mixed. This is leading to lively discussion among economists regarding what to expect in the coming months.

Inflation in Japan remains modest when compared with both the US and Europe, standing at approximately 3.2 per cent for 2023. Next year’s inflation is forecast to be 2.0 per cent, with the following two years boasting even lower inflation. Japan’s unemployment rate is estimated to be 2.6 per cent and labour force participation is reportedly up. Other economic data, such as the most recent Purchasing Managers Index (PMI), indicate that an eight month increase in private sector growth may be coming to an end. Manufacturing output has reportedly fallen, along with the cost of raw materials. S&P Global Ratings has recently stated that Japanese corporate creditworthiness continues to increase, domestic consumption remains strong and corporate financial positions remain healthy.

Investor sentiment

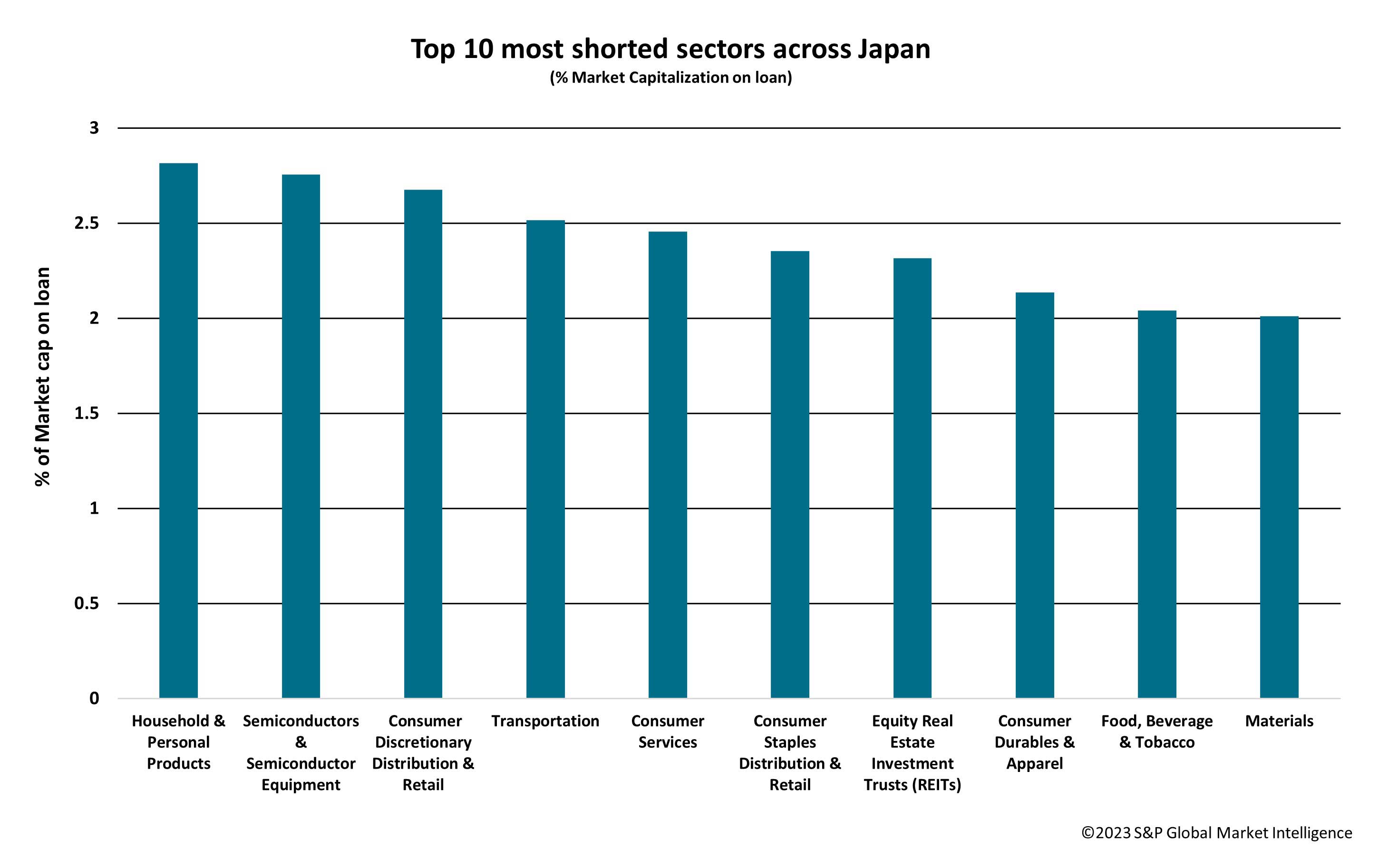

When attempting to translate these metrics into a prediction for future growth, investor sentiment remains key. The degree of short interest across the Japanese economy, calculated by using the average percentage of market capitalisation on loan, currently stands at 1.82 per cent. This is approximately 1 per cent higher than the APAC region (excluding Japan). The largest differences can be seen across the Consumer Discretionary Distribution & Retail sector and the Consumer Services sector, where short interest in Japan is more pronounced (fig 2). These differences may suggest that sentiment is relatively negative in terms of the future performance of the Japanese economy as the service and consumer discretionary sectors often act as a bellwether for consumer confidence.

Fig 2: Top 10 most-shorted sectors across Japan

(% market capitalisation on loan)

Given previous false starts and the current mixed bag of economic data, investors may start to ask questions regarding what will be needed to return the economy to a sustainable level of growth. That is likely to be the case if the combination of factors that are currently supporting the growth of the Japanese economy, and pushing its stock market to recent highs, cannot be sustained. When comparing Japan to Europe, or even the US — where the threat of recession remains a strong possibility and inflationary pressures remain high — investors may also wish to question whether low inflation, low unemployment and a sustained but low level of prolonged growth is really that bad after all.